The Knowledge - What is VAT?

Before getting into the intricate details and the flow of things, you must address the elephant in the room.

What is VAT?

VAT is "Value Added Tax". But anyone can answer that.

What is VAT?

VAT is a consumption tax applying to all digital/physical goods and services. But I bet you can find this after browsing through a couple of pages on the internet.

How does VAT work?

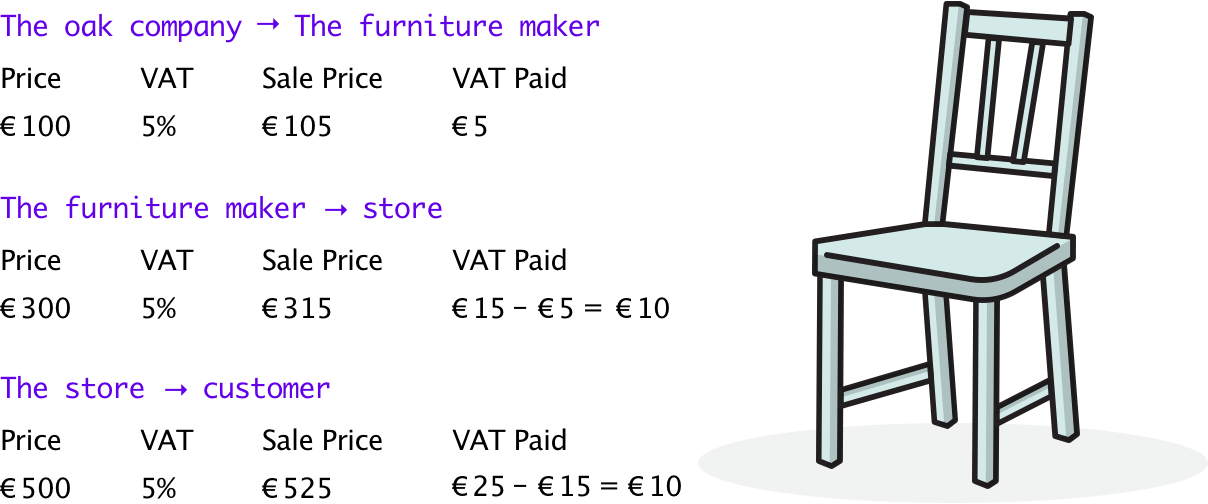

VAT Chair is not simply, a chair. It has a special purpose of making everyone understand VAT. There is an Oak company that sells raw Oak to a furniture maker for €100 + a VAT rate of 5%. It will charge the maker €105 and pay the tax amount of €5 to the government.

The furniture maker will sell the furniture to a store for €300 + a VAT rate of 5%. It will charge the store €315 and pay €15 - €5 = €10 to the government.

Finally the store will sell the finished furniture to its customer for €500 + a VAT rate of 5%. It will charge the customer €525 and pay €25 - €15 = €10 to the government.

Thus, the VAT is basically the tax imposed on the value added at each stage of the VAT Chair's story.

The Bigger Picture - Your SaaS business and VAT

Now that you have understood what VAT is, let's see how you fit in the grand scheme of things.

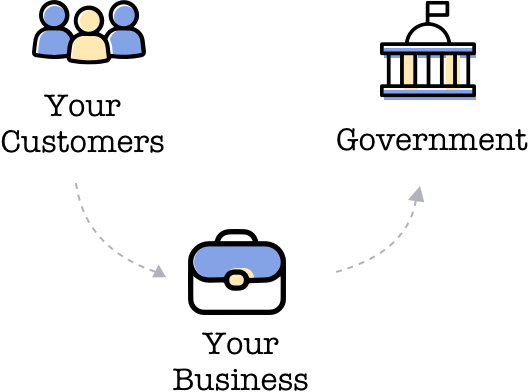

You are a business that sells certain goods/services to customers in the EU. You collect the taxes from them at the time of purchase and pay it to the government. You are essentially a VAT intermediary.

Sounds simple right? But this is where more problems pop up.

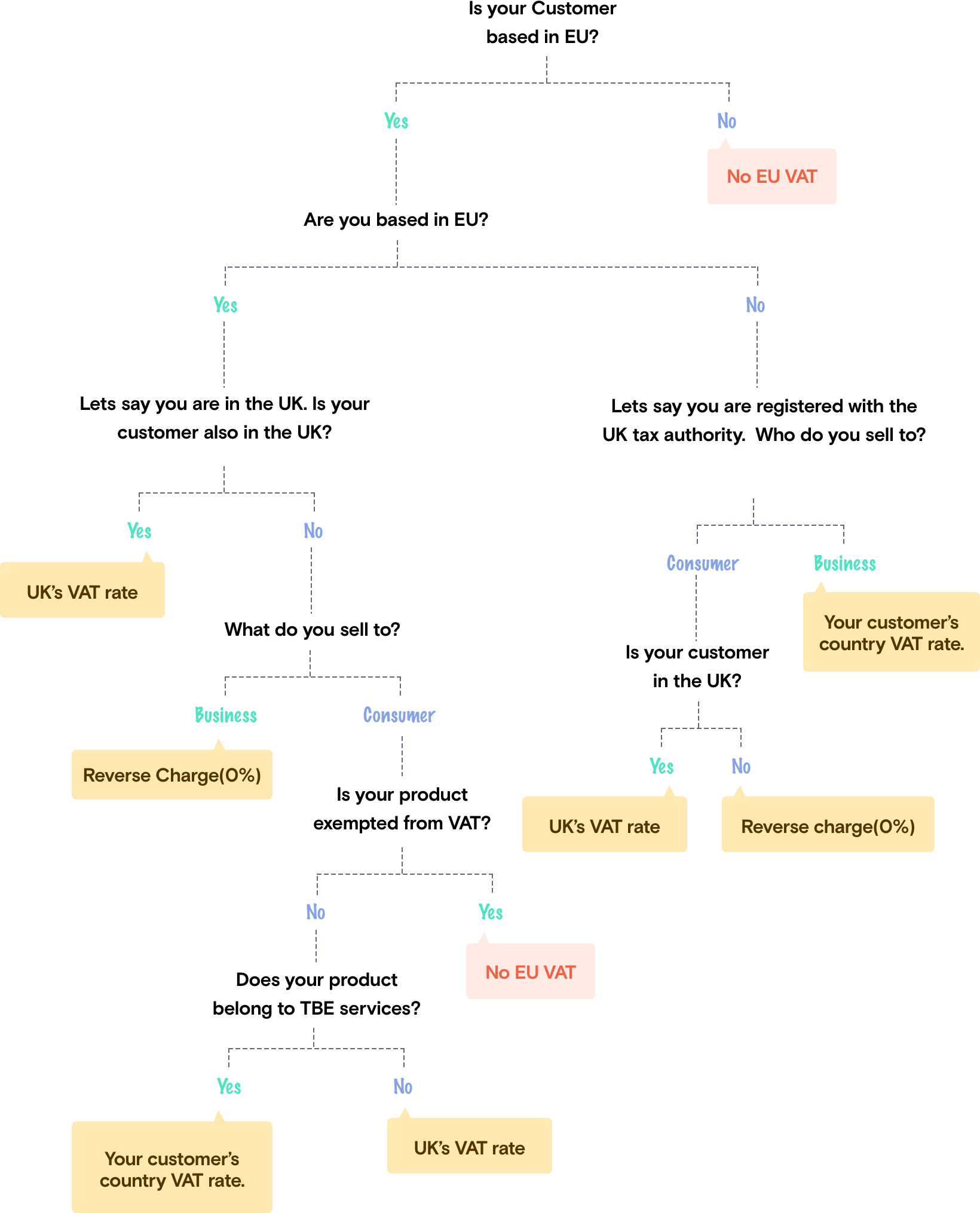

How will you know when to charge VAT? If you do, the next question would be, what EU VAT rate would you charge? What if your company is in one country and your customers are in another country? Which country's VAT rate do you charge then?

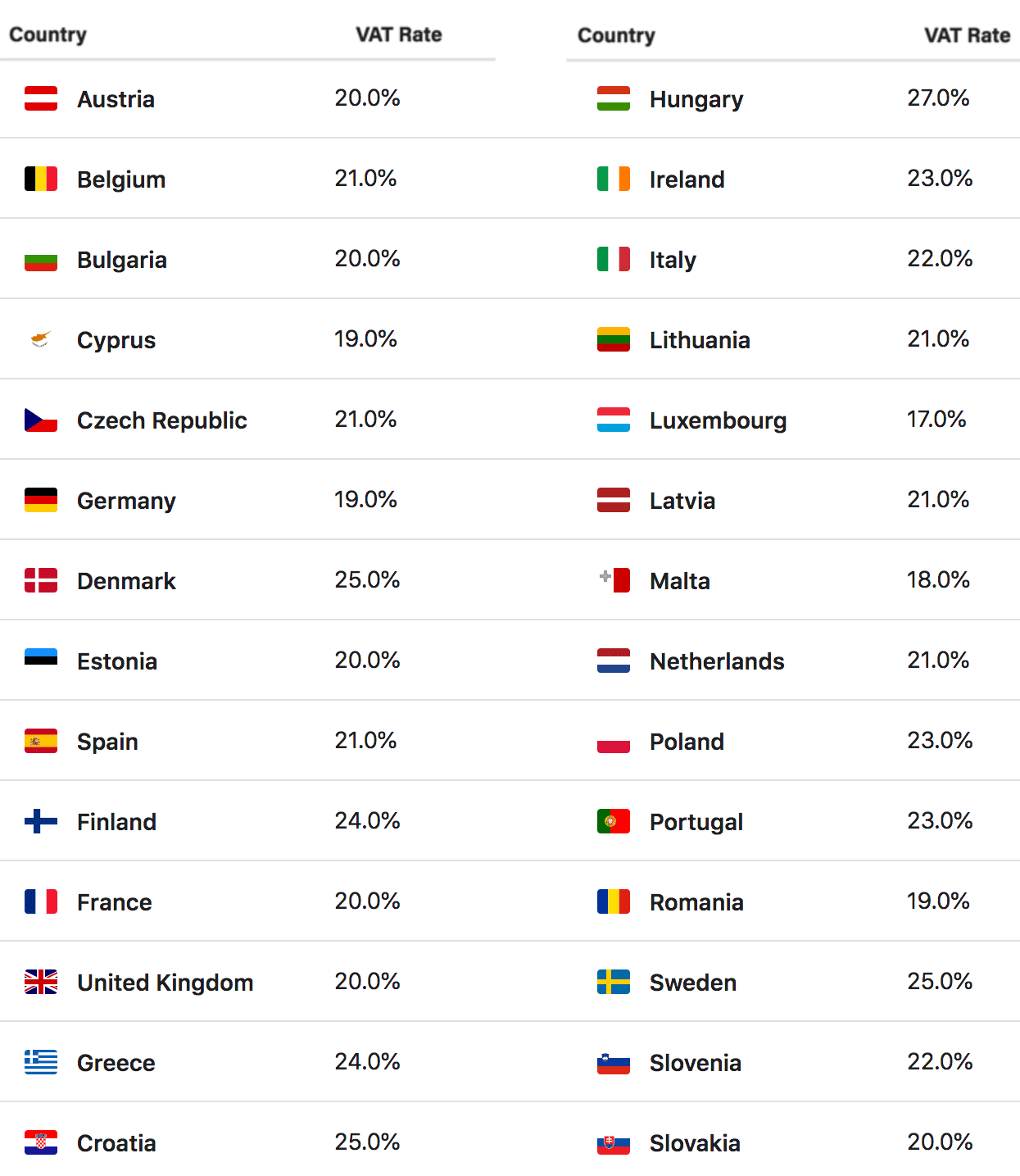

There are 28 member states with different EU VAT rates ranging from 17% to 27% along with the reduced rates, special rates and zero rates.

How do you validate the location of your customers? What are the details that you need to account for? From keeping invoices compliant to submitting VAT returns regularly, this process gets more and more messy.

The Product - VAT for Digital Goods

Before we help you untangle yourself from the entanglement you just saw, let's talk about the goods that you are dealing with here.

If you are someone who sells products through emails, websites, internet... anything under the umbrella of digital platforms, then you serve digital goods.

And to make that umbrella bigger, and to provide room for digital innovations, the European Commission has laid out a few conditions for a product to be considered digital:

- It is not a physical, tangible good.

- It's essentially based on IT. The offering could not exist without technology.

- It's provided via the Internet or an electronic network.

- It's fully automated or involves minimal human intervention.

All Cloud-computing software and SaaS, Online music/movie streaming platforms, Online games, ISPs, Websites, e-books fall under this category and this list grows as we speak!

With these prerequisites in your arsenal, let's solve that problem right away!