In 2007, mathematical statistician and former Wall Street trader Nassim Nicholas Taleb argued that inflexibility, even in the most meticulously built systems, ultimately makes them fragile. Or, in my gym trainer’s words – “the more you bulk, the harder dancing gets.”

Take the example of Taneli Armanto’s late-90s breakaway mobile game – “Snake.” The objective was to guide a snake on our mobile screens to eat tiny dots while avoiding collisions with the wall or its own body.

In the initial stages, spot decisions about whether we turned left or right had little influence on the overall outcome. Still, the longer the snake grew, the more significant the implications of each decision became.

Similarly, in the early stages of a business, the choice of platforms, tech, integrations, and tools may have less bearing initially. But their implications on revenue are significantly higher as the business scales.

Yet, many early-stage businesses launching (or moving to) subscriptions for the first time tend to develop their revenue monetization process by force-fitting point solutions because they are viewed as – more economical or easy to implement. For instance, startups expect payment gateways – the fundamental tool that initiates and collects transactions – to manage subscriptions at scale autonomously. More often than not, it always leads to complications over time.

The argument for flexibility on top of payment gateways

A typical design flaw that impacts our revenue monetization process is that we treat it as an individual point within the customer experience journey. In doing so, we define parameters under which a revenue system belongs – to collect payments and relay a confirmation to all other systems.

The tools to handle revenue collection, i.e., payment gateways, payment processors, or invoice generators, become significant yet isolated points on which our entire revenue channel depends.

Jeopardization of any component can go beyond payment failures or cart abandonments. It can also directly impact customer experiences. If we zoom out to accommodate the large volume of transactions typical for a business, the damage to revenue can be significant.

Overreliance on a payment gateway lends to systemic rigidity. A single process disruption – e.g., a sudden payment gateway crash – can generate ripple effects through the revenue ecosystem.

Sure, payment gateways can easily handle multiple payment methods, store and wire critical transaction information to key systems outside the revenue ecosystem, and even handle edge cases where payments are periodic. Yet, it is a limited technology solving for a particular layer of complexity.

Asking for it to scale by adding layers (either through custom-builds or with simple integrations to other point solutions) on top does little to handle the multiple beyond-the-horizon events only visible once a business reaches a significant scale – proration, mid-cycle cancellations, variable add-on charges, etc.

- What happens once we expand into a region that prefers a payment method not supported by the gateway?

- What happens when customers change their plans mid-cycle? What happens when tax laws change in a serviceable region, upending how we’ve always invoiced customers?

- Or what happens when the payment gateway experiences temporary downtime?

> Relevant Read: Signs that your payment gateway cannot keep up with your growth

The merit of antifragile revenue operations is that they do not rely on individual point solutions. They are the orchestration layers that sit atop our existing components, govern how data flows, and enable us to add more tools without significantly changing the status quo of our operations.

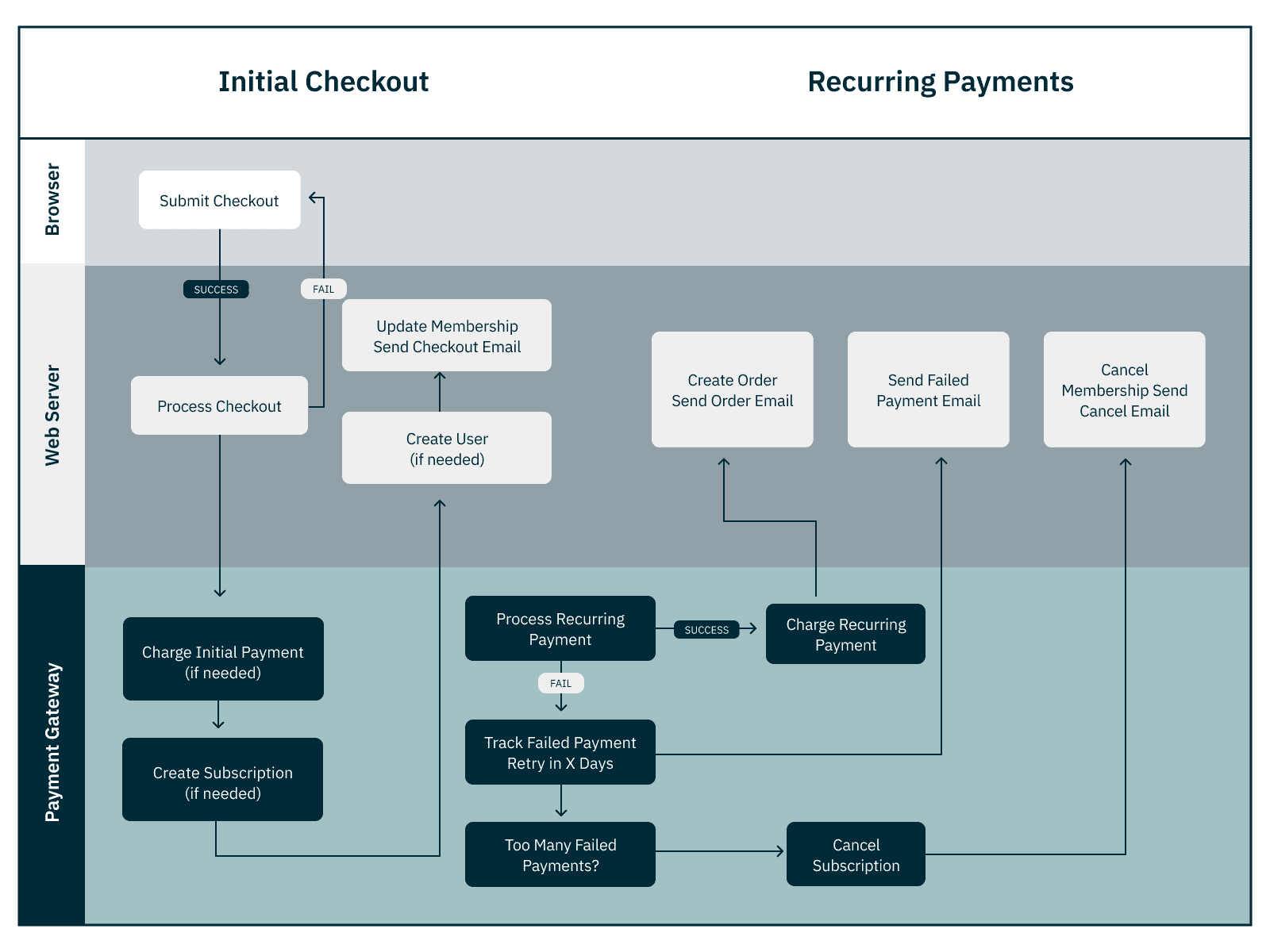

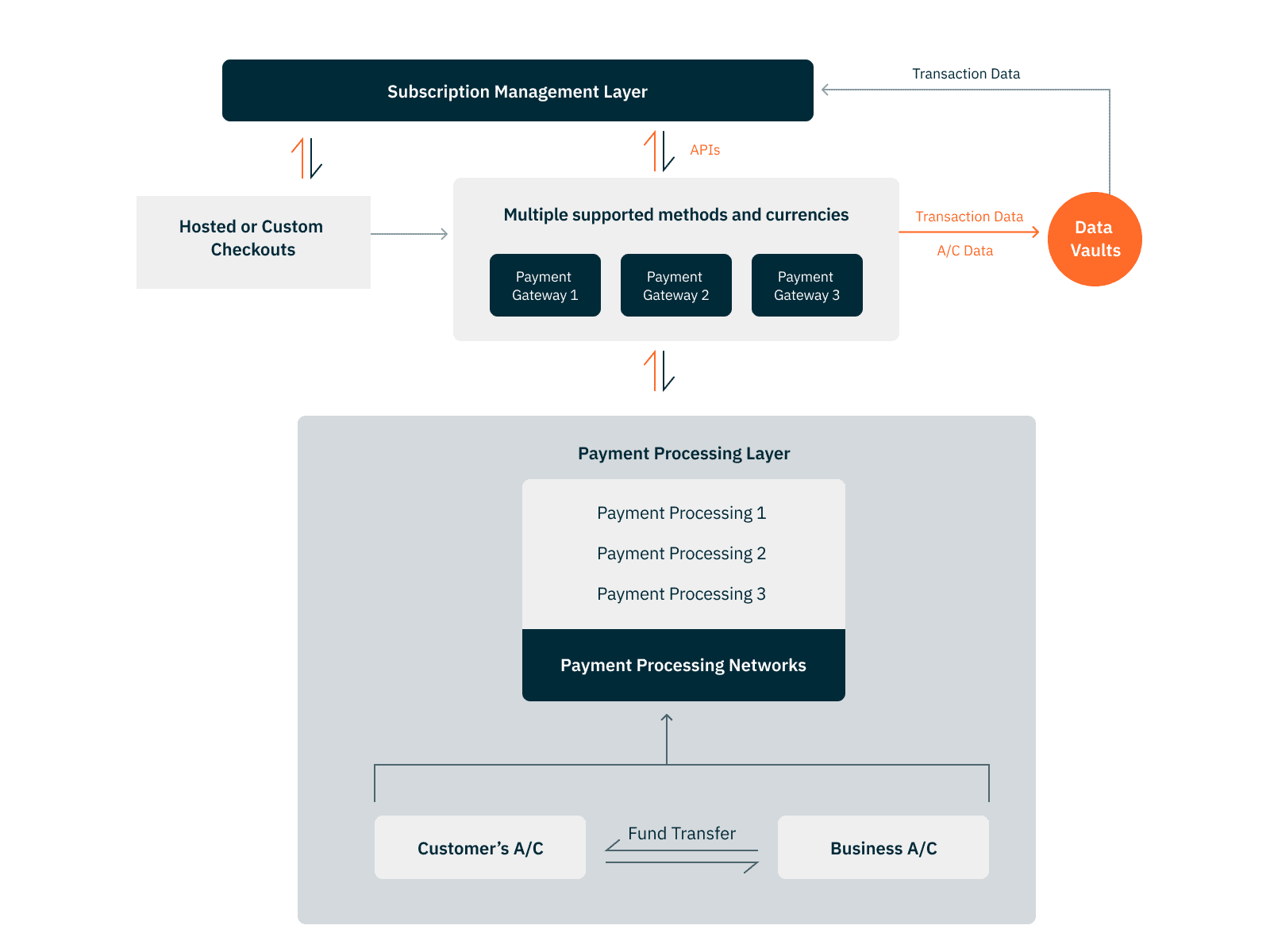

In our particular case, think of a subscription management layer above our payment collection and payment processing infrastructure which communicates with every component in the quote-to-cash process –

- Sets up the checkout page

- Routes information to (a single or multiple) payment gateways

- It even allows us to add as many components on top without disturbing the existing status quo of revenue collection

By operating across the customer experience lifecycle, they can work on sudden issues within the quote-to-cash process and automatically reroute us to alternative solutions without breaking the experiential flow.

Instead of solving vertically for a specific problem, these orchestration layers communicate with the varied hidden corners of the business to find accurate responses for revenue challenges –

If a customer cancels their subscription mid-cycle, it pokes the CRM for details about their plans, reads through billing contracts to look for unpaid receipts, and issues collection measures or chargebacks with the help of the payment recovery/processing layer. If a payment gateway fails, it readily reroutes the charge through an alternative gateway (and, by extension, supports multiple such gateways).

The free-moving fulcrum lends flexibility to an otherwise rigid revenue system. It is – if the snake in the game could slide over itself.

Building flexible revenue systems

In 2014, Study.com – an online learning platform – started monetizing its product with a simple monolithic revenue architecture – a paywall and a payment gateway. With customers, plan complications, and a low volume of transactions for their early-stage business, they found this a quick-to-implement solution that helped them funnel early revenue in.

With time, however, each new customer demanded more: differentiated pricing, new plans, mid-cycle changes, add-ons, and custom discount codes. Everything required developers to add new lines of code as an extension to their simple revenue or payment ecosystem.

Before long, they realized that their reliance on a payment gateway to handle subscription management and billing didn’t only leave them exposed to downtimes but also made their process more rigid and complicated.

How long before it broke the camel’s back?

With plans for market expansion, Study.com decided to onboard Chargebee – to sit atop their revenue systems – support multiple payment gateways, and better implement and manage plan, pricing, and coupon changes.

If their primary payment gateway broke, they could reroute payments. If they expanded to more locations with different preferred payment gateways, checkout languages, and compliance requirements, they could add as many gateways, sales tax automation, or compliance tools without putting unnecessary pressure on a single element.

Ultimately, by enabling plug-and-play across the revenue process, Study.com has already integrated with four payment gateways. The platform continues to serve millions of customers and grow horizontally, allowing it to expand its revenue infrastructure as and when needs arise.

Lapses and downtime also become easier to handle because there is no dependence on individual point solutions. Instead, revenue can still be processed through multiple routes, making them flexible.

That’s how Chargebee’s revenue growth management platform helps avoid rigidity in your monetization process –

Avoiding point-of-sale rigidity

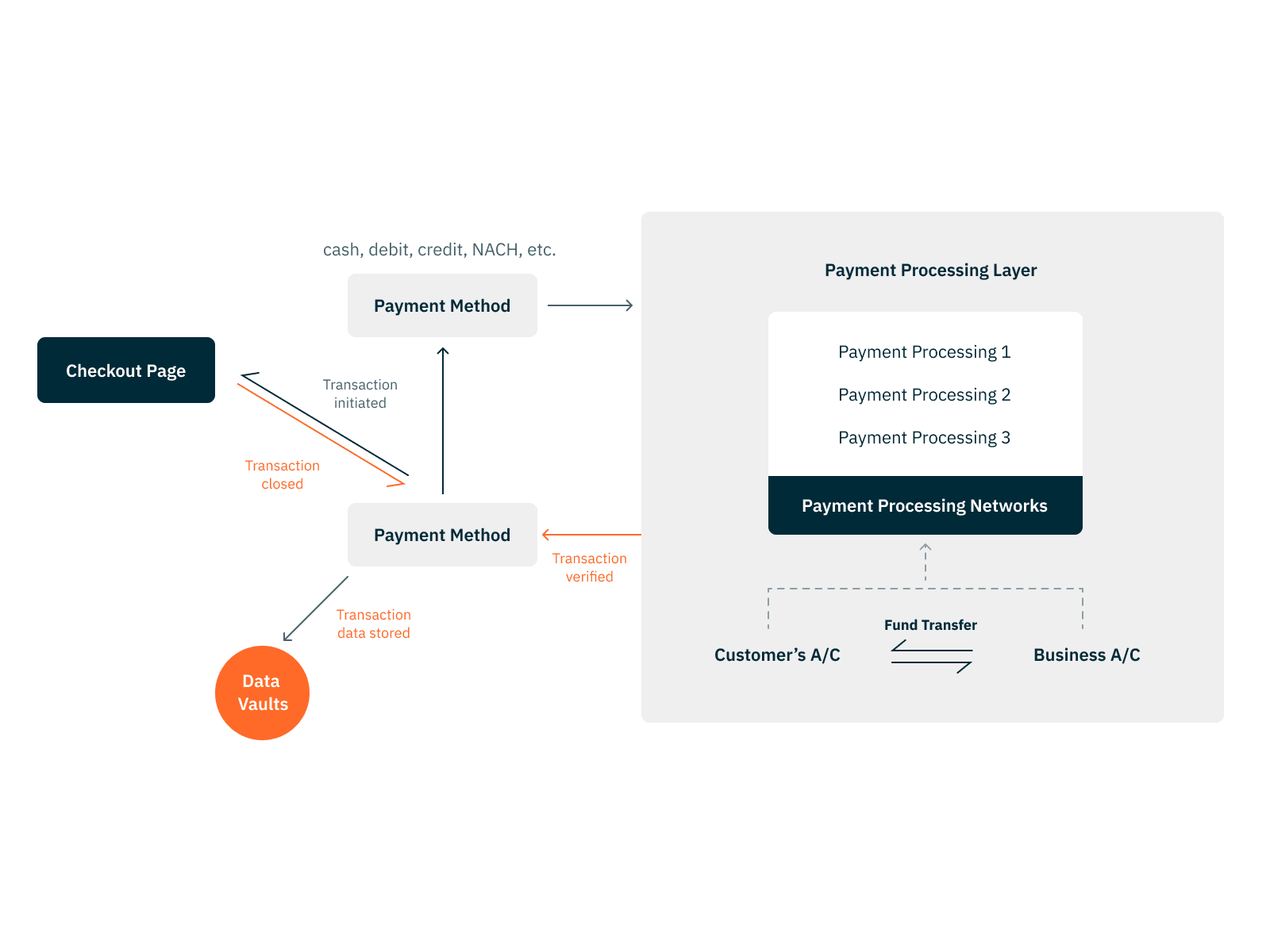

When a customer initiates a payment, a gateway does many different things to fulfill a transaction. It allows the customer to select their preferred payment method, accepts a payment event, jumpstarts processing, validates a successful payment, and speaks with the business platform to close the circle on a purchase.

We are only as flexible as our most rigid process.

In this ecosystem, the payment gateway gains critical mass. It controls which payment methods, or even currencies, we support, where the data is stored, and how data is shared across the revenue cycle. A transaction fails if any of the defined rules are unmet.

Again, you must build individual integrations with existing tools (CRM, sales tax automation, warehousing, inventory management, etc.) to add a new payment gateway.

Now, notice how the same thing works, this time, with Chargebee’s subscription and billing orchestration platform sitting above the payments layer –

Adding or removing payment gateways from the system becomes easy since you can seamlessly share data between the subscription management and transaction layer. The subscription management platform can then accept and distribute this data to interdependent systems (CRMs, sales tax automation, inventory management, etc.).

We are no longer limited by the constraints of preferred currencies/payment methods supported by individual gateways.

Avoiding post-purchase rigidity

Every decision we make, mainly as subscription-powered businesses, will inevitably affect the point of sale. It involves any changes the customers or we enforce after the first purchase is live.

For example, adding new products also means we need new definitions around how these are priced and how a customer is charged. This, in turn, aggravates complexity –

- How do new pricing models impact existing customers?

- If the new products are add-ons, how do we add them to existing invoices?

- How do we prorate charges when customers change their subscription or add a product mid-cycle?

You can extend this form of inquiry to any change in how a business operates, including customer and market expansion –

“We won our first 100 customers. We were very excited about the next phase of scaling. The new geographies we’d enter, the next level of customers we’d acquire. But, this growth brought new challenges and almost a new operational obstacle every day.”

– Benjamin Jaboeuf, Head of Business Operations at Instaply

Async customer communications platform: Instaply had a colorful problem. Having signed up many customers, they were hit with a “huge wave of invoices” and a bevy of failed payments every end-of-month.

Additionally, once Instaply planned to expand into Europe, it also needed to accommodate –

- Multiple payment, language, and currency preferences.

- Support for GDPR, 3DS, and EU-VAT.

- Multiple payment gateway integrations and compliance regulations.

Despite initiating recurring billing with Quickbooks, Instaply realized these weren’t cases that point solutions like payment gateways and accounting tools were typically built to handle.

Instead, they chose Chargebee to add flexibility to their revenue process. With Chargebee, they could –

- Integrate multiple payment gateways to accommodate various currencies, payment methods, and languages

- Match their book of accounts by comparing data from their payment gateway and accounting software

- Invoice as many customers as they want to

- Run parallel deployments on pricing/plan experiments, but more importantly

- Add as many capabilities/tools to their revenue process without changing anything

As you can see, a subscription management tool helps resolve new unmet use cases by allowing us to add/replace any existing tools without damaging how customers transact, or revenue is collected and recognized.

“Complexity that works is built up out of modules that work perfectly, layered one over the other.”

– Nassim Nicholas Taleb [The Black Swan: The Impact of the Highly Improbable Fragility]

Revenue growth needs proactive flexibility

Revenue growth is more than just collecting customer charges accurately. It aggregates all the decisions we make as a business – go-to-markets, product launches, experiments, and everything in between.

Despite it all, founders over-index on product roadmaps and revenue models in the early stages than building revenue resilience. This is why, while building a product-over-platform focus at the earliest stages of a business might seem rational, it also leaves room for improbability. Our growth-minded, agile customers recommend having flexibility and scalability entrenched in the foundation of their tech stack.

“If you are in your growth phase, you want to have [billing] optimized. And if you want to go international, you want to build [payment method and gateway] features as soon as possible. So if I were to advise somebody who’s starting a company today, I’d say, try to bring in Chargebee from day one because it will save you a lot of time and boost growth.”

– Quirijn Kleppe, Chief of Staff, Leadinfo

According to Taleb – “Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors and love adventure, risk, and uncertainty.” Truly resilient businesses are prepared for uncertainty. It isn’t about predicting each scenario before it happens but more about being adaptive enough to respond situationally.

Chargebee provides this adaptive flexibility by readily integrating with 23+ payment gateways, supporting 100+ currencies across the globe, and connecting with a host of additional tools from tax automation to compliance to security infrastructures, completely de-risking the entire revenue lifecycle.

Need to add a new payment gateway? Easily integrate it through custom APIs. Customers seeking non-card payments? Accept ACH or even wallet-based transactions. Need help being sales-compliant in a new market? Add sales tax automation or set up custom rules for billing. Every scenario is facilitated through Chargebee. The entire revenue architecture is plug-and-play. And since we can edit components at will, there is no “reimagining the existing process” when running future experiments.

Wondering what the fuss is all about? Get your test drive.