Subscriptions

Existing Subscriptions

Customers whose cards are stored before December 31st, 2020, will be eligible for SCA exemptions and the approval rates for their transactions will be better if at least one transaction is carried out before December 31st, 2020.

New Subscriptions

For new subscriptions created post December 31st, 2020, customers can be asked for additional verification on your checkout page. If your checkout is not capable of handling the SCA flow, then the payment will fail.

When new customers are signing up for a subscription plan and paying with their cards, they will need to complete a 3DS verification at the checkout page. Once the first payment goes through 3DS, future recurring payments (if the plan amount is fixed) can be exempted from SCA.

Subscription Changes

For existing customers, if they decide to upgrade to a higher plan or buy any add-ons, they may be asked for a 3DS verification.

Subscription Renewals

In the case of subscription renewals, the payments take place without the customers being online. Even though subscription renewals are exempted, there is a chance that some recurring payments may still require SCA to complete a purchase.

Another common scenario for an MIT is when your customer asks to resume or reactivate their subscription. For a subscription being resumed or reactivated after December 31st, 2020, customers can be asked to complete 3DS for their subscriptions to be activated.

Future and Trial Subscriptions

It will be a similar situation for future and trial subscriptions. If you have existing customers with a future or a trial subscription that's set to be activated any time after September 14th, gateways should ideally apply exemptions for these subscriptions. Since the approval rate for cards stored in the vault with at least one successful transaction is expected to be higher, you can perform a $1.00 authorization to make the approval rate better.

Another good practice you can follow after September 14th, is to have your new customers complete 3DS for at least one transaction, so their other transactions have a better approval rate. This goes for billing future renewals or changing next renewals as well.

Complying with PSD2 can get challenging even for subscription businesses that bill their customers based on usage, as the amount would vary over time.

A good way to tackle these use cases is to get all your customers to provide 3DS verification for their first or upcoming transaction so it does not turn into a problem later on.

Checkout and Invoicing

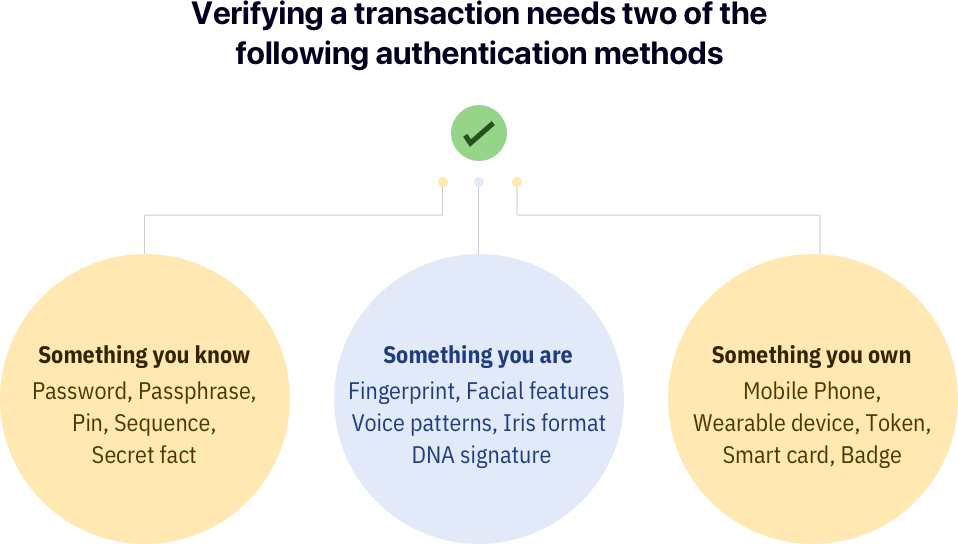

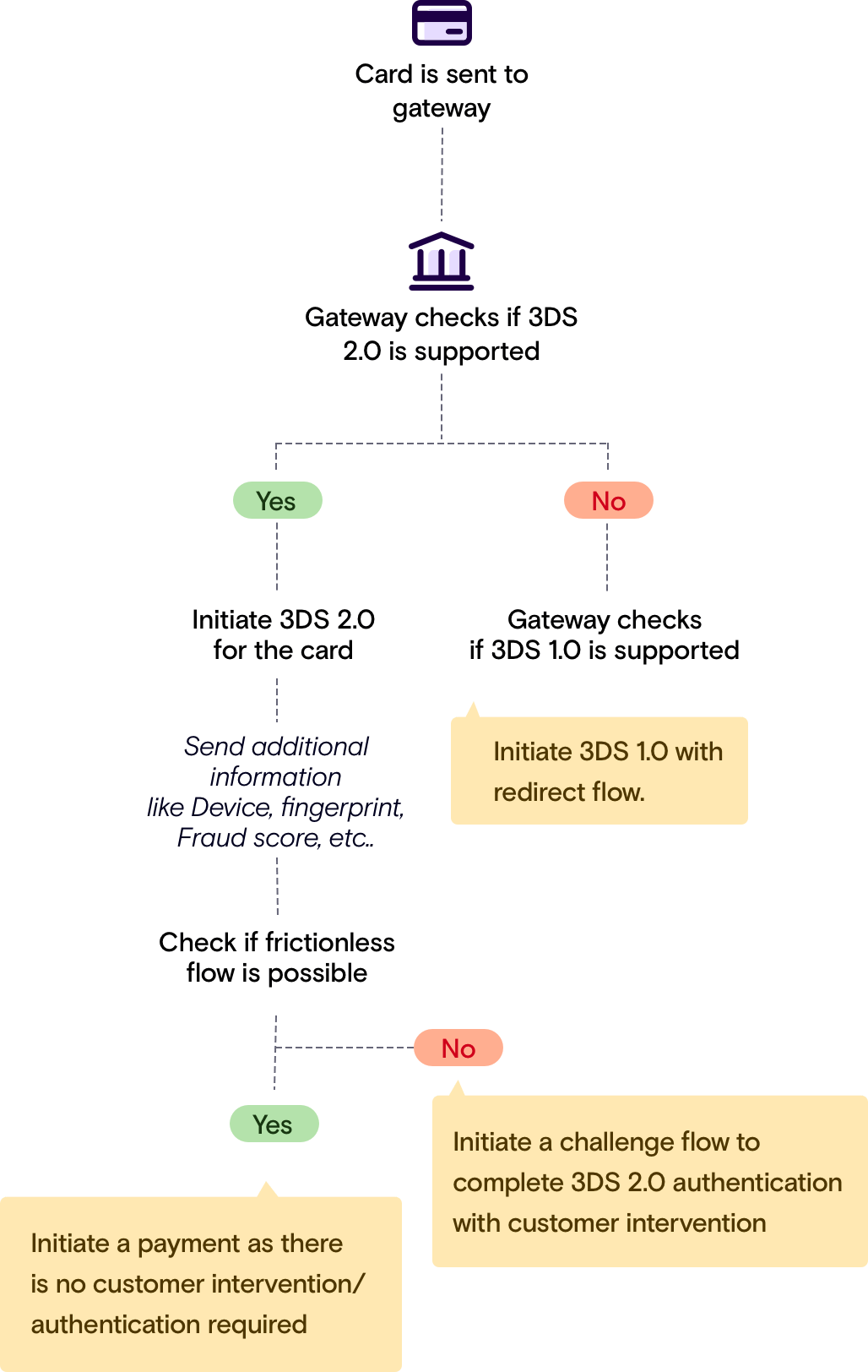

Merchants with subscription businesses will have to apply 3DS to their checkout flows once the PSD2 regulation goes live. Your checkout needs to be able to handle all the SCA flows so that 3DS 1 and 3DS2 can be applied for transactions that require it. This means your checkout page will need additional authentication built in.

Along with this, you will need to check if your checkout page has all the required fields to capture the necessary information.

When a payment fails at checkout, we recommend that you generate an unpaid invoice so you can keep track of transactions that fail and accordingly decide the necessary actions for those subscriptions.