No matter how exciting a customer finds your SaaS product, one of the first things they want to know is, “How much does it cost?”

That’s why choosing the right pricing model is as critical as developing the right features or having a strong sales strategy.

A flat-rate pricing model is simple to understand and implement, but will it give you the competitive edge? Before you make a decision about SaaS pricing, consider the pay-as-you-go model.

This article explains pay-as-you-go, including its benefits and drawbacks, and provides instructions on how to get started.

What is the Pay-As-You-Go Business Model?

The pay-as-you-go (PAYG) pricing model means that users pay based on how much they consume. For example, a cloud storage service provider could charge based on the amount of storage used, while many phone carriers bill based on minutes used.

You’ll also hear pay-as-you-go referred to as a usage-based or consumption-based model.

While traditional per-seat and flat-rate models are still common, PAYG is now a core pricing strategy for many SaaS and AI businesses. It's especially popular among companies delivering infrastructure, APIs, or AI-driven features, where customer value is directly tied to usage.

PAYG has moved beyond early experimentation. A growing number of SaaS companies now use it as a foundational part of their pricing strategy, often layered into hybrid models for predictability and growth.

What are Examples of Pay-As-You-Go Pricing?

Pay-as-you-go pricing can take many forms and is customizable to a company’s needs. Let’s look at what pay-as-you-go looks like for two well-known SaaS companies.

1. AWS

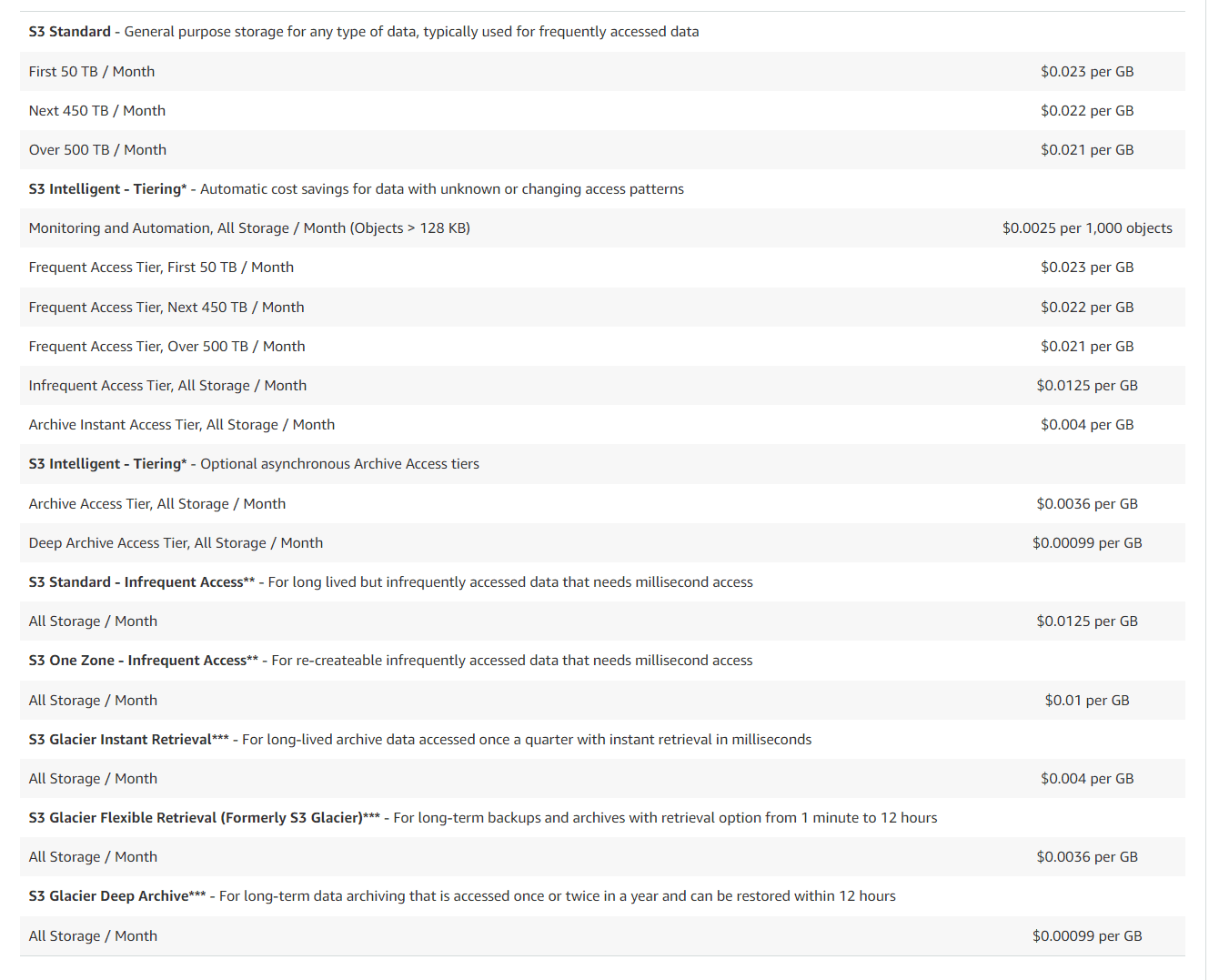

Cloud resources are a common pay-as-you-go use case. One of the most famous examples is Amazon Web Services (AWS). AWS offers over 200 cloud services, each of which has its own pay-as-you-go pricing system.

For example, if you choose to run applications on the EC2 virtual server, you pay for computing resources by the hour or second. Or, you could use an AWS storage solution and pay based on the size of the objects you store and how long you store them.

2. MailChimp

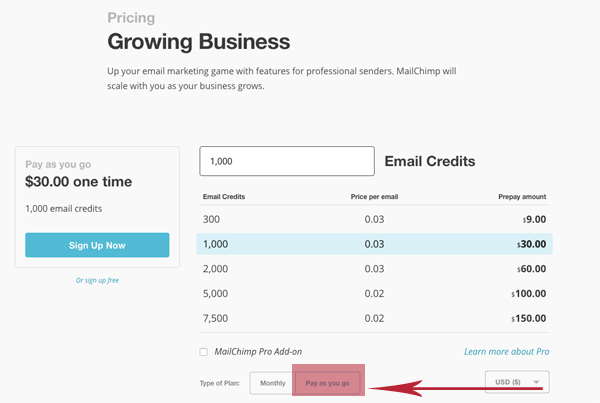

An example of a different type of pay-as-you-go model is the email marketing platform MailChimp. In addition to its usual tiered pricing plan, MailChimp offers a credit-based pay-as-you-go plan.

In this plan, you can buy as many or as few email credits as you need. Each email credit can be used to send one email, and credits expire after twelve months.

What are the Types of Pay-As-You-Go Plans?

As you can see from the examples above, pay-as-you-go plans come in two main types.

Consumption-Based

The first is consumption-based. The more you use a certain resource (like transactions, storage, bandwidth, minutes, and so on), the more you pay.

For example, for credit card payments, payment processing service Stripe charges 2.9% of each transaction plus 30¢. You don’t have to pay a monthly fee, just a pay-per-use price for each transaction.

Credit-Based

The second type of pay-as-you-go model is credit-based. In a credit-based system, you purchase credits that can be exchanged for a service.

The main difference is that you typically use what you want and get billed accordingly with a consumption-based plan. In a credit-based system, you purchase what you need in advance and then use it.

An example of a credit-based service is Audible, which lets you purchase audiobooks for credits. You get credits every month that you’re on a subscription plan, but you can purchase more using a pay-as-you-go system if you run out.

Credit-based pricing models are appealing to the company because you get paid upfront. But they’re a risk to end users — they don’t always know if they’ll use all of the credits or let some go to waste.

What Are the Benefits of the Pay-As-You-Go Pricing Model?

1. Lower Upfront Costs Attract Users

Potential customers might like your business but feel intimidated by committing to a subscription plan. A pay-as-you-go model has a low upfront cost — all the customer has to pay for is what they’re going to use right away.

This low level of investment often leads to customers making a quicker purchase decision. They also like how pay-as-you-go puts them in control. They won’t pay for anything they don’t use.

Pay-as-you-go is ideal for businesses that won’t use their product or service consistently from month to month. For example, if you offer an email platform, the customer can pay to send 5,000 emails one month and nothing the next month when they send none.

2. You Can Charge More for High Consumption

Some customers use more resources than others. This typically costs you more, so you should be able to charge them more. But in a flat-rate system, these major users pay the same amount as everyone else.

Even with a tiered system, some customers in the higher tier may be using a lot more resources than the others who are paying the same rate. Pay-as-you-go accounts for that.

3. You’ll Learn About Your Customers

A pay-as-you-go plan helps you understand exactly how much your customers use and when they use it. This information is valuable for determining future offerings and prices.

4. Revenue Grows Faster with Pay-As-You-Go

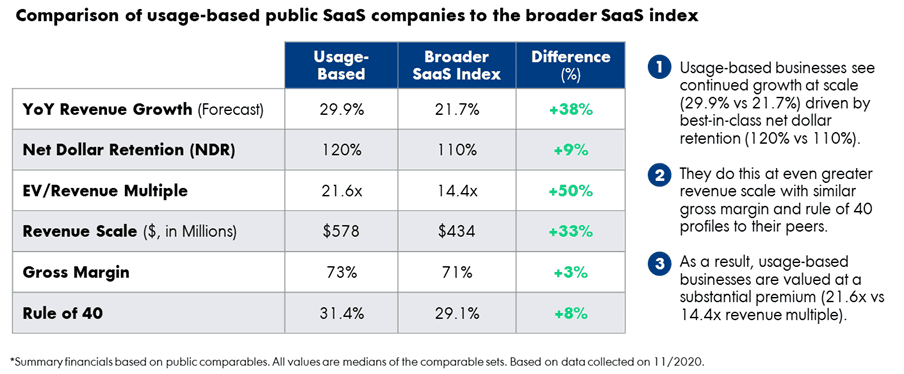

PAYG is proven to accelerate revenue as customer usage increases, without the need to constantly renegotiate plans. It aligns your pricing with the customer’s growth curve, resulting in faster expansion and improved net revenue retention.

The result is that companies with usage-based pricing models have a YOY revenue growth of 29.9%. That’s more than the SaaS average of 21.7%

What Are the Disadvantages of the Pay-As-You-Go Pricing Model?

Pay-as-you-go has seen increased adoption over the years, but not everyone loves it. Here are a few disadvantages of the model.

1. It’s Challenging To Retain Customers

Businesses with monthly subscription plans often require customers to pay for several months or a year at a time. Others offer a discount if the customer pays annually rather than monthly.

Even without these requirements or incentives, customers are likely to stick with a monthly subscription service, whether they’re using it every month or not.

However, pay-as-you-go customers may quickly disappear since they haven’t made any commitment. This can result in an increased churn rate for your SaaS business.

(That said, pay-as-you-go also has an advantage for customer retention: if a customer can’t afford their usual rate for a month, they don’t have to cancel their subscription.)

2. Revenue Is Unpredictable

With pay-as-you-go, you have no idea how much each customer will pay per month or year, making it hard to forecast revenue.

For example, an enterprise customer might test your service with one small team first. They like what you have to offer, and suddenly the whole company is signed up. Usage goes up by 2000% overnight.

3. Pay-As-You-Go Is Complex

Want a payment model that’s easy for your customers to understand and easy for you to calculate? Use a flat-pricing model (Charge everyone $25 per month, every month), or use a tiered pricing model to charge end users at three or four price points.

Pay-as-you-go gets a bit more complicated, especially if you have separate pricing schemes for different types of resources (like our AWS example).

It’s hard to know how much you’ll pay if it’s calculated on a per-day or per-gigabyte basis. So some customers will opt for a company with a simpler flat rate. Typically, small startups and medium-sized businesses with limited budgets like the predictability.

What’s the Difference Between Pay-As-You-Go and Other Subscription Models?

If you’re not choosing a pay-as-you-go pricing model, what other options do you have?

Flat Rate Pricing

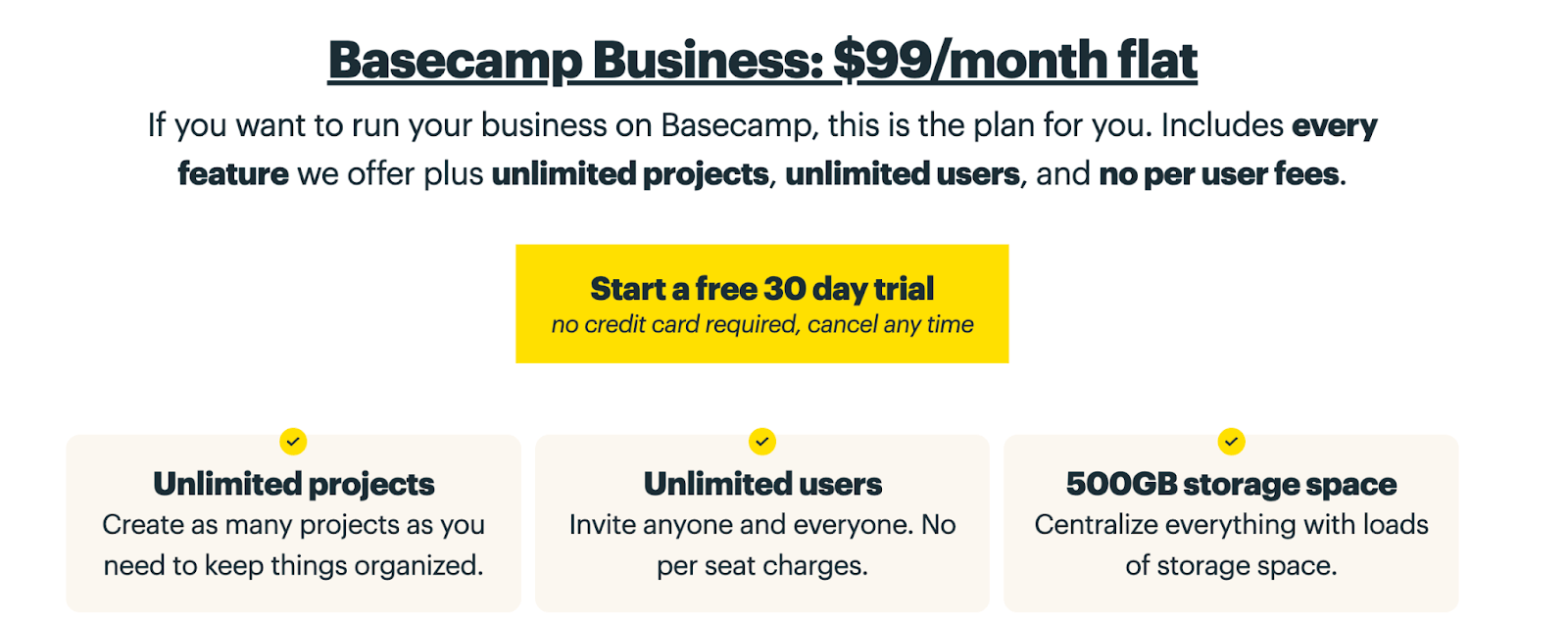

Your customers all pay the same amount for your service. They’re usually billed for this amount monthly or annually.

For example, Basecamp charges every customer $99 per month. They all get the same thing — unlimited projects, unlimited users, and 500 GB of storage space.

Tiered Pricing

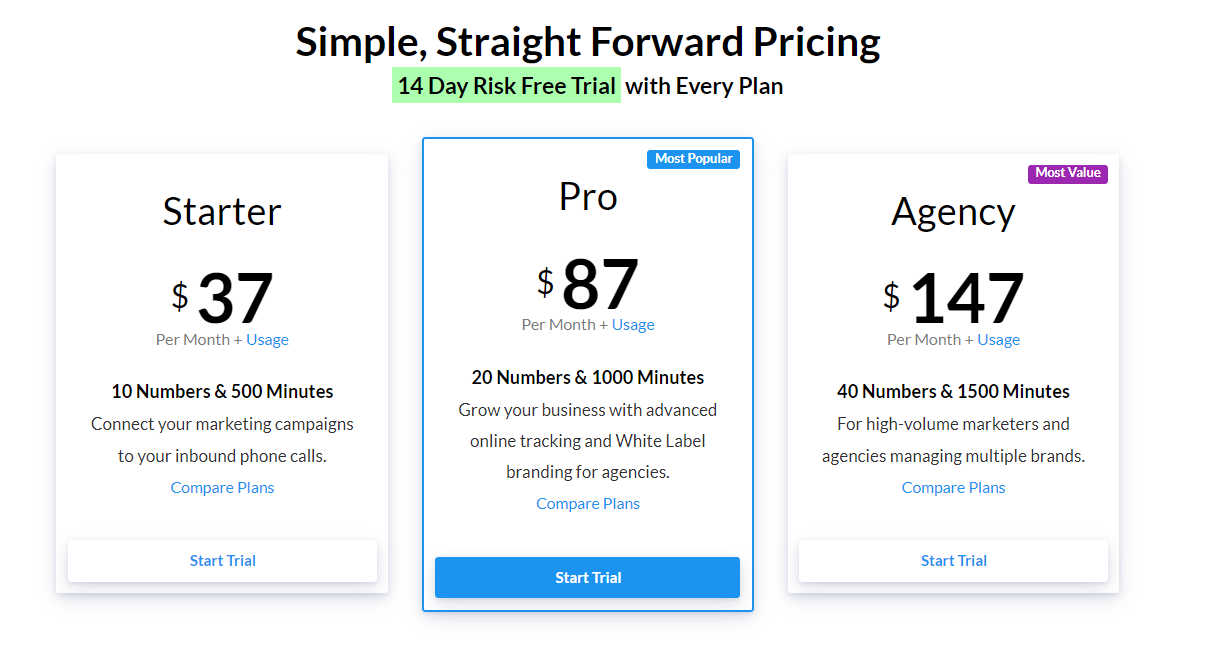

A more common type of flat-rate pricing involves offering several different pricing tiers. The higher-priced tiers offer more features or resources than the lower tiers. Each tier costs the same amount every month or year.

Per User Pricing

Seat-based pricing, charging per user, is one of the most established SaaS pricing models. This is often combined with a tiered system. For example, the lower tier charges $20 per month per user, while the higher tier charges $40 per month per user.

Hybrid Pricing

You don’t have to stick to just one pricing type. There’s an endless variety of hybrid plans you can create to suit your organization’s needs.

Some companies, like MailChimp, offer a monthly flat-rate subscription as well as a separate pay-as-you-go plan.

Other businesses offer pay-as-you-go as an add-on service. For example, your monthly subscription gets you 20 GB of storage, and you pay-as-you-go for every GB after that.

Related Read: Learn about the other SaaS pricing models here.

Is Pay-As-You-Go Right for Your Business?

Pay-as-you-go can be applied to companies across multiple software categories, but as with any pricing model, it’s not right for everyone. Here’s how you know that pay-as-you-go is a potential fit for your SaaS business.

1. You have a diverse user base

If all of your customers use roughly the same amount of resources, you might as well charge them all the same rate. Likewise, if you can easily break your customers into two clear groups based on their usage, a tiered plan might suit.

Pay-as-you-go makes the most sense when your customers range from super users who would be willing to spend a lot of money with you to frugal newbies who just want to test the waters for a low rate.

2. You can precisely track customer usage

It’s pretty straightforward: you can’t charge for bandwidth if you don’t know exactly how much bandwidth each customer is using.

Make sure you’re set up to track usage easily and precisely. This is also important for customer loyalty—if there’s any suspicion that your subscription billing is based on incorrect information, it will damage your reputation.

3. You’re prepared for higher short-term costs

With a subscription plan, you can cap customer usage. No one will use more storage space than their price tier allows.

What if you switch to a pay-as-you-go system and a few of your customers start using ten times their previous maximum storage allowance? Can your cash flow support it?

These big usage jumps are exactly what allows pay-as-you-go businesses to scale quickly, but they can also cause you to incur costs quickly. If you’re not prepared for that possibility, you should hold off on switching to pay-as-you-go.

4. Your customers frequently move between plans

A sure sign that your customers would be happy with a more flexible pricing model is if they frequently jump between tiers of your existing subscription plan.

They’ll be grateful when you make their lives easier by letting them pay as they go.

How To Implement a Pay-As-You-Go Model for Your Business in 4 Steps

You’re convinced — pay-as-you-go is the future of SaaS, and you’re on board. But unlike your current subscription plan, pay-as-you-go is complex. How do you get started?

Making the change doesn’t have to be daunting. Just follow these four steps.

1. Choose Your Metric or Resource

What resource are you charging your customers for?

Sometimes the answer is obvious, like a cloud storage company choosing to charge for storage space. But sometimes, you have more than one option. For example, some web services may be able to charge for storage, bandwidth, or hours of usage.

If you’re not sure of the best option, step 2 might help you decide.

2. Track and Analyze Usage

Before you implement your pay-as-you-go model, you need to do some analysis of current customer usage.

Start by tracking any metrics that might be used for billing. As we discussed, it’s important to make sure your tracking is precise and reliable.

Tracking usage will help you optimize the amount you should charge for each billable unit of the resource. It can also help you determine which of two resource types to charge for first.

When you’ve chosen your metric, you can use that information to bill customers.

3. Determine Time and Frequency of Billing

First, you have to decide between a pre-pay (credit-based) or post-pay (consumption-based) pay-as-you-go plan.

The advantage of a credit-based plan is the upfront cash flow. The customer pays you before you incur costs for their services. It also makes things a little more predictable — if a customer has only prepaid for 500 emails, they can’t unexpectedly send 5,000.

On the other hand, customers aren’t always thrilled with pre-paid systems. They may not know how many minutes of cloud computing they need in advance, or the credits might expire before they use them. Overpaying doesn’t give customers a good impression of your business.

You’ll also need to decide how frequently your customers will be billed. A monthly billing model is common but not the only option. For example, some companies send a bill once a certain balance is reached.

Google Ads is an example of a company with a mix of billing practices. You can be billed monthly or receive a bill whenever you’ve spent a predetermined amount.

4. Rely on the Right Tool

Pay-as-you-go models have become central to how modern SaaS and AI companies monetize value. While the model is conceptually simple (charge users based on what they consume), implementing it across billing, entitlements, metering, and reporting is anything but.

That’s where Chargebee comes in.

Chargebee offers full-spectrum Usage-Based Billing, built for the complexity of real-world pricing. Whether you're charging per API call, video minute, compute unit, or number of workflows executed, Chargebee makes it easy to configure, meter, and bill with precision.

Here’s how:

Flexible Metering: Automatically track and aggregate usage data using events ingested via APIs or S3, down to the most granular unit.

Hybrid Pricing Models: Layer PAYG charges into existing plans, so you don't lose revenue predictability while still scaling with usage.

Entitlement-Aware Pricing: Define usage limits and PAYG pricing rules directly in Chargebee—no custom code needed. Set clear guardrails to ensure the right customers get the right features at the right thresholds.

Audit-Ready Invoicing: Ensure every charge is traceable from raw usage to invoice line item, whether billing daily, monthly, or in arrears.

And beyond billing, Chargebee equips you to operationalize PAYG across your GTM motion:

RevenueStory gives you real-time insights into how usage drives MRR, expansion, and churn, so your pricing isn’t just reactive, but strategic.

150+ ready-made reports help connect usage patterns with business outcomes, making it easier to iterate pricing or prove ROI to stakeholders.

In a world where customers demand pricing that scales with value, and AI features introduce cost at every interaction, usage-based models aren't just relevant; they're necessary.

Chargebee is purpose-built to help you launch, learn, and scale them, without drowning your engineering team in billing logic.

PAYG is already powering the next wave of SaaS growth. Chargebee makes it easy to operationalize from day one. Start for free.