There’s always that one metric that makes your stomach churn:

Churn.

Where virtually every other SaaS metric is one you want to see grow, a rising churn rate makes most SaaS businesses sick.

SaaS churn rate can be measured and interpreted in a number of ways, but all approaches seek to help marketers and growth managers understand one crucial measure: the proportion of customers that cease to continue their subscriptions, and the resulting loss of revenue.

Though a simple concept, churn rates can be fairly complex to calculate, compare, and benchmark, especially when every company is using a slightly different calculation.

This article will teach you everything you need to know about SaaS churn rates, from calculation methods and industry benchmarks to tips for reducing churn and improving customer retention.

To navigate straight to the section which interests you most, click the links below:

- What is SaaS churn?

- How Do You Calculate Churn Rate?

- ARPU and ARPCS – The Causal Camaraderie

- What Is An Acceptable Churn Rate For SaaS Businesses?

- How Do You Reduce SaaS Churn Rate?

- Why Is SaaS Churn Rate A Key Metric For Subscription Services?

- Key Findings

- Minimize Churn and Maximum Growth with Chargebee

What Is SaaS churn?

In SaaS, churn (also known as churn rate) is the rate at which customers cancel their recurring subscriptions, measured as a percentage.

If you have a churn rate of 5%, then you can expect that in a given period, 5% of your customers will cancel their subscriptions with your company.

Understanding your churn rate is vital as it helps you to understand where the revenue bucket is leaking, and compare your measurements against benchmarks, whether they be your own or others’.

SaaS churn rates are not something to be taken lightly, with US businesses losing $136b per year as a result of churn.

But it’s not always your (or your client’s) fault…

What are voluntary and involuntary churn?

Voluntary churn is a result of a purposeful cancellation. That is, your customer no longer needs your product or switches to a competitor.

On the other hand, involuntary churn occurs when a customer’s credit card fails upon renewal of their subscription.

You might think that wouldn’t have a huge impact. If the card declines, you send them a dunning (request for payment) email, and they provide you with a new card number, right?

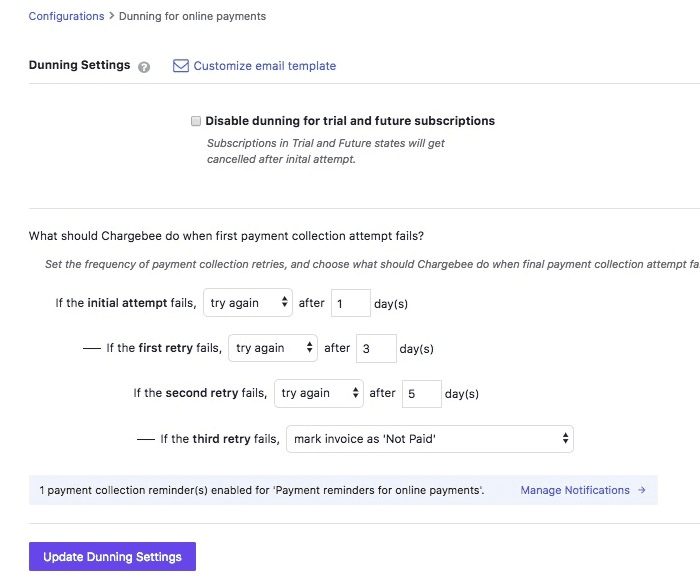

Just set something up like this in your system’s backend, and hit “Launch:”

Unfortunately not. Around 85% of customers never respond to dunning emails.

We’ll break down exactly what to do when this happens later in this guide.

Between failed credit cards and voluntary subscription cancellations, churn can be the end of many SaaS companies, so it’s worth paying close attention to.

How do you calculate the churn rate?

Before you dive headfirst into churn rate calculations, you need to decide what exactly it is you’re looking to track.

There are a few different kinds of SaaS churn:

- Subscriber churn

- MRR churn

- Annual revenue churn

For many SaaS companies, annual churn is too much of a lagging indicator to really be of any use. It’s something you might report on in an annual report, but the measurement intervals are too far between to be of any use for active changes.

That leaves us with Monthly recurring revenue (MRR) and subscriber churn, the essential difference being whether you’re using revenue or number of customers as a measurement.

Subscriber churn, also known as logo churn or customer churn, is used by about 69% of SaaS companies. Interestingly, 62% of those same companies measure MRR churn, so it’s clear that many companies are actually keeping track of both rates.

SaaS customer churn rate is a fairly simple calculation:

Subscription Churn = Cancellations in period/subscribers at the beginning of the period

MRR churn gets a little more complicated, especially because you can either calculate gross or net MRR churn.

Where gross MRR churn simply measures your lost revenue as a percentage of revenue at the beginning of the period, net monthly recurring revenue churn takes into account any new subscriptions added during the period.

Net MRR Churn = Revenue quit in the period – New subscriptions revenue/Revenue at the beginning of the period

By taking into account revenues from any new subscriptions or upsells, net MRR churn is a much more accurate measurement of actual revenue losses. It can be a little tricky to read, as it can deliver a positive or negative percentage as a result.

A negative churn rate means that the new revenues added during the period were greater than those that were canceled, which is, funnily enough, a positive place to be!

Net MRR churn rate beautifully sums up how much trouble you’re in because it takes into account your revenue expansion from upsells and cross-sells as well. Since it comes in a percentage, even a slight decrease in your Net MRR churn rate means it’ll be leaking dollars.

Is Net MRR churn enough to check the pulse of your business?

The churn rate captures only one dimension of your business. It only captures how good your revenue retention game is.

“The single story creates stereotypes, and the problem with stereotypes is not that they are untrue, but that they are incomplete. They make one story become the only story.”

If you devise strategies to just decrease your SaaS churn rate, you risk trading off Upgrade MRR for your Downgrade/Cancellation MRR. If your downgrade MRR decreases more than your increase in Upgrade MRR, your churn rate still falls, creating a false sense of security.

But the problem still remains.

Existing customers aren’t growing at an increasing rate. Looking into the churn rate and its immediate constituents will definitely help. But it won’t take you far without the help of a guiding metric or two. Metrics that give you a reality check.

Most of the SaaS metrics don’t do well in isolation. They don’t show you the entire picture, much like another beloved metric, Average Revenue Per User (ARPU). The SaaS industry has a bit of a love-hate relationship with ARPU because some believe that it’s a vanity metric. At the same time, others view it as a great benchmarking metric.

The way you track your ARPU can make or break your business. When not tracked in context with its sister metrics, like Customer Acquisition Cost (CAC) and Customer Lifetime Value (LTV), ARPU can derail your analytics.

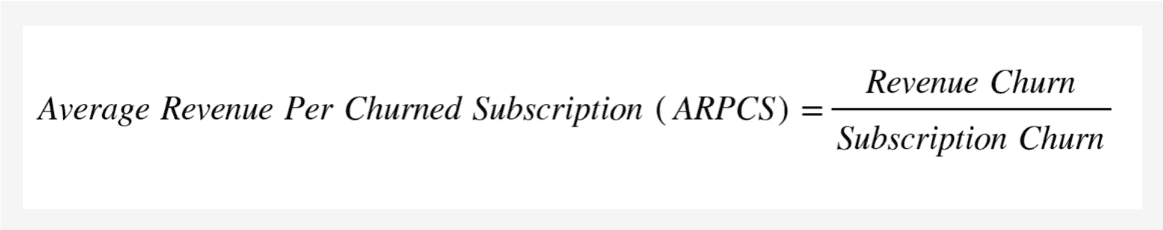

ARPU and ARPCS: The causal camaraderie

An easy way to probe the SaaS churn rate is to look at it with ARPU and Average Revenue Per Churned Subscription (ARPCS).

Let’s see an example…

Let’s say your churn rate is high, at around 10%. Your ARPU is $100, and your ARPCS is $20.

Now, this can be interpreted in two ways depending on your marketing strategy:

- If you’re trying to move upmarket and attract a high-paying customer base, it’s working. The high churn rate needn’t be as alarming.

- If you’re focusing on early-stage companies or SMBs, then you need to put out that fire as fast as possible, because it’s blazing.

This high-volume churn could be due to multiple reasons. It could be either because you made a recent pricing change that didn’t go down well with your smaller customers. Or perhaps you made a significant UI/UX change in your product that your existing customers didn’t immediately appreciate.

A solution would be:

- Grandfathering customers whenever you make a major pricing change.

- Roll out subsequent UI/UX releases to a smaller audience first. Consider having a phasing-out period when you give users the option to switch between multiple versions of your product.

Remember that low churn isn’t always good.

Imagine this: Your ARPCS is high (higher than your ARPU). Your churn rate is low.

This means you’re in grave danger even though your churn rate is low. You’re losing high-value customers. An immediate measure is to see if there’s a pattern forming and figure out why these customers churned.

If it is a one-time thing, assigning customer success managers and getting regular feedback would help.

If there’s a pattern, then go a step further and see at what point are these customers churning. If they’re churning early, then there’s a problem with the promises you’re making. If they’re churning at a much later stage, it means your product is not scaling with their growth.

So, a good rule of thumb to keep your churn in check would be to make sure your ARPCS doesn’t exceed your ARPU.

What is an acceptable churn rate for SaaS businesses?

Knowing how to calculate SaaS churn is one thing; knowing where you stand against industry benchmarks is another.

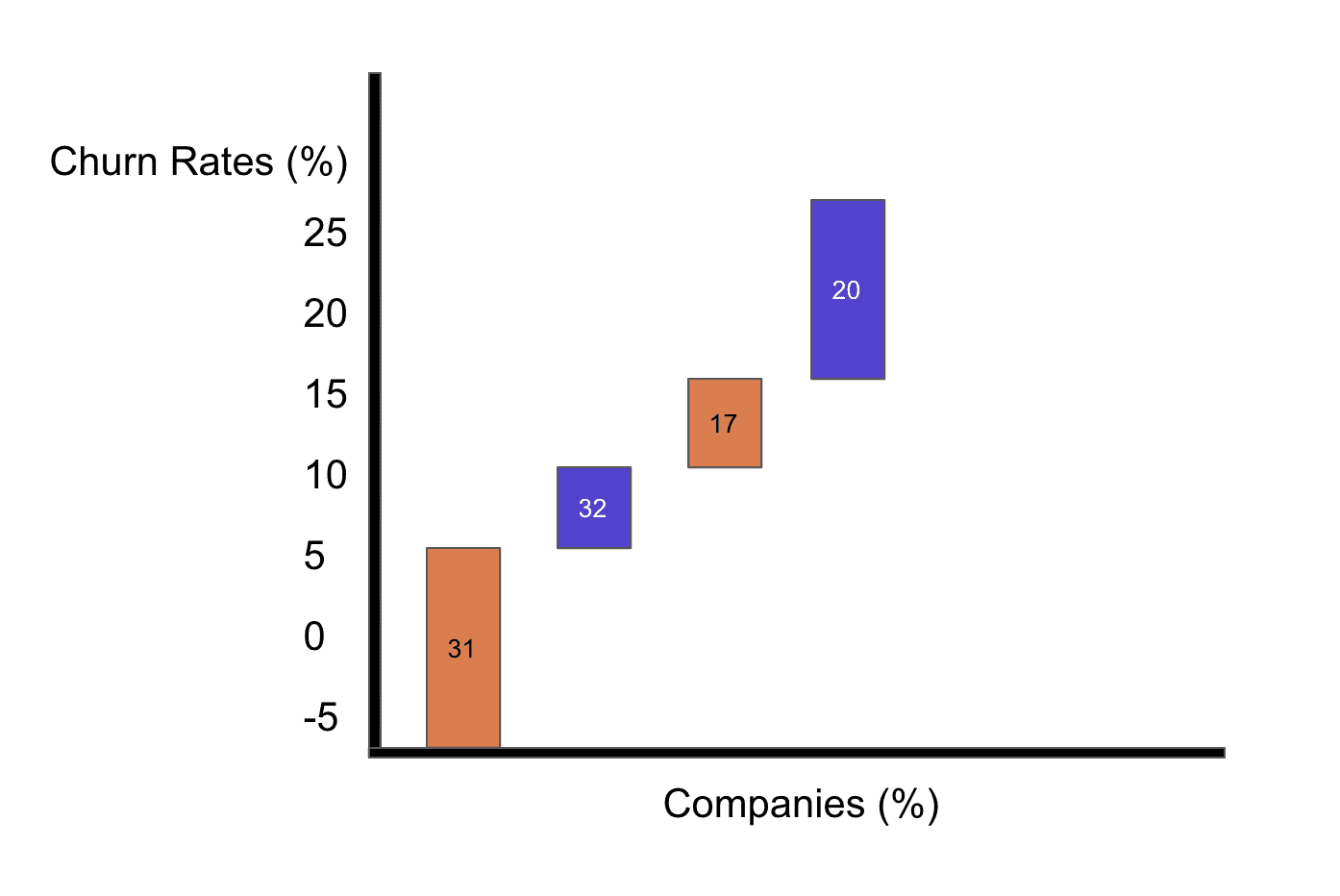

Though SaaS churn rates can vary from industry to industry (and as you’ve seen, depend a lot on the calculation used), the typical benchmark for average churn rate is 5-7%, with a 3% churn rate usually being seen as a great rate.

The interesting thing is, that though 5% is generally referred to as a good benchmark, two-thirds of companies have experienced churn rates higher than this.

That’s a pretty concerning statistic, especially when as high as 20% of companies are seeing churn rates of more than 15%!

With 30% of companies reporting increases in churn over the last year, learning how to control churn is absolutely vital to the ongoing success and longevity of your SaaS business.

There are a few different ways you can work towards reducing your churn rate. Let’s take a look.

How do you reduce your SaaS churn rate?

The obvious solution here is to have a product so great that nobody ever wants to leave.

That’s the dream for every SaaS business. But it’s just that; a dream.

Churn is a natural part of doing business — an inevitability.

There are, however, a couple of simple tactics to introduce that can help mitigate churn.

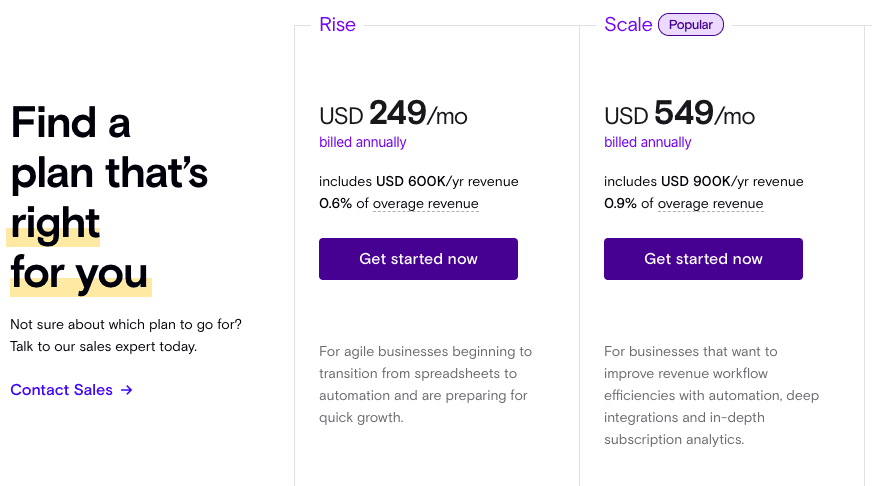

1. Offer an annual pricing plan

Compared to an across-the-board SaaS churn rate of 5-7%, monthly contracts have rates as high as 14%.

Annual plans, like Chargebee’s below, limit the chance for someone to churn:

By offering an annual pricing plan, you’re reducing the opportunity for churn in two ways.

- Firstly, you’re only charging their credit card once a year, rather than 12 times a year. So you’re far less likely to experience a payment failure and consequent involuntary churn.

- Secondly, with an annual contract, your customers are only making the decision to stay or leave once per year, when the contract comes up for renewal. With a monthly plan, it’s a lot easier for your subscribers to break and go with another option.

If you’re not already, offering an annual plan as a churn reduction method can convert 6.5% of the time, resulting in revenue lifts of around 4%.

2. Implement a smart Dunning Management System

A tenth of your recurring may be at risk, due to failed transactions. Many of these are due to expired credit cards, network outages, or insufficient funds on the card.

A simple approach would be to simply email your customer as soon as the payment fails, but this often isn’t the best approach.

For example, if the payment failure was due to a network outage, you’ll probably be fine to try again in a day or too.

On the other hand, trying over and over again to take payment can damage your reputation with payment gateways, and in the case of failures due to an expired card, are simply a waste of time.

The solution?

A payment retry automation feature such as Chargebee’s Smart Retry.

With Custom Retry, you can customize the payment retry sequence based on your own history and what you’ve found to be the best procedure for your company.

Alternatively, you can set it to Smart Retry, in which case Chargebee uses transaction patterns and industry best practices to maximize your revenue recovery.

By implementing a payment retry and dunning management system such as this, businesses can reduce their churn rates by as much as 100%.

Churn prevention or churn reduction?

Churn is a lagging indicator. By the time the numbers show on your reporting dashboard, the customers have already left.

It’s a symptom of an underlying disease.

Churn prevention is an uphill battle. There are a lot of other cues you can pick up before a customer churns out: Support tickets, plan movement, and (mainly), usage.

Usage retention is your Golden Snitch. If the paying subscribers aren’t using your product, they are going to eventually churn.

Trying to win the game just by tracking and improving revenue retention is not the solution. You can, however, make people stay by building a sticky product and scaling it consistently, i.e., usage retention.

Usage retention accelerates acquisition. New customers continue to stay and drive in more customers, thereby creating a self-sustaining cycle. If you improve usage retention, not only do you lose fewer users than you otherwise would, but you also influence the rest of your funnel.

A thoughtfully executed product is the best retention tool there is, aside from quality customer service. 66% of customers say that the best way to ensure this is to value customer time, so if you make this a priority, you’re likely to keep churn as low as possible.

Why is the SaaS churn rate a key metric for subscription services?

There are plenty of ways to interpret churn or any other metric for that matter. The underlying principle here is to pair them up with relevant SaaS metrics and not look at just one in isolation.

Mapping such metrics and deep-diving into them helps you identify and experiment with growth levers faster.

Quoting our earlier article on SaaS growth,

“If Baremetrics, Ning, and Bidsketch could have run faster acquisition, monetization, and retention experiments, they might have caught on that Freemium wasn’t working for them earlier than they did. Better yet, they could’ve ramped down on patterns that were not working and sidestepped freemium altogether.”

Looking at churn breakdown reports, subscription retention cohorts, and MRR churn by the plan could’ve helped them get to the root cause faster and minimize the damage. I’m saying minimize and not completely prevent the whole thing from happening because churn isn’t the best indicator of a company’s growth.

It’s definitely one to track, but it shouldn’t be your be-all and end-all metric for SaaS business growth.

Key Findings

Whether you’re a brand new B2B SaaS or an established company with hundreds of subscribers, SaaS churn is going to be a key metric to track.

It’s not one you should look at in isolation, but you should definitely be monitoring it on a monthly basis.

For many a SaaS startup, high churn rates can spell the end of a company, so it’s something to monitor from the get-go.

More than that, though, you should be analyzing why subscribers are churning. Knowing how many is one thing, but if you’re aiming to lower churn, then you need to know what’s causing your customers to leave.

Minimize Churn and Maximize Growth with Chargebee

Struggling with high churn rates? Chargebee is here to help. Our platform offers smart analytics, customizable dunning management, and automated payment retries tailored to your needs.

Discover Chargebee’s Difference. Don’t let churn hinder your growth. Learn how Chargebee can improve retention and boost your revenue.

Get Started Now!

Click here for your personalized Chargebee demo and take the first step towards lower churn and greater success