Credit Notes

See also

Overview

A credit note is a document sent by the merchant to the customer, notifying that a credit has been provided to their account. A credit note can be issued for the following reasons:

- Return of products due to:

- Expiry or damage.

- The product being different from what the customer had ordered.

- Change in the quantity.

- Customer's dissatisfaction.

- Cancellation of the purchase.

- Invoice amount wrongly stated due to miscalculation of price, tax, or discounts.

- Partial or complete waive off of the product sale after the invoice is generated and sent to customer.

A Credit Note in Chargebee will also be created when you:

- Refund an amount to the customer(not when the refund is issued from Excess Payments).

- Change to a subscription with lesser value with Proration enabled.

- Write off an invoice.

Note:

Note that a credit note will not be created when a refund is issued from Excess Payments, as these payments are not associated with any invoice.

Types of Credit Notes

Chargebee offers three types of credits - Adjustment, Refundable, and Promotional. Of the three, a Credit Note will be created only when you are offering adjustment or refundable credits.

Adjustment Credit Note

Adjustment credits reduce the amount a customer owes on an invoice that has already been issued but not paid.

- Primary use case: To adjust an invoice when a customer makes a subscription change (like a downgrade) after an invoice has been generated but before payment is collected. This scenario commonly involves calculating a prorated credit for the unused time on a higher-tier plan, which then adjusts the open invoice.

- Impact on invoices: This credit is directly applied to a specific, unpaid invoice, reducing its outstanding balance. The adjustment is meant to correct the amount due before the payment transaction occurs.

- Credit note generation: An "Adjustment Credit Note" is created to formally document this change.

Example(Proration Scenario)

A customer is on a $100/month plan. Their invoice for the upcoming month is generated on June 1. On June 2, before the payment is collected, they downgrade their subscription to a $60/month plan.

To reflect this change, you should issue a $40 adjustment credit. This credit is immediately applied to the open $100 invoice, reducing the amount your customer needs to pay to the correct price of $60.

Learn more about the creation of adjustment credits.

Note:

Adjustment Credits appear as Adjustments in the invoice.

Refundable Credit Note

Refundable credits represent an amount that you owe back to your customer on paid invoices. This credit can either be retained to be applied to future invoices or refunded directly to the customer.

- Primary use case: To provide a refund for a product or service the customer has already paid for. This is common for prorated downgrades or cancellations that occur mid-cycle on a prepaid plan, lack of fulfilling the service or delivering the product, or as a goodwill gesture.

- Impact on invoices: This credit is added to the customer's account balance and can be used to pay for future invoices. It is not tied to a specific unpaid invoice. You also have the option to refund this amount directly to the customer's original payment method.

- Credit note generation: A "Refundable Credit Note" is created.

Example

A customer on a $50/month plan that was paid on May 1st decides to cancel their subscription halfway through the month. You decide to credit them for the unused portion, which amounts to $25. You would issue a $25 refundable credit. This credit can either be kept on their account for future use or be refunded directly to them.

Learn more about the creation of refundable credits.

Standalone Credits

A standalone credit is a type of refundable credit that you can create independently, without linking it to any specific invoice.

- Primary use case: Use this when you want to provide a credit that is not related to any single past invoice. This is perfect for situations like issuing a credit for a returned product, a service outage, or as a special reward where you want to add a refundable balance directly to the customer's account.

- Impact on invoices: The credit is added directly to the customer's refundable credit balance. It can then be applied to any future invoices or be refunded to the customer.

- Credit note generation: A "Refundable Credit Note" is created.

Example

A customer who pays $50/month experienced a one-day service outage. To compensate them, you decide to offer a $10 credit. Since this isn't a refund against a specific invoice, you would create a $10 standalone credit. This amount is added to their account and will automatically reduce the payment due on their next invoice to $40, assuming that is the next upcoming invoice.

Learn more about the creation of standalone credits.

Note:

- Contact support@chargebee.com to avail the Standalone Credit Notes feature for your Chargebee Billing site.

- Refundable Credits appear as Credits in the invoice, while Standalone Credits appear as Refundable Credits in the customer balance.

Promotional Credits

Promotional credits allow you to offer a discount to your customers to encourage them to use your product or service.

- Primary use case: For marketing promotions, such as offering a "welcome credit" to new customers or as a reward for referrals.

- Impact on invoices: These credits are added to the customer's account and will be automatically applied to their next invoice. They cannot be refunded to the customer.

- Credit note generation: No, a credit note is not created for promotional credits.

Example

You run a promotion offering a $10 credit to all new customers. When a new customer signs up, you add a $10 promotional credit to their account, which will automatically reduce the amount of their first invoice.

Learn more about the creation of promotional credits.

- Contact support@chargebee.com to enable the Standalone Credit Notes feature for your Chargebee Billing site.

- Refundable credits appear as Credits on the invoice, while standalone credits appear as Refundable Credits in the customer balance.

- Promotional credits allow you to offer discounts to your customers to encourage them to use your product or service.

- Primary use case: For marketing promotions, such as offering a "welcome credit" to new customers or as a reward for referrals.

- Impact on invoices: These credits are added to the customer's account and will be automatically applied to their next invoice. They cannot be refunded to the customer.

- Credit note generation: No, a credit note is created for promotional credits.

Refer to this document and learn how you can customize the PDFs of credit notes sent to your customers.

Comparison of Credit Note Types

| Feature | Adjustment Credits | Refundable Credits | Promotional Credits |

|---|---|---|---|

| Primary purpose | To reduce the amount of an unpaid invoice, often due to proration from a subscription change. | To refund a customer for a paid invoice or provide a credit for future use. | To provide a discount for marketing or promotional reasons. |

| Creation logic | Linked to a specific unpaid invoice. | Can be linked to a paid invoice (i.e., refundable credit) or created independently (i.e., a special type of refundable credit called a standalone credit) | Added directly to a customer's account. |

| Sample use case | Downgrading a plan after invoice generation but before payment. | Prorated refunds for cancellations or downgrades after payment. Issuing a credit for a returned product, a service outage, or as a special reward without linkage to an invoice(Standalone credit). | Welcome credit for new customers. |

| Generates a credit note? | Yes | Yes | No |

| Refundable to customer? | No | Yes | No |

| How it’s applied? | Applied to a specific, existing unpaid invoice. | Can be applied to future invoices or refunded. | Automatically applied to the next invoice. |

| Point of application | Applied after tax and does not reduce the recorded tax. | Applied after tax and does not reduce the recorded tax. | Applied before tax and it reduces the taxable amount. |

Creating an Adjustable or Refundable Credit Note

You can create a refundable credit note by clicking the ‘Create a Credit Note' option in the Invoice.

The type of Credit Note that can be created depends on the invoice status.

If the invoice is in Payment Due state, then you will be able to only create a Credit Note to adjust the due amount.

If the invoice is in the Paid state,then you will be able to only create a Credit Note to provide refundable credits.

If the invoice is partially paid, you can choose to either adjust the due amount for the unpaid amount or provide credits against the paid amount.

Checkout the visuals below to see how this is done.

Refundable Credit Note:

The credit note created will look as shown below:

Adjustable Credit Note:

The reason that you select while creating the Credit Note will be displayed in the Credit Note. Any Credit Note in Chargebee will have one of the following status:

- Refund Due: When the credits are yet to be used, or have been partially used

- Refunded: When the entire credits have been used, the status of the Credit Note will change from Refund Due to Refunded

- Voided: When a Credit Note has been canceled

- Adjusted: When a Credit Note has been adjusted against an Invoice amount

You can also choose to customize your Credit Notes to suit your requirements (such as numbering, adding a note etc). To customize your Credit Notes, go to Settings > Configure Chargebee > Invoices & Credit Notes.

Note:

Fractional Correction:

When using the Create Credit Note operation, by default, the total invoice amount will be prorated against all the line items present in the invoice. Suppose that you edit the credit note amount and create multiple credit notes against a single invoice. The line items' amounts in such credit notes are arrived at by applying the same ratio as was in the original invoice. This can lead to a small surplus or deficit, which is captured as fractional correction. Keep in mind that this amount is not lost anywhere. It will be adjusted in the final credit note that you create for the respective invoice.

Creating Standalone Credits

Standalone credits refers to the credits that can be created independently from an invoice. You can assign standalone credits to your customers based on select items, and these credits will not be directly related to any invoice. Standalone credits are added under the section of refundable credits on a customer balance.

Note:

- Contact support@chargebee.com to avail the Standalone Credit Notes feature for your Chargebee Billing site.

- This feature is not supported if you are using Chargebee RevRec.

The below visualization helps you add Standalone Credits via the Chargebee user interface.

See also

Service Period of Line Items on the Credit note

When a credit note is generated for an invoice, the service period for the line items in the credit note is also captured which can be displayed on the credit note PDFs.

You can display either of the following as the service period of the line items on your credit notes:

- The line items' billing period on the invoice: The service period for the line items in the credit notes will be the same as their respective billing period on the invoice. This allows for a clearer revenue recognition wherein the credit note generation does not reflect against a single month, but instead gets distributed across the entire billing period.

- The credit note generation date: The service period for the line items in the credit notes will be the date on which the credit note is generated.

The service period gets displayed accordingly regardless of the credit note being generated manually, or automatically when an invoice gets voided, cancelled, or through dunning.

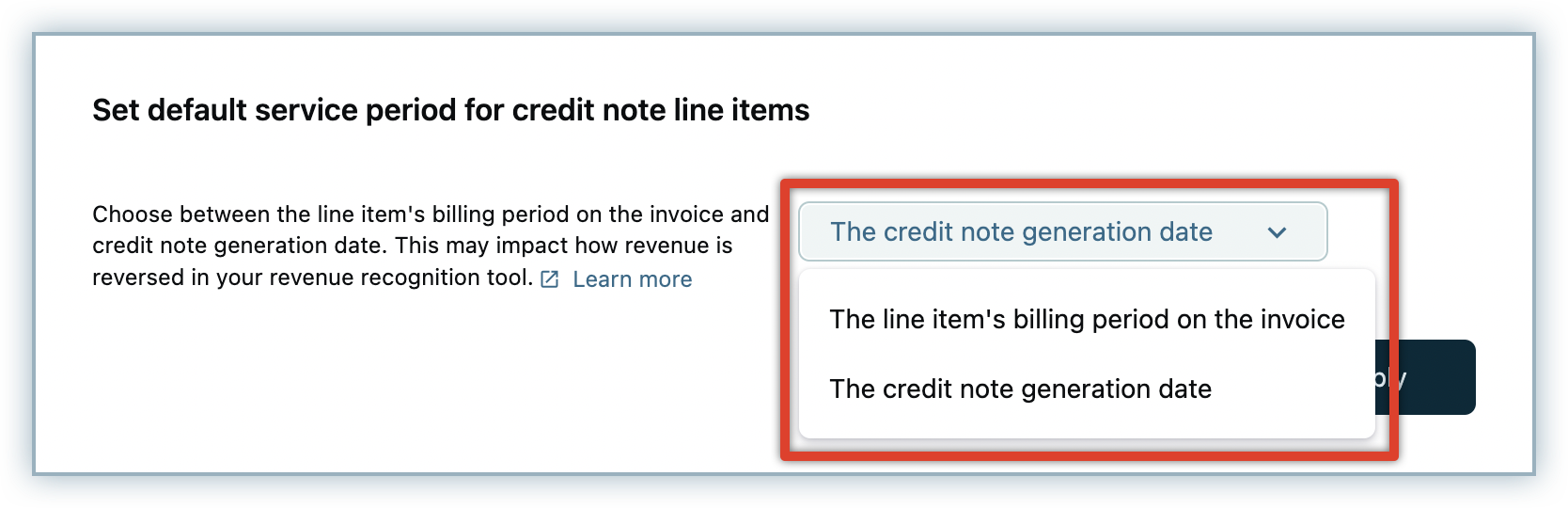

To configure the default service period for credit note line items, follow these steps on your Chargebee site:

-

Click Settings > Configure Chargebee > Billing LogIQ > Billing & Invoices > Set default service period for credit note line items.

-

On the Set default service period for credit note line items popup, select your preferred option from the drop-down.

You can choose from the following options:

- The line item's billing period on the invoice

- The credit note generation date

-

Click Apply.

The credit notes details page and the credit notes PDF displays the service period for the line items based on the above setting.

Creating a Credit Note for a Line Item

Chargebee allows you to create Credit Notes for individual line items if your Invoice has more than one line item. You can choose to create a credit note for the entire line amount or a part of it. The below visualisation shows how to create credit notes for one or more line items.

Proration and Credit Note Creation:

During a subscription change, Credit Notes created due to proration (Adjustment/Refundable) will be generated depending on the invoice status. Learn more.

Time Zone of Credit Notes:

Credit notes will be recorded in the time zone of the Chargebee site at the time of generation. However, if you change the time zone, the newly generated credit notes will follow the new time zone and the ones that were generated already will be recorded in the previous time zone. Say you had your Chargebee site set to follow PST till the 30th of April. On the 1st of May, you change the time zone of your Chargebee site to EST.

The credit notes generated till the 30th of April will be in PST and credit notes generated from the 1st of May will be in EST. For invoices that are impacted with the time zone alteration, a banner, with the details of the change, will be displayed on the Credit notes details page.

You can view all the Credit Notes that you have created by clicking Invoices and Credit Notes > Credit Notes.

Creating Promotional Credits

Any referral bonus, loyalty credits, rewards, cash back, etc. that you would like to provide your customer can be provided as promotional credits. These credits are added at a customer level which means they can be adjusted towards any invoice of the customer.

Note:

- Credit Notes will not be created for Promotional Credit.

- Promotional Credits can be applied only on upcoming invoices, both one time as well as recurring.

- The treatment of Promotional Credits is similar to that of discounts, so tax will not be applicable on Promotional Credits.

- If an invoice is deleted, the Promotional Credits applied on that invoice will be reclaimed.

- Promotional Credits cannot be refunded as cash in Chargebee.

- In the case of Metered billing, these Credits will be applied only when the invoice gets closed.

You can add or deduct Promotional Credits via the Chargebee user interface or API.

The below visualisation helps you add Promotional Credits via the Chargebee user interface.

The credit balance will reflect in the summary section.

You can also view the transactions made using the promotional credits by clicking the Promotional Credits tab in the History section.

You can perform the following operations with respect to Promotional Credits using APIs:

- Adding Promotional Credits for a Customer

- Deducting Promotional Credits for a Customer

- Setting Promotional Credits for a Customer

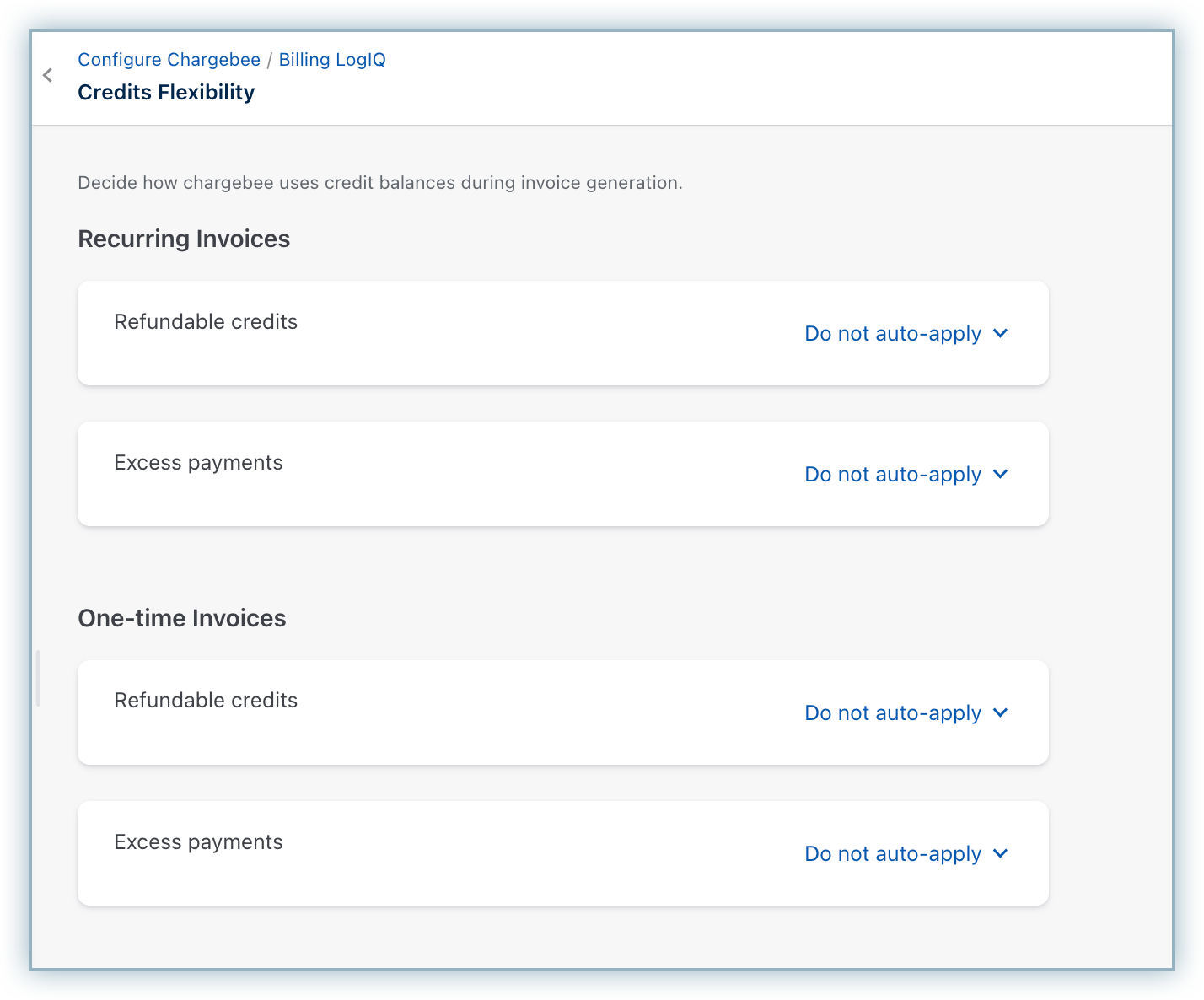

Credits Flexibility

The Credits Flexibility feature is currently in Beta. Contact us at support@chargebee.com to avail this feature on your Billing site.

The Credit Flexibility feature in Chargebee Billing provides enhanced control over how refundable credits and excess payments are applied to invoices at a site or subscription level. It enables your users to manage automatic credit application at the site level for both recurring and one-time invoices. You can choose to enable or disable the auto-apply functionality, offering greater flexibility to align credit usage with specific billing preferences or business needs.

To configure Credits Flexibility feature on your Chargebee Billing site, follow these steps:

- Navigate to Settings > Configure Chargebee > Billing LogIQ > Billing & Invoices > Credits Flexibility.

- On the Credits Flexibility page, you can set whether Refundable credits and Excess payments can be auto-applied for Recurring Invoices and One-time Invoices using the respective drop-downs. You can select from the following options:

- Do not auto-apply: If you select this option, refundable credits or excess payments will not be applied on invoices automatically. You can choose to apply them manually as and when required.

- Auto-apply during invoice generation: If you select this option, refundable credits or excess payments if any, are automatically applied during invoice generation.

This is a site level setting and what you select here is applicable for all recurring and one-time invoices by default.

- Once you are done, click Apply to save your changes.

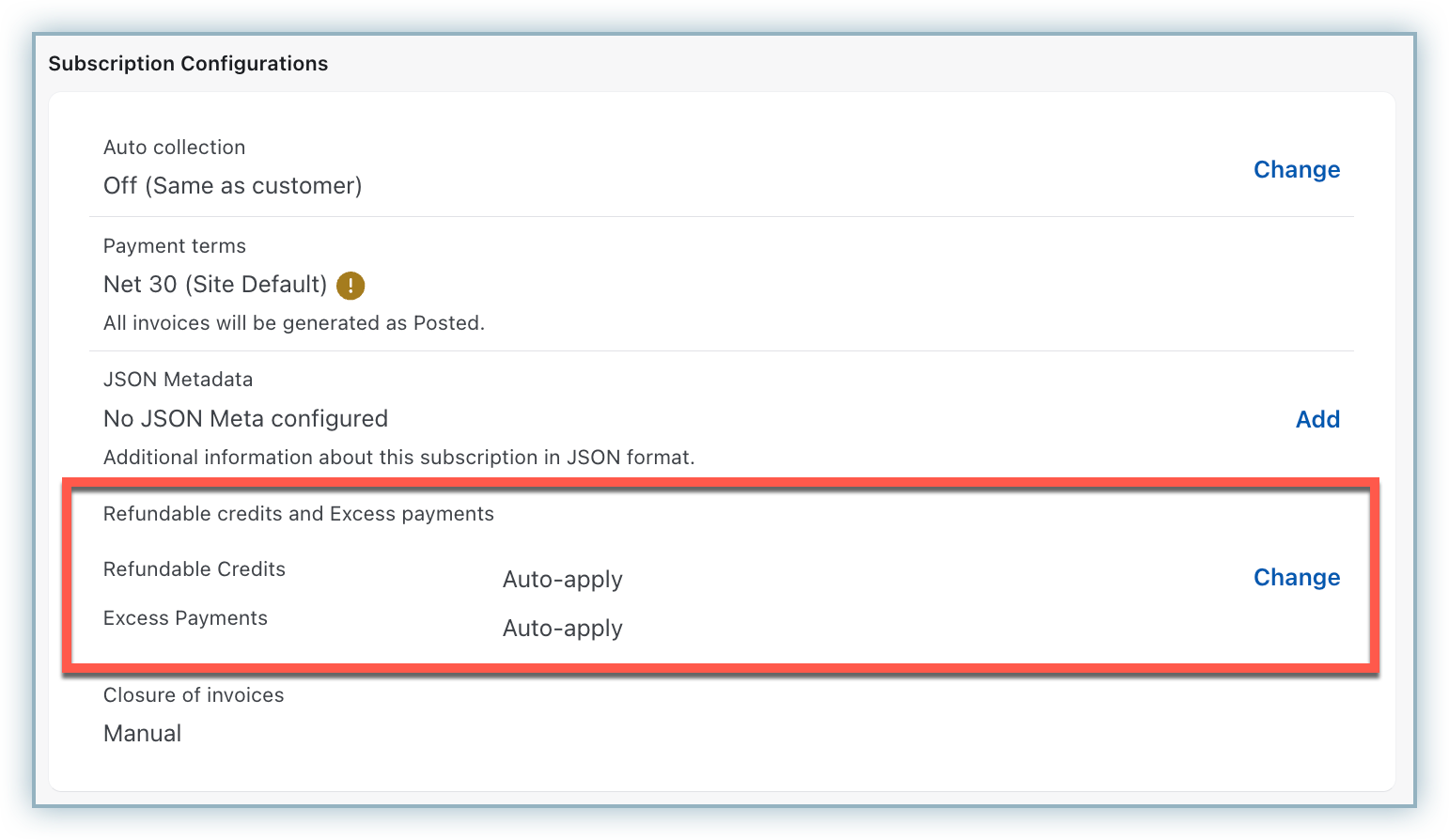

Overriding Credits Flexibility for Subscriptions

Refundable credits and excess payments are applied(or not) to invoices of all your subscriptions based on the credits flexibility settings configured at your site-level. However, you can customize this site setting for individual existing subscriptions as required, overriding the default site-level credit flexibility settings. You can even set a maximum limit for a subscription upto which refundable credits or excess payments can be auto-applied on an invoice that get generated for the subscription. This gives your finer control and ensures that unique billing requirements for specific subscriptions are met without impacting your site-level setup.

To customize the credits flexibility for an existing subscription record, follow these steps:

-

Navigate to the details page of the subscription record.

-

Under the Subscription Configurations section, the Refundable credits and Excess payments displays the default settings for credits flexibility configured at your site-level.

Click Change to update the credit flexibility settings for this subscription.

-

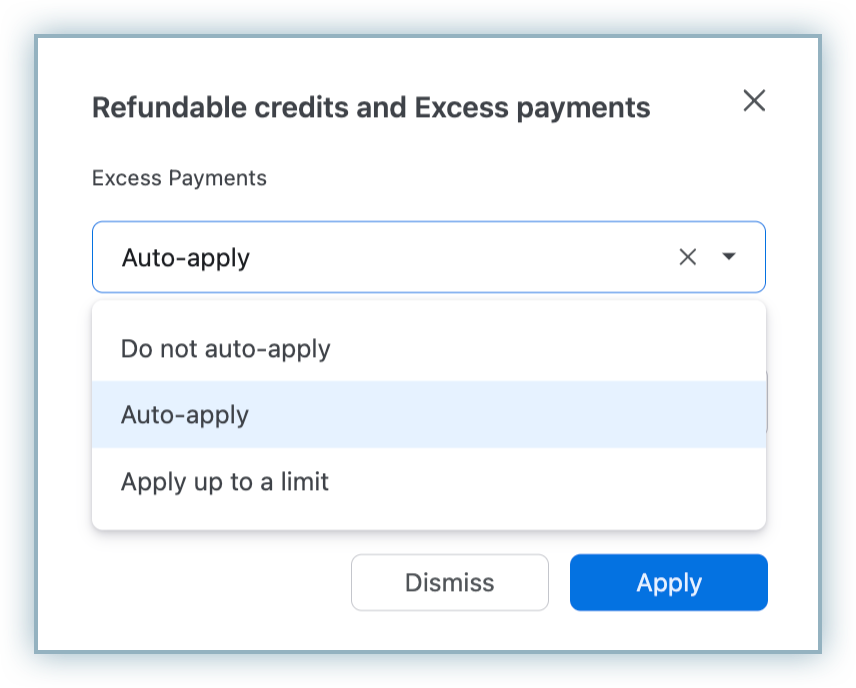

On the Refundable credits and Excess payments pop-up that appears, select from the following options:

- Do not auto-apply: If you select this option, refundable credits or excess payments will not be applied on invoices automatically.

- Auto-apply: If you select this option, refundable credits or excess payments if any, are automatically applied during invoice generation.

- Apply up to a limit: If you select this option, you can specify an amount limit upto which refundable credits or excess payments will be applied on an invoice automatically.

-

Click Apply.

The site-level credits flexibility settings is successfully overridden for the subscription record. Alternatively, you can pass the following parameters at create subscription and update subscription APIs:

-

billing_overrides[max_excess_payment_usage] -

billing_overrides[max_refundable_credits_usage]

These parameters determine how much of each credit type should be auto-applied every time an invoice is generated for a subscription.

Note:

Overriding credits flexibility settings via UI is currently available only for existing subscriptions and is not possible while creating a subscription. You can set these limits at the time of subscription creation only via API.

Applying Credits

Any invoice that is generated after the Credit Note has been created will be auto adjusted.

For old invoices in payment due status, the credits must be manually applied as shown below.

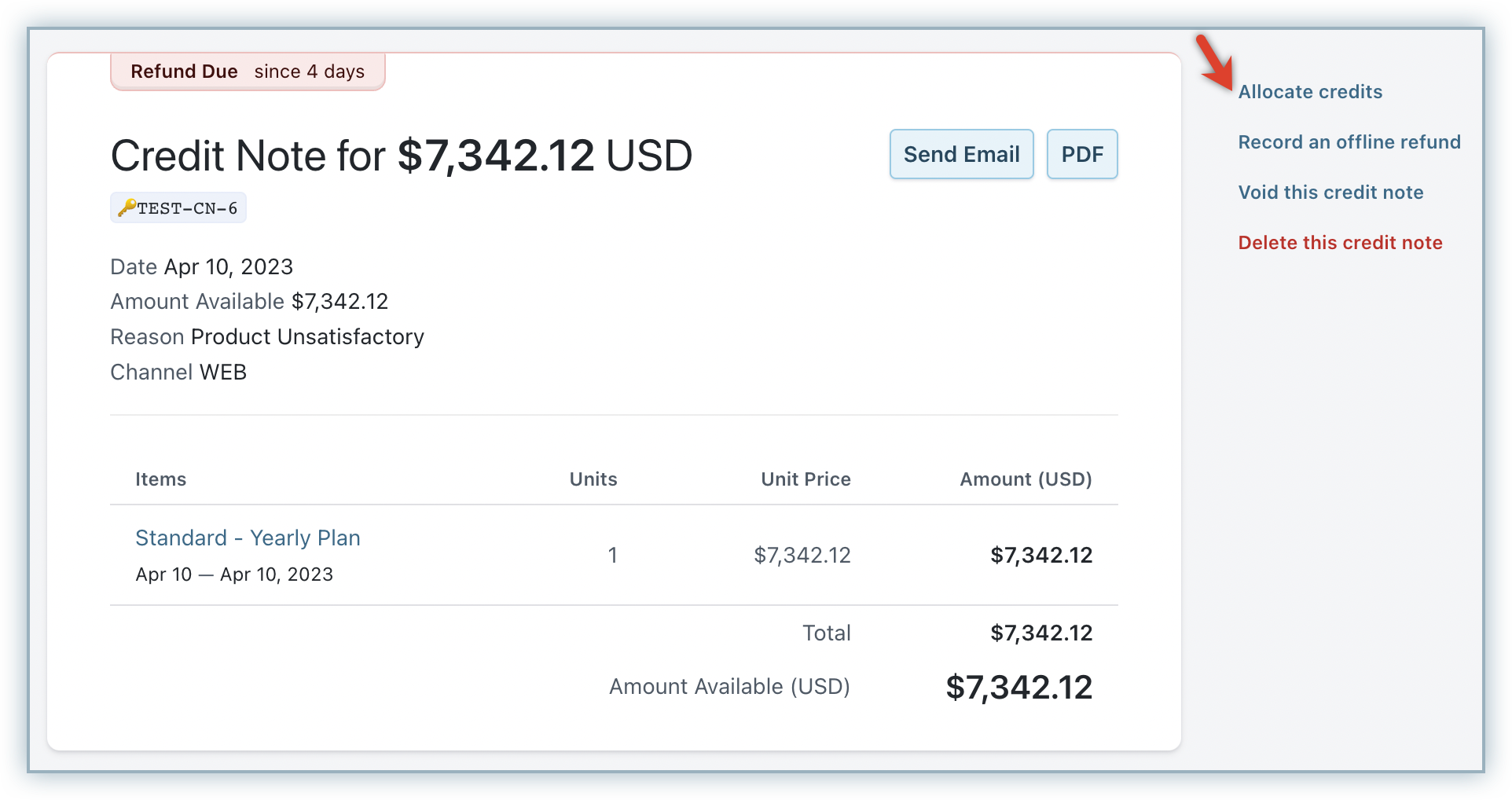

Alternatively, to apply the credits to existing invoices:

- Open the Credit Note

- Select Allocate Credits

- Select the Payment Due Invoices and click Allocate.

Removing Applied Credits

You can remove the allocated credits from an Invoice. When you remove the allocated credits, the Invoice moves to a 'Not Paid' status and the Credit Note moves to a 'Refund Due' status.

From the Credit Note:

Issuing a Refund

You can directly issue a refund using the Issue a Refund option in the Invoice. When you use this option a Credit Note will be created with the 'Refunded' status. The amount will be directly refunded to the original payment method.

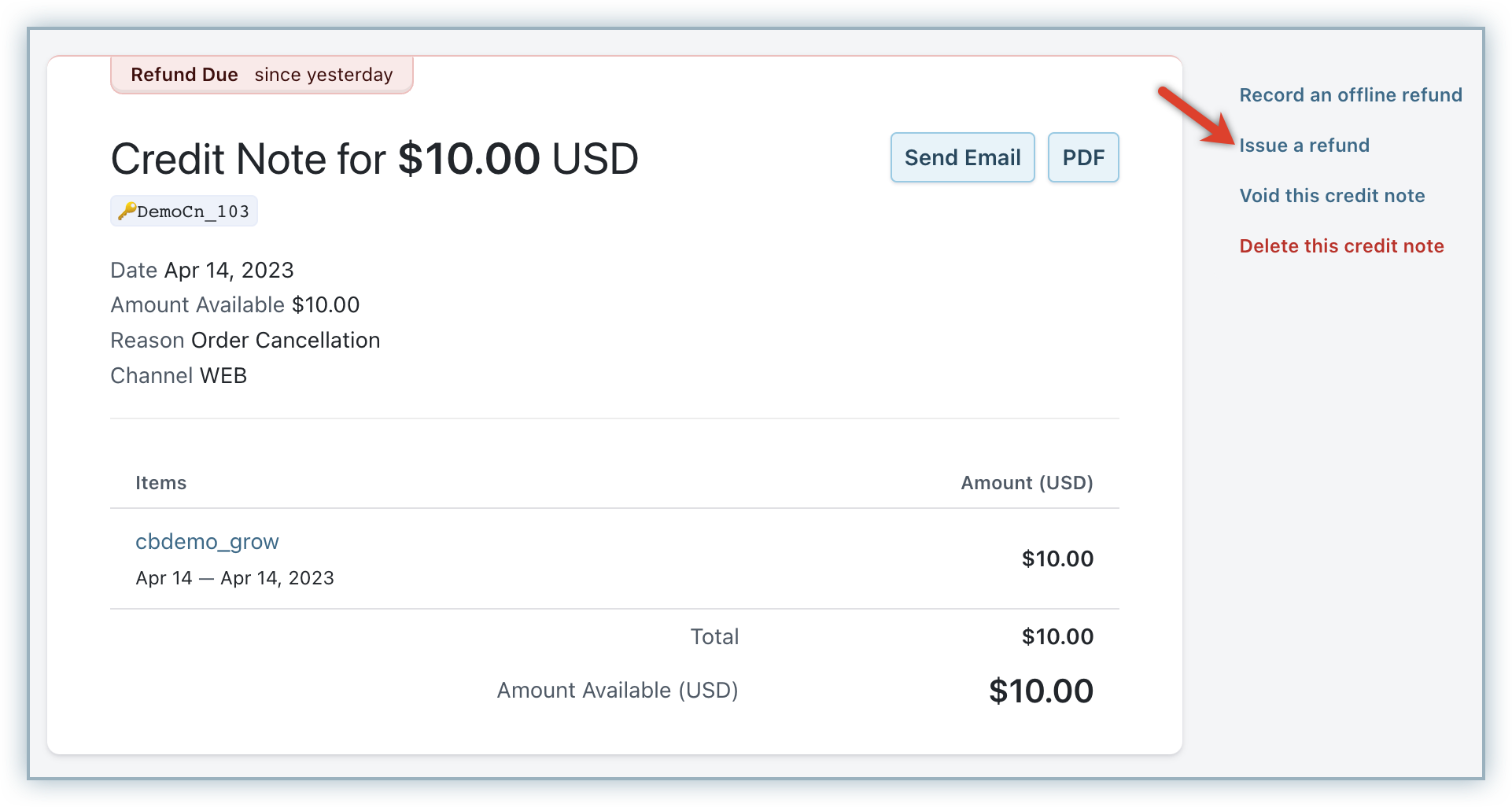

In case you have created a Credit Note, and your customer wants a (partial or full) refund of the amount to their original payment method, then:

- Open the Credit Note

- Click Issue a refund

- Enter the amount and click Refund

Note:

This option is applicable only if you have made the payment via card. For payments made via cash, check, bank transfer etc, please use the 'Record an Offline Refund' option and refund the amount manually.

Voiding or Deleting a Credit Note

The option to Void or Delete a Credit Note can be used to remove wrongly generated Credit Notes. If the Void option is used, the status is marked as Voided but the Credit Note will still be available in the system. However, if a Credit Note is deleted, it is removed from the system and the operation cannot be undone. It is good accounting practice to void an invoice instead of deleting one.

To void or delete the Credit Note, select the credit note from the Credit Notes page and click the Void/Delete Option.

Exporting Credit Notes

You can download your Credit Notes as a PDF or a CSV using the export feature.

- Navigate to Invoices & Credit Notes > Credit Notes

- Click the Ellipsis icon (three dots) and select the Export option

Displaying Exchange Rates in Credit Notes

To stay compliant with the South African law, when billing is done on a different currency other than South African Rand, you can display the exchange rate on the credit note details page and the credit note pdf. Contact us at support@chargebee.com if you want exchange rates to be displayed on your credit notes.

FAQs

1) How is revenue recognised from a credit note?

Credits raised in Chargebee are accounted for in reports non-retrospectively. When a new credit note is created for an invoice in the past, the past days' reporting is not altered. Instead, the credit note charge is calculated and recognized on the current day.

2) How can I use a query or report to calculate the total amount of promotional credits applied to invoices within a specific time period?

To calculate the total promotional credits applied to invoices during a specific time period, follow these steps:

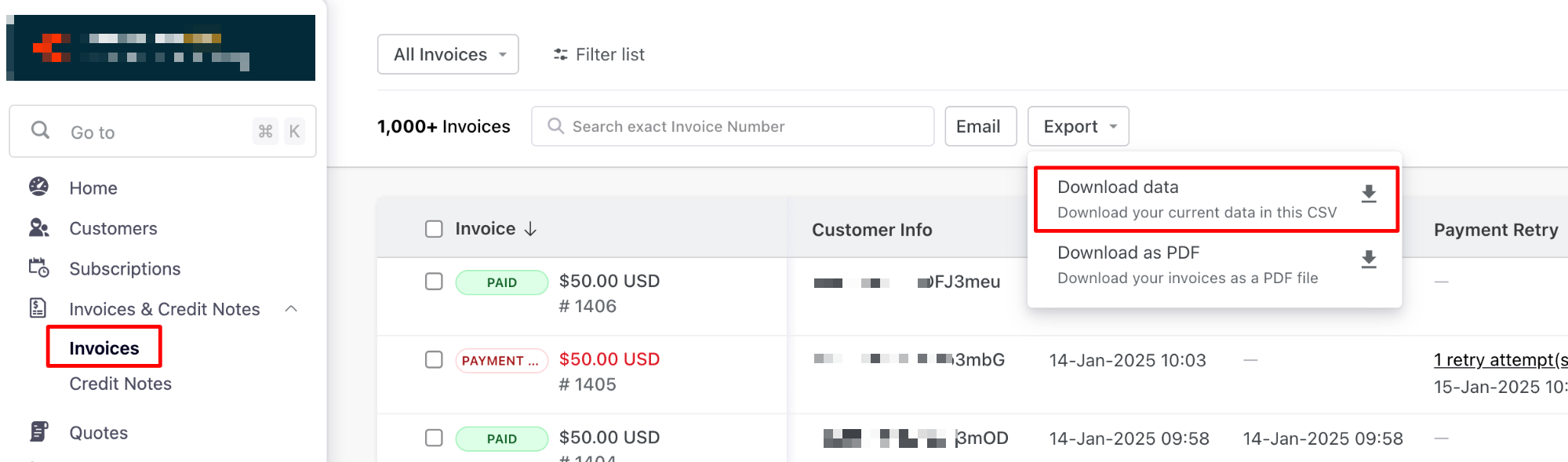

-

Export Invoice Data Navigate to the Invoices page in your Chargebee site and go to Invoices > Export > Download data.

-

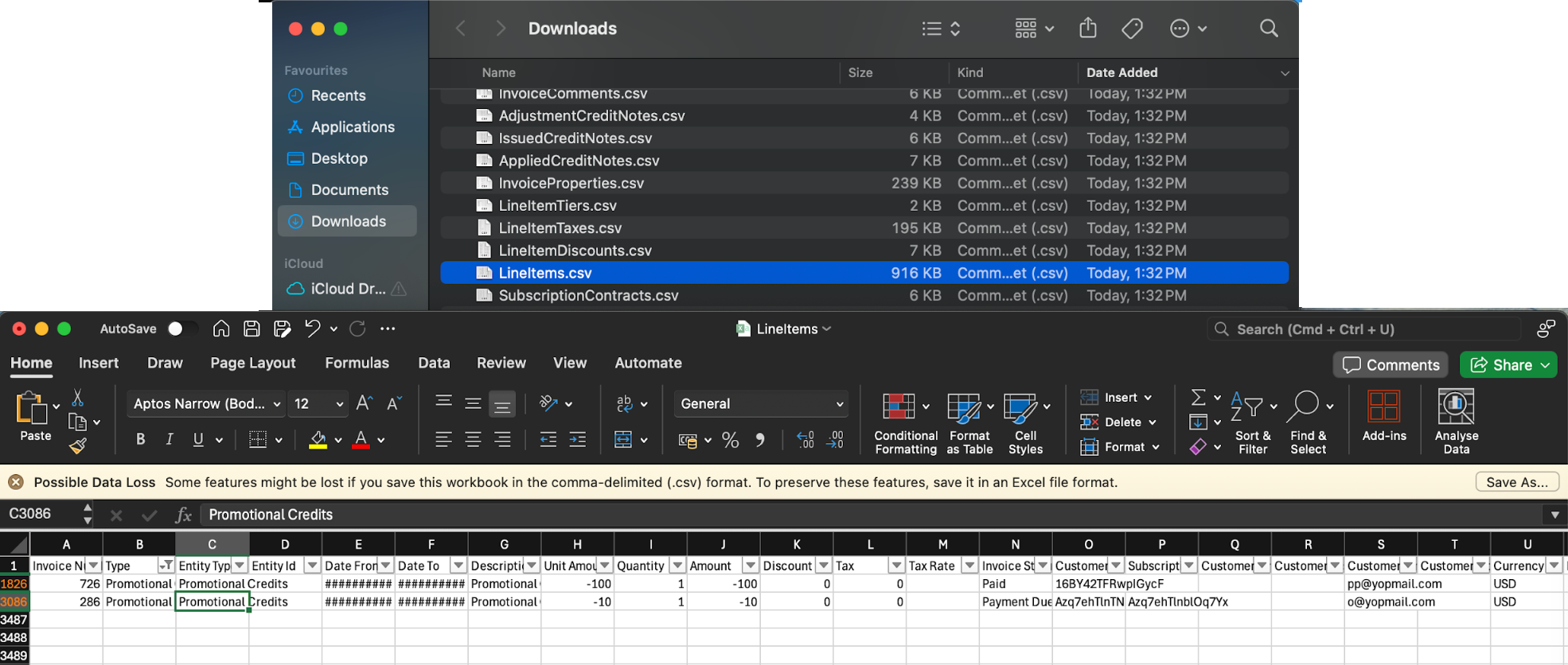

Use the LineItems.csv File After exporting, locate the

LineItems.csvfile from the downloaded archive. This file contains detailed line-level data, including information about applied promotional credits.

-

Filter and Calculate Open the file in Excel or Google Sheets and filter by:

- Line item type: Look for rows tagged with "promotional credits" or similar indicators.

- Date range: Filter by the invoice creation date to match your required time period.

- Sum the amounts in the relevant column to get the total promotional credits applied.

This method provides a simple yet effective way to analyze credit usage across invoices.

If you need more advanced reporting, you can also explore Chargebee's RevenueStory or connect the data to external BI tools.

Was this article helpful?