As we deploy the world's most advanced AI supercomputers, we needed billing that scales with our complex hybrid business model. Chargebee's flexibility, extensibility, and roadmap align with our ambitions.

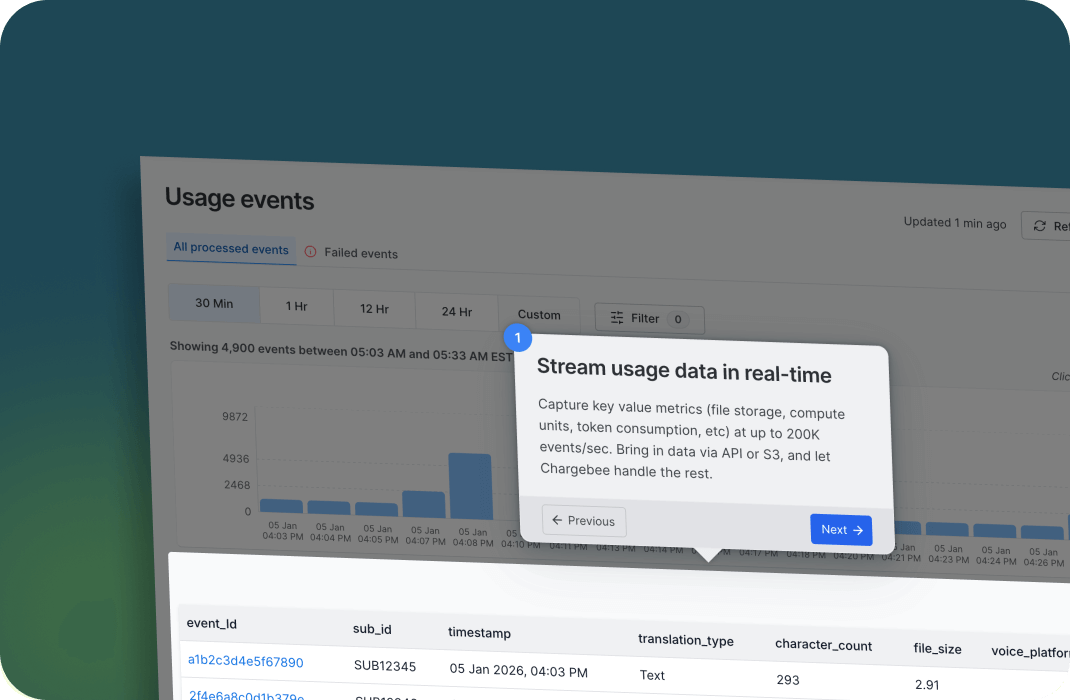

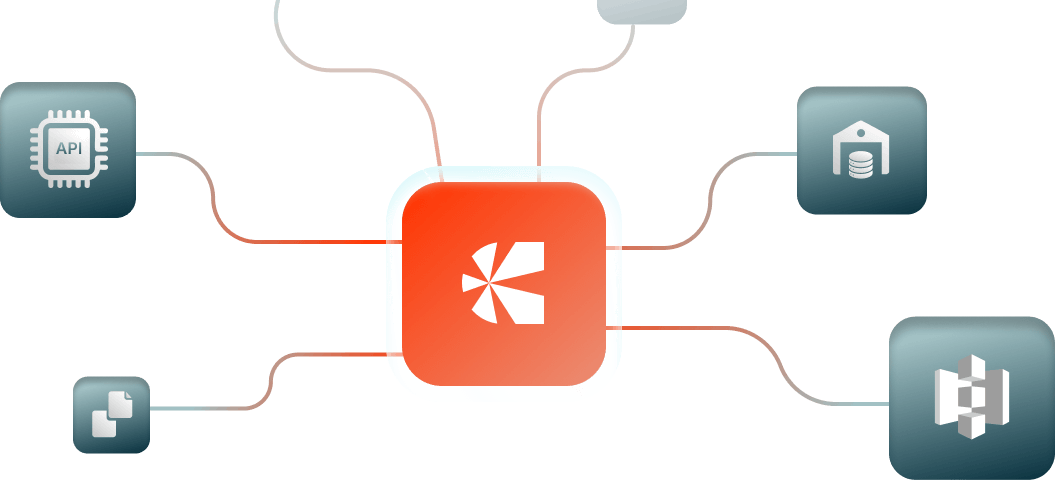

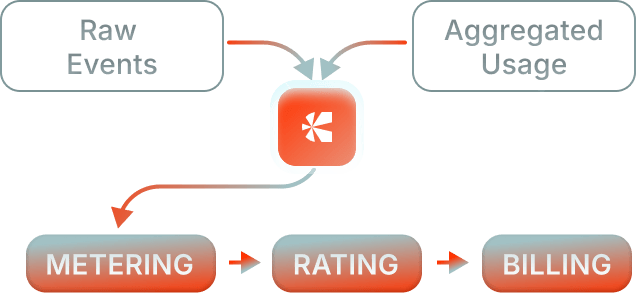

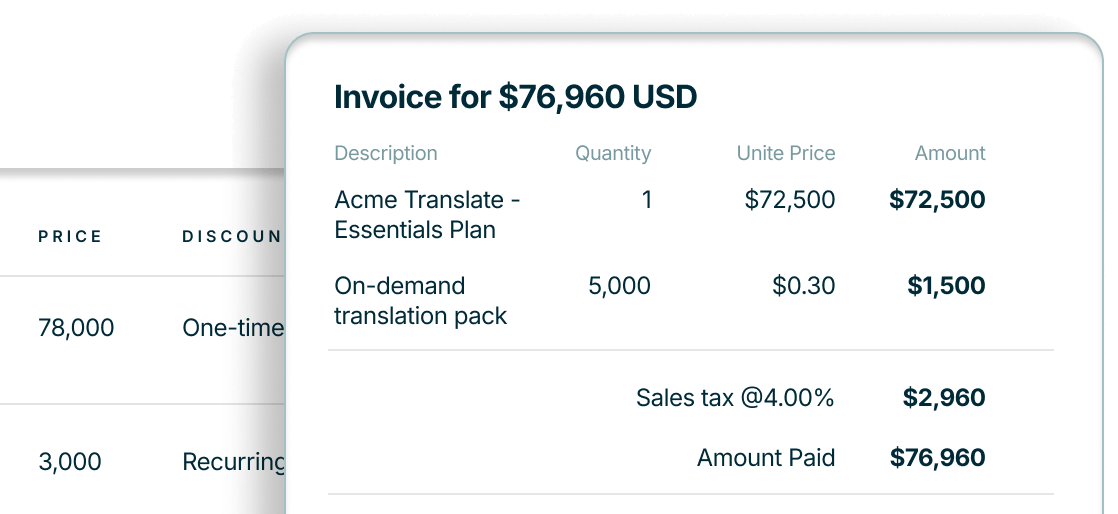

Bring your usage data, define your business logic, and Chargebee handles the rest — ingestion, rating, and billing at scale. Move from raw signals to billable value instantly.

Send usage data from any source — S3, data warehouses, flat files, or stream directly via API

Send raw events or pre-aggregated data, whatever works for your setup

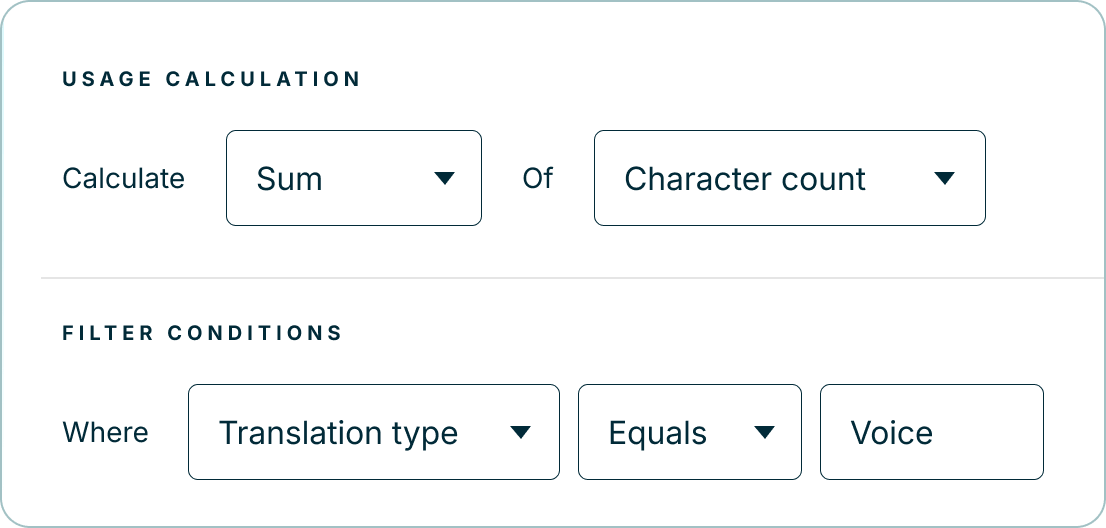

Transform usage data with a flexible metering engine: visual filters for simple rules, SQL for advanced logic

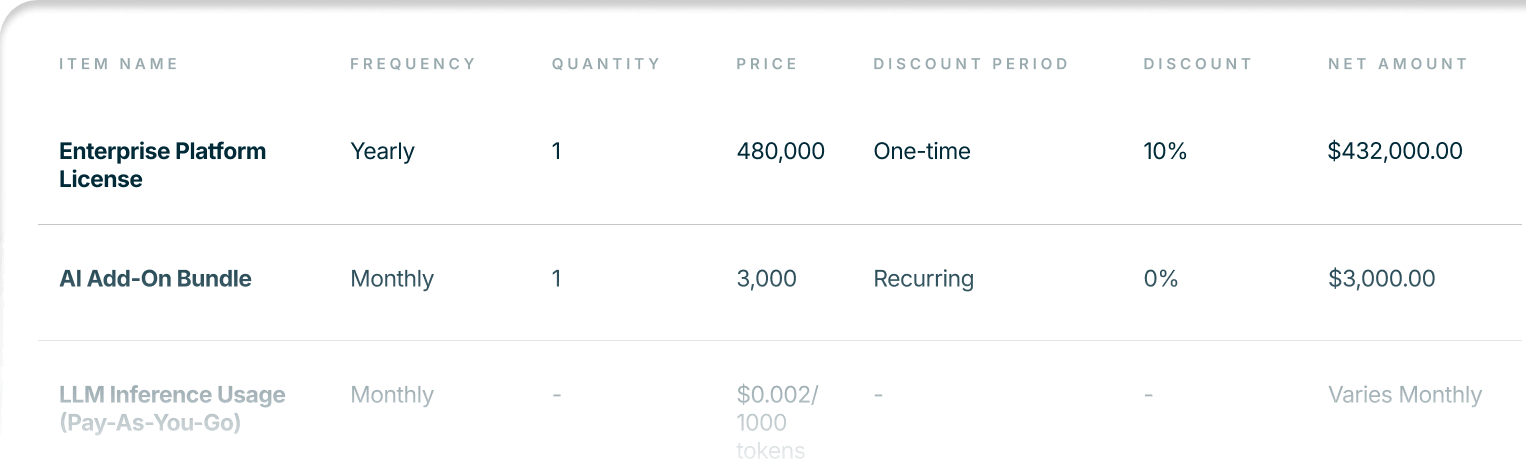

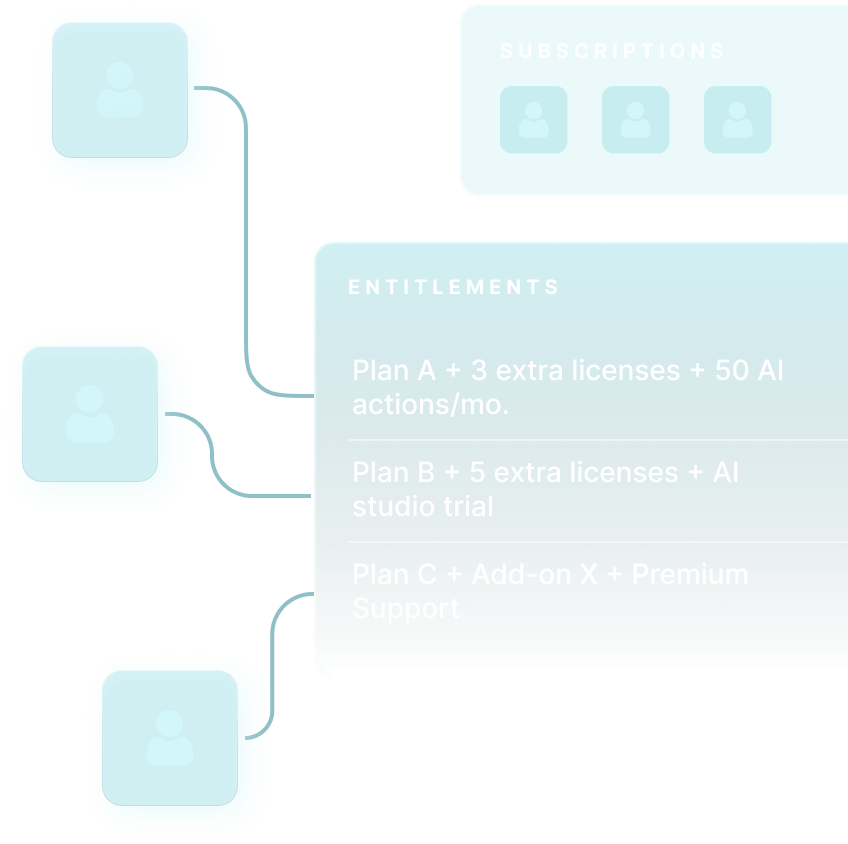

Every usage model adds operational complexity across teams. Sales has to quote it, Product has to gate it, and Finance has to bill accurately. Chargebee connects usage data to quoting, contracting, and billing in one system so you can avoid delays, deal blockers, and dev backlogs.

Let Sales say “yes” on the call — CPQ will quote it, Billing will run it, whether it's recurring, usage-based, included units, overages, or credits

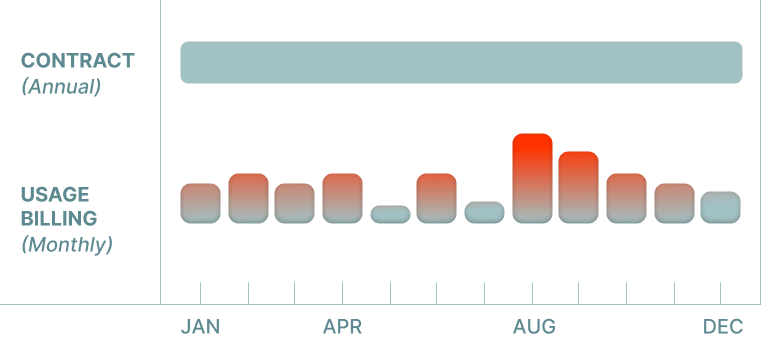

Lock in multi-year contracts while billing usage monthly

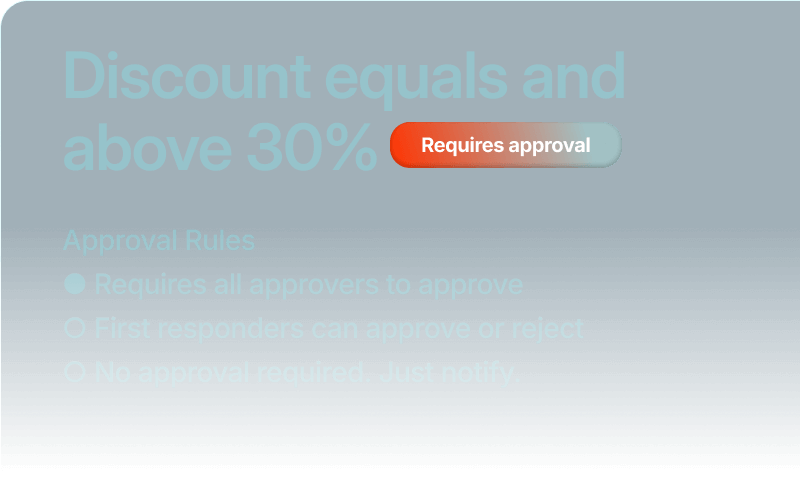

Govern pricing changes, quote approvals, and amendments with built-in controls

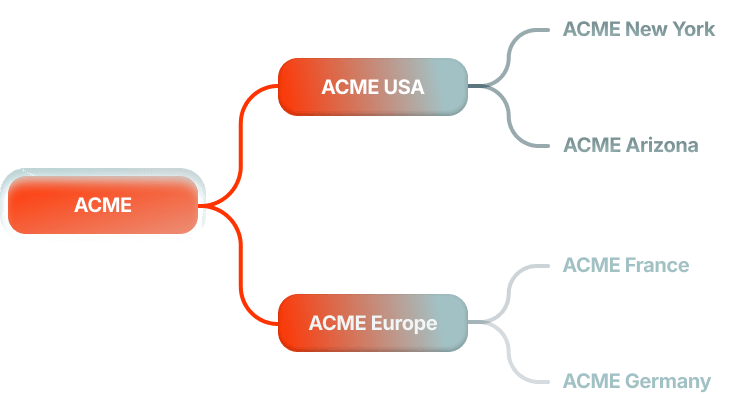

Support parent-child accounts and central billing out of the box

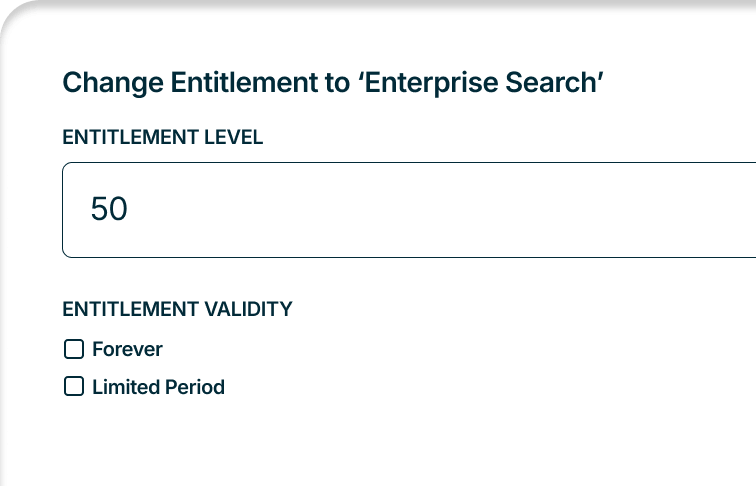

Make exceptions for enterprise customers (like feature trials or usage overrides) without dev work

As pricing gets more complex, it outgrows your billing system. Usage tiers, overages, hybrid models—what should be simple changes become engineering tickets and finance workarounds. Chargebee puts pricing control with business and GTM teams, so you can support any model via configuration, not code.

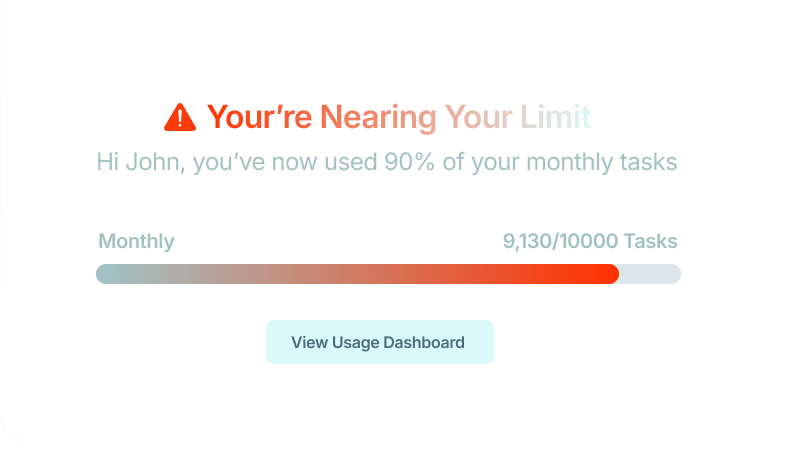

Power users and rapid adoption can quietly pressure margins. Without the right controls, what should have been expansion signals turn into billing disputes and delayed upgrades. Chargebee gives you the visibility and controls to intervene early, and grow revenue without friction.

React faster to margin pressure. Change entitlements, limits, and pricing without engineering involvement

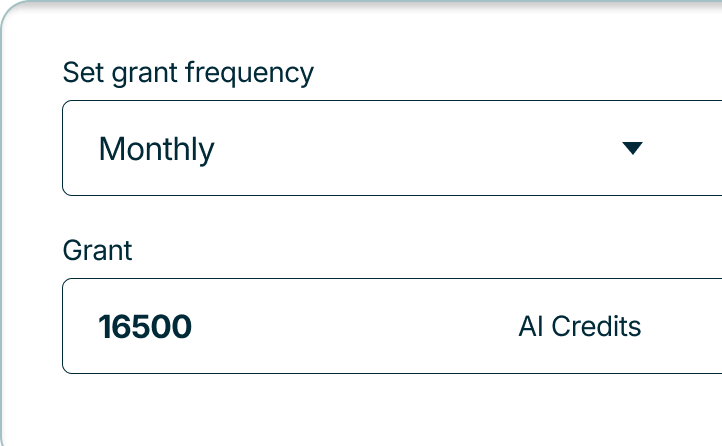

Offer prepaid credits to lock in commitment and improve cash flow (coming soon)

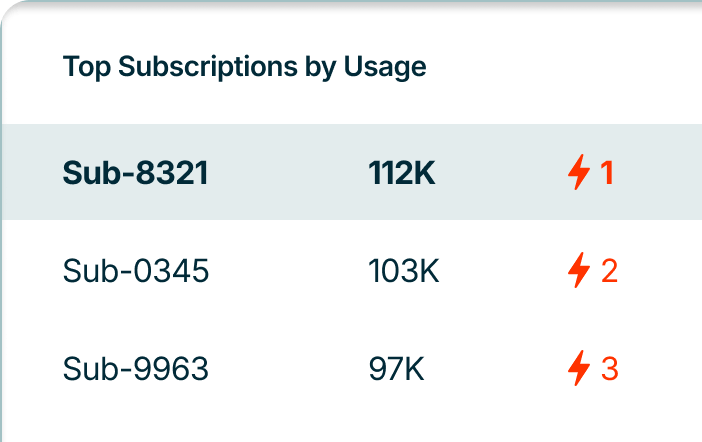

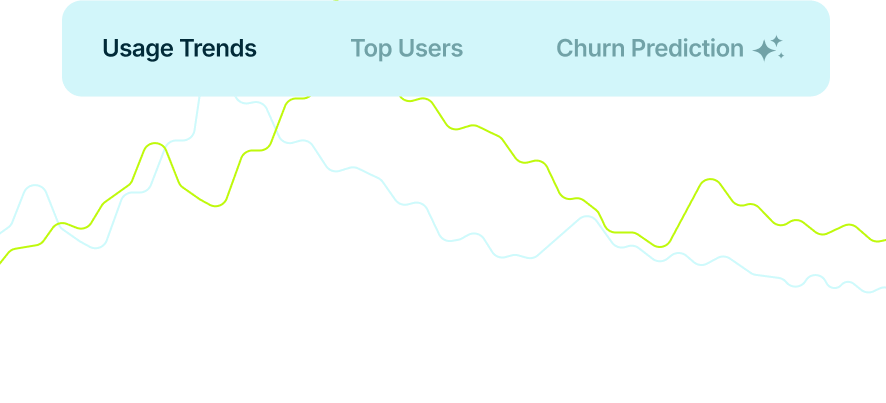

Spot power users for compute-intensive features and drive timely renewals and upsells

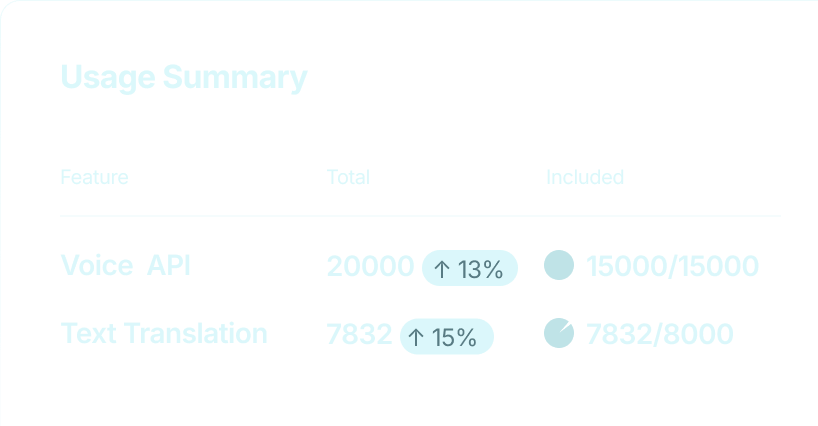

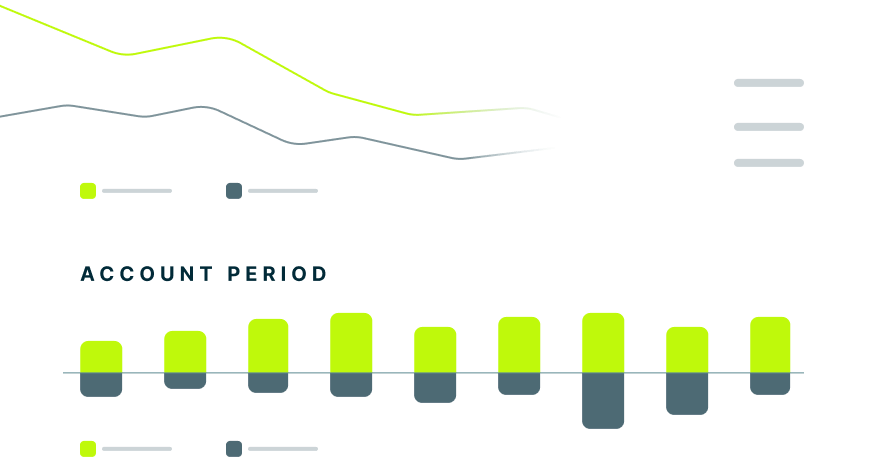

Track allocated vs. actual consumption at aggregate and subscription-level

Set usage alerts to surface upgrade opportunities and prevent bill shocks for customers (coming soon)

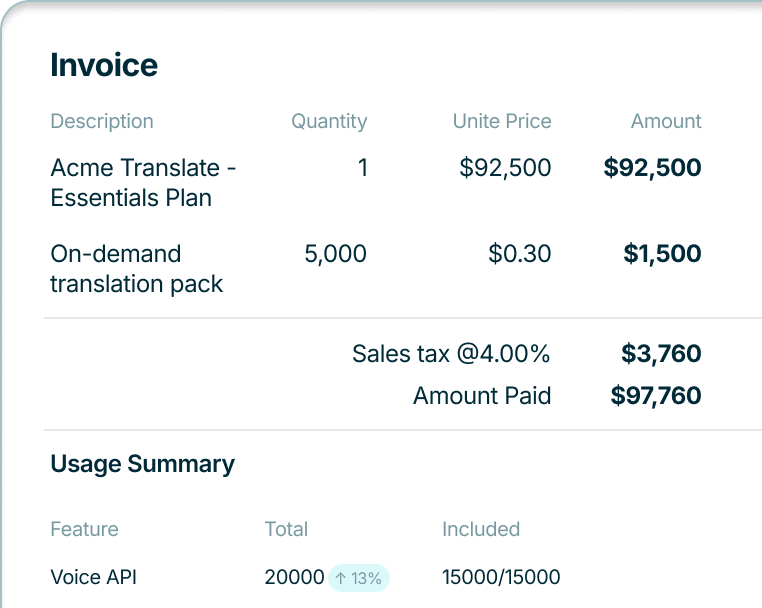

As usage revenue grows, finance teams feel the risk first—late data, messy reconciliations, and compliance pressure. Chargebee brings usage and hybrid revenue into a finance-grade system of record.

Eliminate revenue leakage with automated usage capture and accurate invoicing

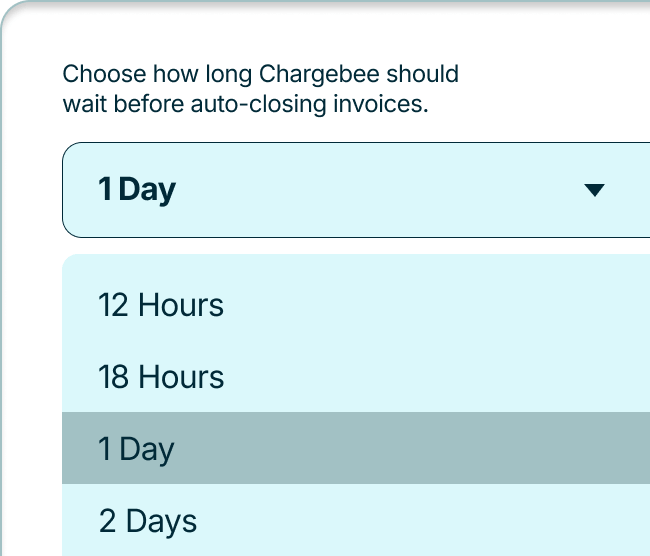

Keep bill runs on time while buffer windows catch late usage

Automated ASC 606 compliance for complex hybrid revenue streams

Track consumption patterns, spot expansion signals, and predict churn all in one platform

Integrations that match the real-world complexity of multi-jurisdiction taxes, GL mappings, and global payment processing

See how Chargebee supports your usage pricing models, quote-to-revenue workflows, and the edge cases most systems can’t handle — all in a personalized demo.