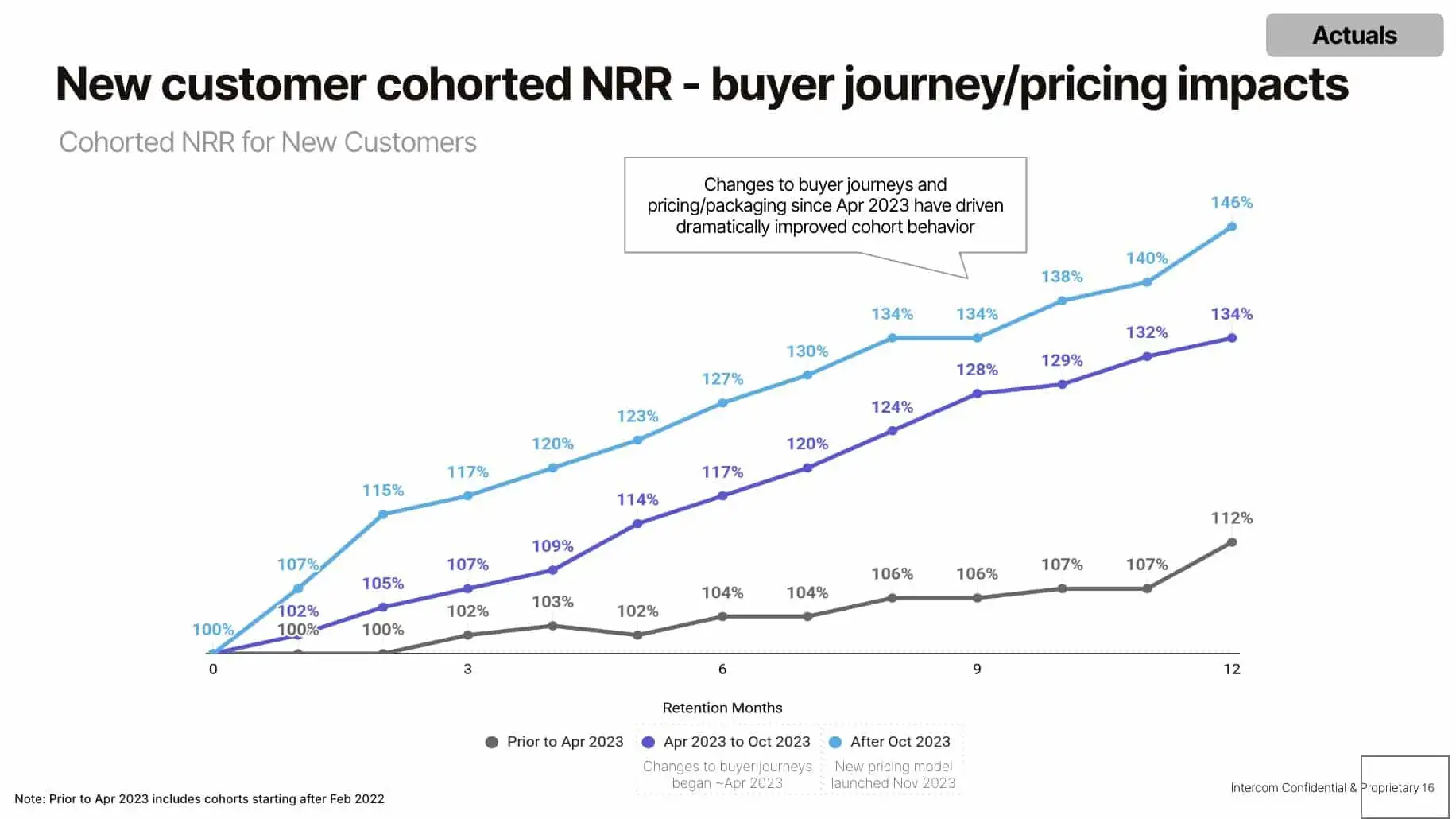

Even when customers agree on the pricing metric, they still need to see the value behind it. The credibility of any metric fades fast if customers can’t track how it grows with their outcomes.

That’s why leading pricing teams are investing not just in the math of monetization, but in the infrastructure of visibility.

The strongest operators treat outcome measurement as a habit, not a model. They set baselines, build in-product dashboards, and run customer feedback loops to mutually validate value before turning those signals into billable metrics.

But value visibility doesn’t stop at reporting. It extends into every revenue touchpoint. As Manu noted: “invest in enablement for sales: clear catalogs, standardized calculators and proposals, and ongoing training.” That’s because making value visible starts inside the company, with teams that can articulate how every line item on an invoice connects back to impact.

Pricing transparency and consistent enablement don’t just smooth negotiations; they build trust capital, the currency that sustains pricing power over time.

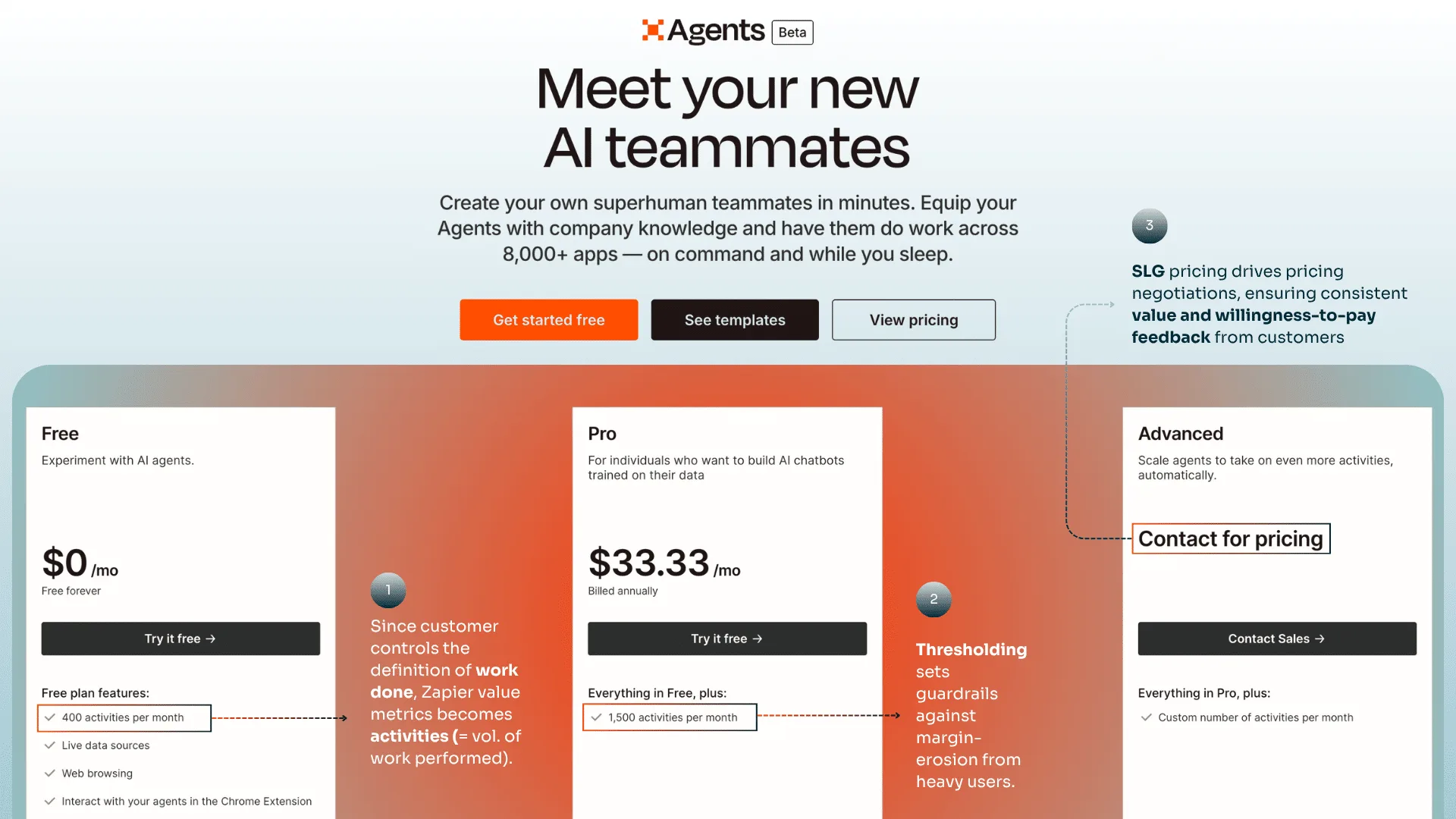

Today, implementing outcome-based pricing remains aspirational for many. While it promises the perfect alignment between product costs and customer benefits, an AI solution’s multithreadability—its ability to power multiple workflows and outcomes, thereby generating variable costs across every usage path—makes that promise harder to hold.

The strongest operators don’t try to force outcomes into a pricing model where they don’t belong. Instead, they treat outcome exploration as a shared journey with the customer, starting with metrics that demonstrate product value rather than challenging the customer’s definition of a business result. These controllable, provable, and sustainable metrics let pricing behave like outcome-based pricing in spirit, without the fragility of its execution.

"Truly understanding where your customers are deriving value in your product and what those outcomes are will unlock all sorts of flexibility when it comes to pricing, even if you never get all the way to the point of fully outcome-based pricing."

- Joey Quirk, Head of Monetization & Technical GTM Advisory, Chargebee

This requires more than testing multiple metrics and price points. But doing this well takes more than testing metrics or price points. It requires a GTM organization fluent in how customers define success, equipped with a clear signal that quantifies it, and disciplined in maintaining a feedback loop that evolves with both. When those pieces click, pricing earns the one thing that spreadsheets can’t model: trust.