As a SaaS business that is on a growth trajectory, you’d be selling globally. And while scaling fast and acquiring more and more customers, managing your taxes would be the last thing on your mind.

Following tax obligations and ensuring compliance right from the beginning saves a tonne of trouble that could crop up, if you care enough about it.

Globally, the tax landscape is undergoing a major overhaul. More so for digital businesses.

To add to the taxation worries, the Revenue Departments around the world amend the regulations to extract maximum revenue from the upcoming trends (in this case, digital business).

What is the NZ GST change all about

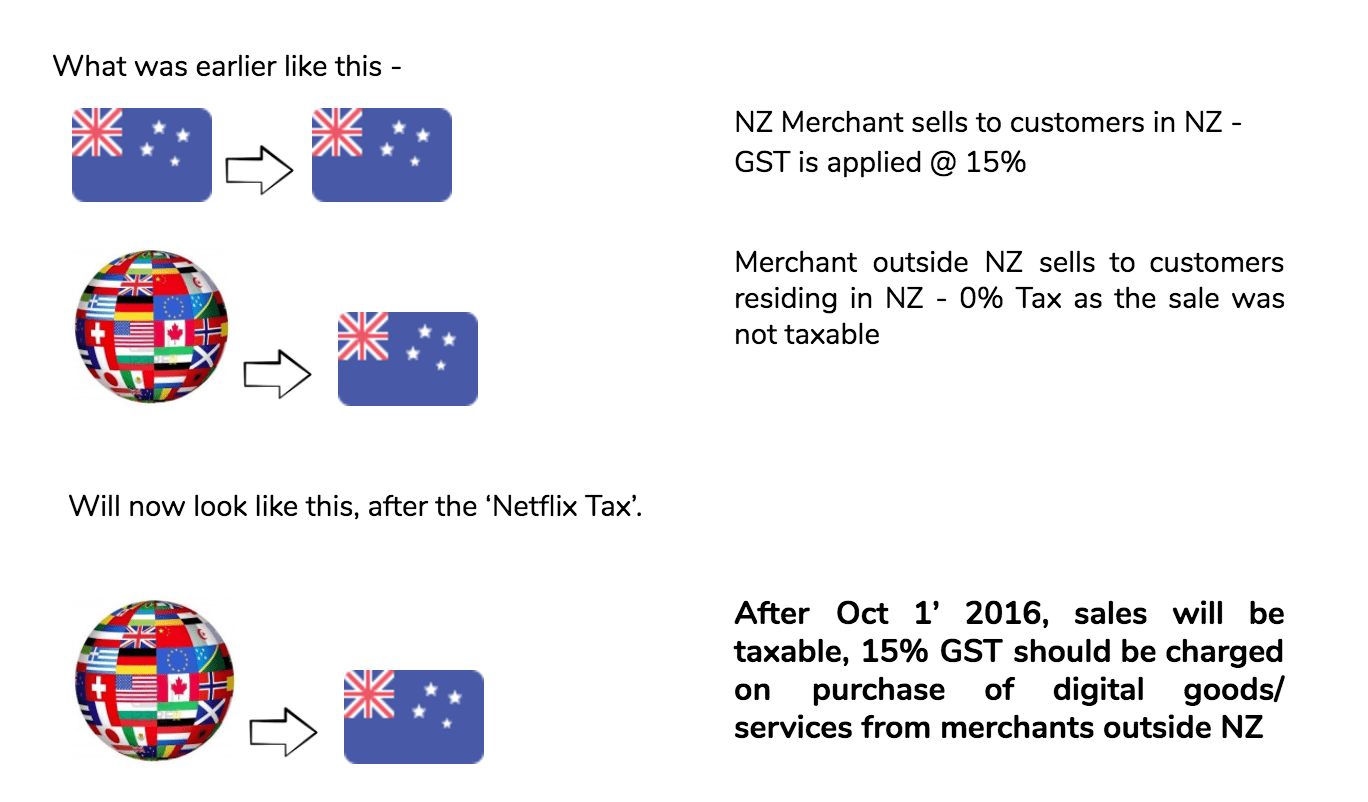

The changes in EU-VAT that was implemented on Jan 1st, 2015 paved way for global tax changes. The VAT MOSS (Mini-One-Stop-Shop) was established to ensure that that businesses don’t have to register for VAT in each of the twenty eight EU member countries.

The situation was no different in the other parts of the world. The Russian State Duma passed the ‘Google Tax’ that would charge 18% VAT on electronic sales.

Come January 2017, the Australian Government will be implementing their digital GST, aka ‘Netflix Tax’, to levy 10% GST.

And now, unwilling to be left behind, the New Zealand Government also made changes to its tax laws.

From October 2016 onwards, every Company around the world supplying digital services to New Zealand (whether it’s movies, games webinars, insurance, web design or legal council) will have to start collect and remit tax at the rate of 15% to the New Zealand government, if their sales crosses NZD 60,000 in revenue over a period of 12 months.

ANY business selling a digital service overseas, will have to configure tax rates on their sale. Here’s everything you need to know about NZ-GST changes from the Inland Revenue Department of New Zealand.

What should you be doing for your global business?

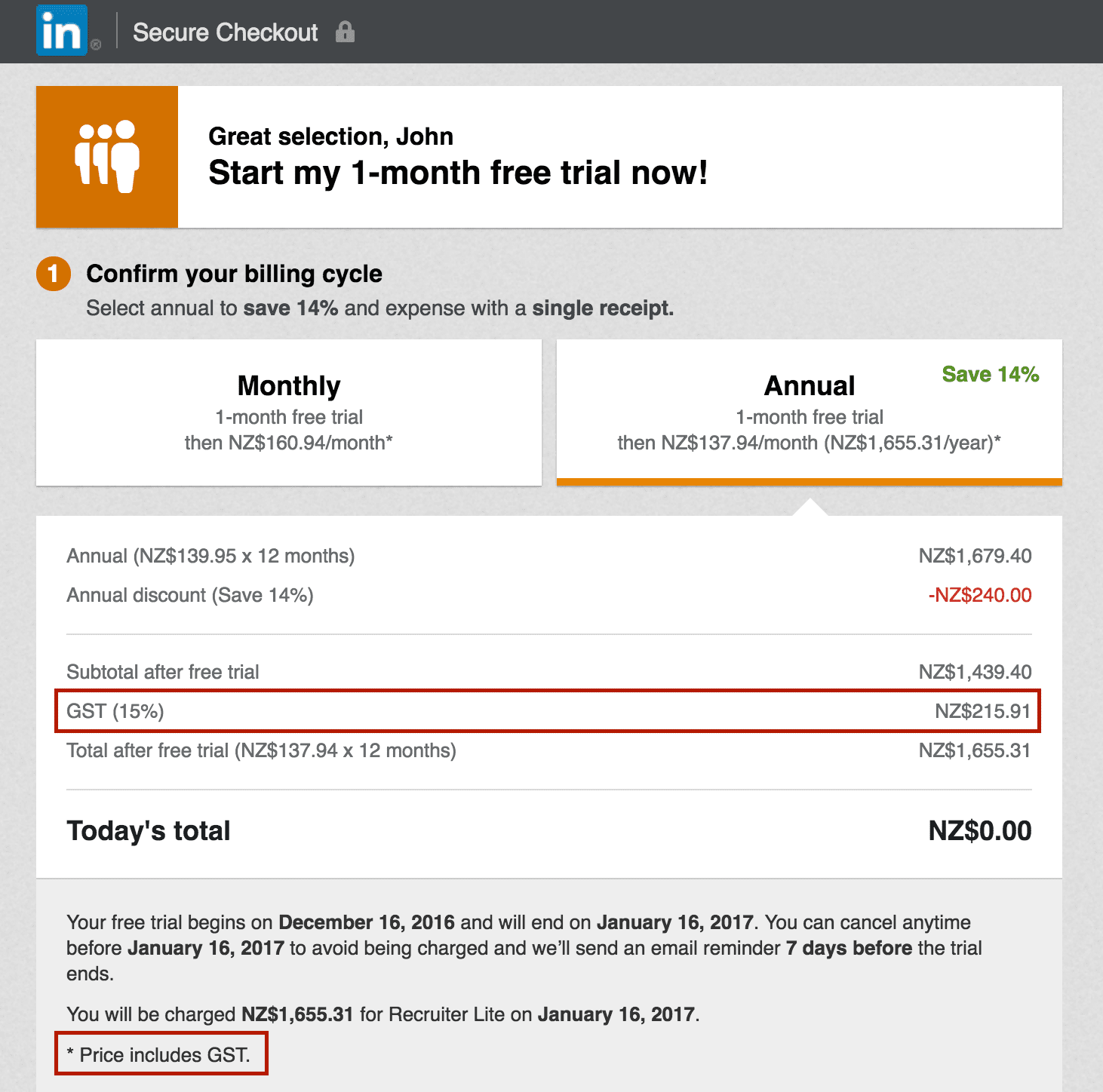

(“Effective November 1, 2016, LinkedIn will charge all customers in New Zealand a 15% Goods and Services Tax (GST). Effective January 1, 2017, LinkedIn will charge all customers in Australia a 10% GST.” Source: LinkedIn Help)

Let’s start with the basics. As a business owner, or a growing entrepreneur, you would not want the hassles of managing taxes to outweigh your actual business problems.

More than that, you will need to meet a bunch of boring tax invoice requirements, and also collect and maintain evidence of all your digital sales. What are they , you ask?

In order to meet tax invoice mandates, you will need to ensure that –

- The words “tax invoice” appear in a prominent place

- The name (or trade name) and GST number of the supplier is present

- The name and address of the recipient of the supply is present

- The date the invoice was issued is mentioned

- A description of the goods and/or services supplied is included

- The amount, excluding tax, charged for the supply is mentioned

- The GST and the total amount payable for the supply is correctly calculated

And as per IR regulations, you need to ensure that the customers or businesses you are selling to are, in fact, residing in New Zealand and you will need two non-contradictory pieces of evidence that indicate that your customers are indeed from New Zealand. So, you will need at least two from following evidences for digital sales

- Customer’s billing address

- Internet protocol (IP) address of the device from which the purchase is made

- Customer’s card details (BIN Number)

- Country code of your customer’s phone number

Where does Chargebee figure in all this tax mumbo-jumbo?

For starters, you can configure tax settings in Chargebee and we’ll take care of calculating the taxes that the customer needs to be charged, based on the plan price and the buyer’s location and include this information while invoicing the customer.

That leaves you with only so much to do. Such as,

- Adjust the pricing to stay competitive

- Communicate with customers about the pricing changes

- Review Partner contracts etc to include GST

- Register for GST

- Prepare and file GST returns

It’s that simple!

You can add New Zealand to your tax jurisdiction list, select the type of product you are selling i.e., digital or physical and select the checkout price type, i.e. tax inclusive or tax exclusive. Once you have selected these, you will need to enter the GST Registration number for New Zealand.

Additionally, you can also enable location validation if you prefer. Remember that thing we told you about collecting ‘non-contradictory pieces of evidence’ of your customer’s location? That comes in handy here.

Even if you don’t enable location validation, Chargebee will collect the evidences including the IP Address and Billing Address of your customer. You can thank us later 😉

And voila! Your tax details for New Zealand will be configured. Essentially, the tax configuration page for New Zealand will look like this –

Keen on getting rid of your tax hassles while billing your customers? Sign up for a free sandbox account of Chargebee and play around. If you have been with us through our journey, head here to learn more about the NZ GST configuration.