Based on a benchmark report from PwC, Finance teams continue to spend about 30-40% of their bandwidth on data collection, quality checks, and reporting. While our customers deeply appreciate the efforts and time their Finance teams invest in ensuring everything runs smoothly, we’re always looking for ways to lighten their load.

That’s why today, we’re excited to showcase a few recent updates from Chargebee that will help Finance teams gain greater efficiency, wrap up their work more quickly, and head to their well-deserved holiday break.

Here’s a look at what’s new:

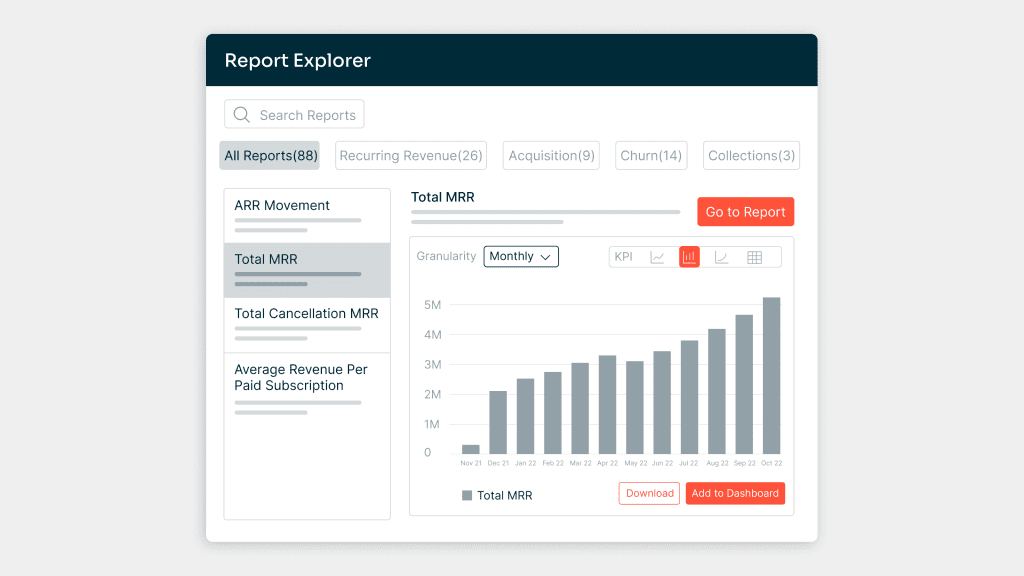

Gain Deeper Insight into Subscription Metrics for Informed Decision-Making

What?

Introducing Chargebee’s Report Explorer — a powerful tool that offers deeper insights into your key business reports, including the ability to view historical data, drill down to your desired data using 240+ filters, and multiple visualization support enabling you to view the underlying trends and make data-informed decisions.

Why?

Subscription leaders and business users need quick access to the right metrics to understand trends and anomalies, determine where to prioritize and make informed decisions. The less time you spend wading through tons of reports to find that one report you want, the more you can spend crunching data and deriving meaningful insights.

How it helps

The new Report Explorer has a more robust interface which enhances data-driven decision-making and introduces advanced data filters and visualization options, making it even more user-friendly.

With this release, you can:

- Search reports, switch categories, and get a quick preview of any report you want, all in one place.

- Slice and dice data the way you want. Filter by attributes across subscription, customer, and more entities; choose specific periods and group them further by key attributes to uncover crucial insights.

- Visualize reports in multiple formats such as line, area, bar, table, or cohort.

- Add reports to multiple dashboards so each team gets access to the metrics that matter the most to them.

- Download the aggregate or underlying data instantly.

Learn more about Report Explorer here ->

Enhanced automation for taxation and revenue recognition compliance

What?

Chargebee can now help calculate taxes based on transitional rules and automate tax reporting in the revenue recognition process.

Why?

Governments introduce transitional rules on taxation when new tax rates emerge. Take Switzerland, for instance, where the VAT rate is set to change from 7.7% to 8.1% starting January 1, 2024. While taxes are typically calculated based on the rates at the invoice generation date, the transitional rule in this scenario mandates computation based on the service period instead. Businesses must adhere to these rules, ensuring accurate tax collection and proper reflection on customer invoices.

While taxes are not considered a company’s revenue, businesses must report on them to comply with revenue recognition standards.

How it helps

With these new updates, you can now:

- Comply with transitional taxation rules in Switzerland by applying different tax rates to different sub-periods in an invoice service period. For example, if a service period is from Dec 15, 2023, to Jan 15, 2024, where the tax rate for Dec’23 is 7.7%, and Jan’24 is 8.1%, the tax rate applied on the invoice for the first half of the service period should be 7.7% and the second half should be 8.1%.

- Generate summary-level tax reports directly in Chargebee RevRec using the ‘Tax Subledger’ feature. This capability accurately pulls in the tax amounts generated by Chargebee Billing and seamlessly integrates it with RevRec, so your finance teams can create these reports without breaking a sweat.

Looking to improve your understanding of revenue recognition concepts? We have just the resources for you. Enroll in our course, "Mastering the Fundamentals of Revenue Recognition," covering ASC 606/IFRS 15 basics and SaaS challenges. Take me to the Revenue Recognition course.

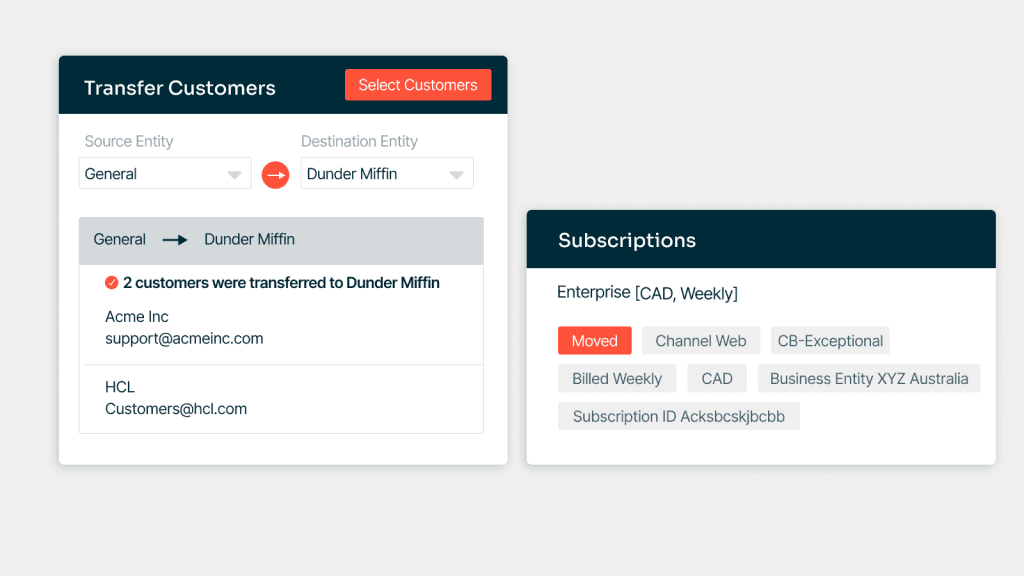

Unified subscription and customer data management for your different business entities

What?

You can now seamlessly move customers across entities and automate billing workflows based on customer data without disrupting the subscription experience for your end users.

Why?

Customer data management in a multi-business entity environment is extremely complex. If you’re a growing business that has recently gone through a merger or acquisition, expanded operations in a new country, added new service offerings, or have specific business processes that require moving customers across entities, you probably want to:

- Bill customers of all your entities from your parent company

- Enhance the subscription experience by transferring customers to a business entity that better aligns with their needs, which can lead to improved service offerings, customized attention, and better pricing.

How it helps

Chargebee helps multi-entity businesses manage customer data effectively by unifying data across your CRM and Accounting software. With these new updates, you can:

- Move customers and associated subscriptions from one entity to another without disrupting the existing billing workflows

- Schedule billing workflows to kick in from a target entity at a specific date or billing cycle

Learn more about multi-entity management here.

Build payment recovery programs without compromising customer sentiment

What?

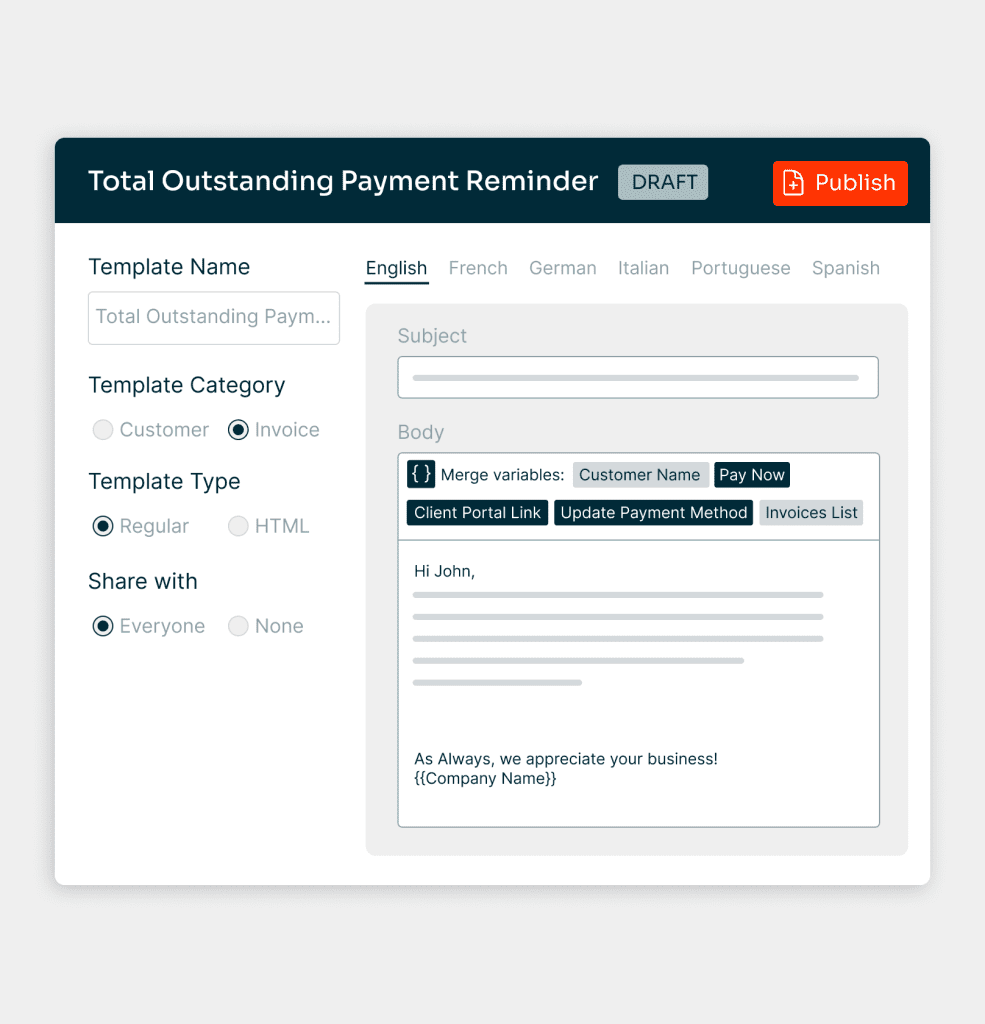

We’ve revamped the email experience in Chargebee Receivables. You can now effortlessly create payment reminder emails from scratch, or import brand-focused HTML templates using our intuitive interface. With multi-language support, flexible publishing options, and various merge variables, your emails will always retain a personalized touch. Upgrade your communication game and make your reminders as unique as your brand.

Why?

Following up on payments to a large customer base often means sending generic messages that aren’t very personal. This leaves your collections or finance teams stuck between the need to reach customers at scale and maintain a personal touch — all while ensuring brand consistency.

How it helps

With Chargebee Receivables’ latest update, you can now,

- Import your existing email templates, allowing you to use fully customized designs with their logos, color themes, and more.

- Save your email templates in both Draft and Publish modes. Create templates, keep them in draft mode, and publish them once the review process is complete.

- Find and utilize suitable placeholders for personalized emails. With this update, all Merge Variables are organized into distinct categories, including Client Portal Essentials and Date-Based variables, to ensure ease of access.

- Save templates in multiple languages with new support for six languages in email communication: English, French, Spanish, Portuguese, Italian, and German. You can also automatically identify the customer’s locale and settings, and trigger the email with the corresponding template saved in that locale.

Learn more about Receivables’ email templates here.

Gain more customer context with Tags

What?

Chargebee Receivables has now introduced Tags, a simple way to add attributes or filters to customers. This allows collectors to gain quick context before reaching out to customers for payment follow-ups.

Why?

Handling receivables manually and at scale is time-consuming. Often, collectors spend more time targeting accounts where customers would have paid even without manual follow-up. The secret to better prioritizing your time lies in customer segmentation, a crucial process that helps optimize collection efforts and recover more receivables at a lower cost.

How it helps

Leverage the Tag feature to categorize and group customers into similar cohorts. For instance, create tags to filter out high-risk defaulters or customers likely to churn. You can also use tags as criteria in payment reminder automation to selectively engage or exclude specific customer cohorts. For instance, ensure the exclusion of customers likely to pay without email communication by using tags as criteria.

Learn more about the Tags feature here.

Turn Customer Goodbyes into Growth

What?

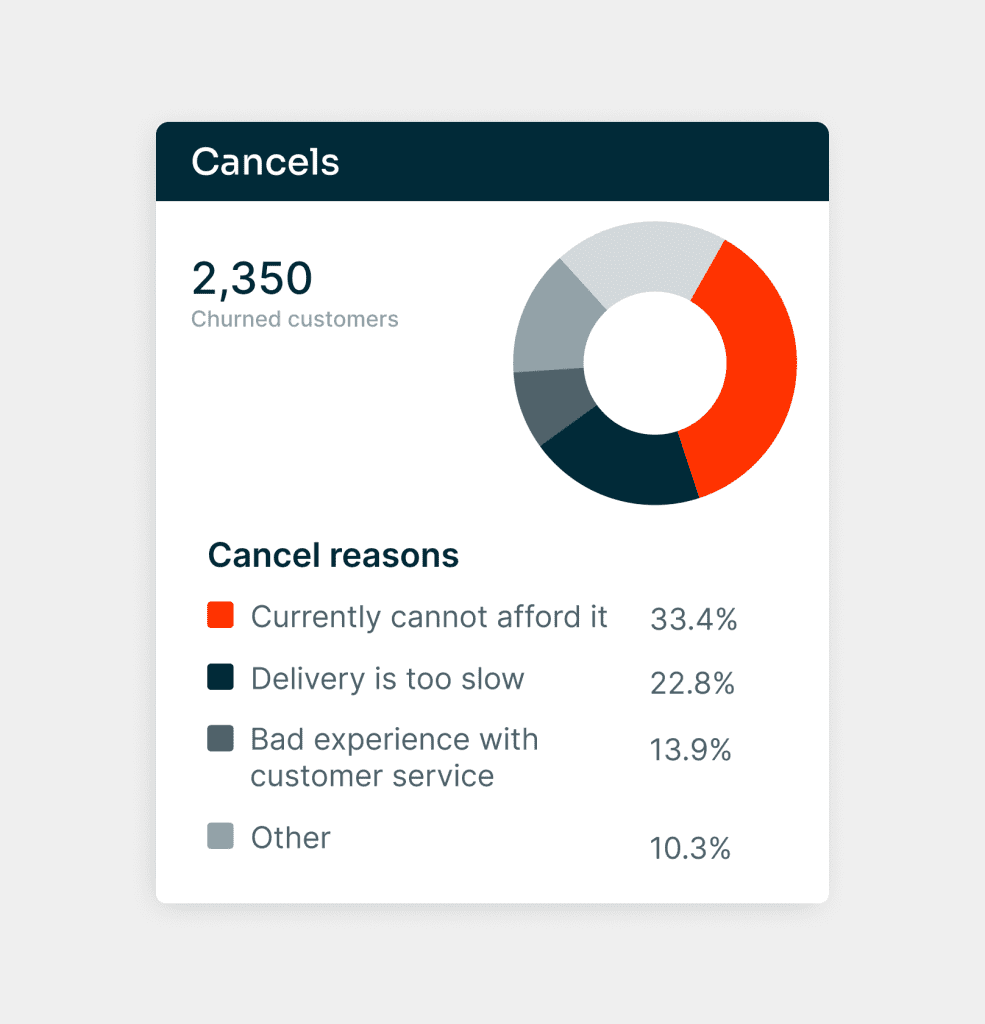

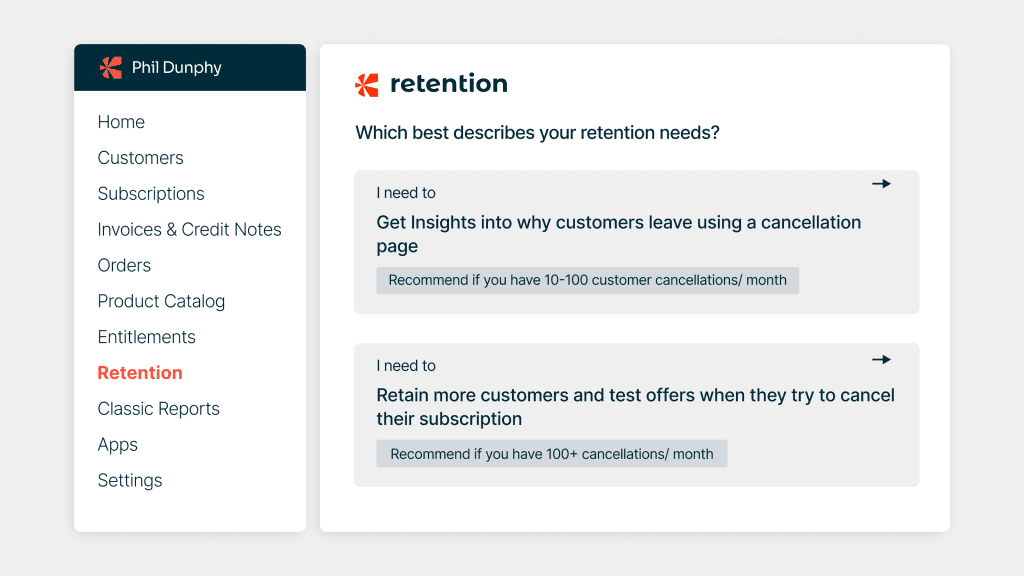

Starter Churn Insights is a focused analytics tool designed by Chargebee to help subscription businesses understand why customers cancel their services. It’s a streamlined, easy-to-use feature that integrates directly into the Chargebee Billing platform, offering clear and actionable insights into customer churn.

Why?

Growth-focused companies spend a significant amount of time on data collection and analysis. Starter Churn Insights addresses this challenge by not only reducing the time spent on data analysis but also providing more accurate and actionable insights. By understanding customer churn better, businesses can make more informed decisions, ultimately leading to operational efficiency and improved financial health.

How it helps

Starter Churn Insights aids teams in several ways:

- Efficient Data Analysis: Automate the process of collecting and analyzing data related to customer churn, significantly reducing the time and resources spent on these tasks.

- Actionable Insights: Clear insights into why customers are leaving, enabling businesses to take proactive steps to address these issues.

- Streamlined Operations: By integrating directly into Chargebee’s platform, Starter Churn Insights ensures that all customer-related data is centralized and easily accessible, streamlining operational workflows.

How to get started

Get Starter Churn Insights enabled for your account by writing to retention-support@chargebee.com. You can also refer to help docs for detailed instructions.

Experience the transformative impact of the Starter Churn Insights on your customer retention strategy. Get started today.

And that concludes this release roundup! If you missed our previous post, catch up here. Stay tuned for more exciting product updates and best practices in this space.