Reconciling Chargebee Invoices with Xero

Introduction

Reconciliation is the process of confirming that the balance in the Accounting books matches the balance in the Statement (gateway statement, bank statement, etc).

Reconciliation helps your accounting team confirm that all the amounts appearing in the statement are recorded in the books of accounts and a clear explanation emerges for the unreconciled items.

Note:

Only Chargebee sites with Stripe gateway configured are supported.

Problem Statement

You have a number of invoices processed on a daily basis. The payments are initiated from Chargebee and processed by your gateway. The gateway transfers the final amount (as a lump sum) at the end of the day or after a few days depending on the gateway, with no correlation to the original invoices for which payments are processed. The problem statement is as follows:

How do you reconcile the invoices/transactions with the bank statement when one lump sum amount is deposited in the bank account (when you do not know which individual invoices make up the lump sum amount)?

| Bank Transaction | Invoices/Transactions |

|---|---|

| Sum of $490 credited to the Bank Account on 4th Jan | Customer 1 - Invoice 001 - $99 (Paid on 2nd Jan) |

| Customer 2 - Invoice 002 - $99 (Paid on 2nd Jan) | |

| Customer 3 - Invoice 003 - $99 (Paid on 2nd Jan) | |

| Customer 4 - Invoice 004 - $99 (Paid on 2nd Jan) | |

| Customer 5 - Invoice 005 - $99 (Paid on 2nd Jan) |

Note:

Stripe can be linked to Xero as a payment processor. But Stripe cannot be connected to Xero to download the statement from Stripe (as you can do with your bank accounts)

Recommended Approach

The Reconciliation process can be simplified by following the steps mentioned below [this is a recommendation from Chargebee and may vary based on different accounting practices]:

- Create an individual clearing account for every gateway in your Xero Chart of Accounts exclusively for transactions processed by a gateway.

- Download a gateway statement from Chargebee.

- Upload the statement into the clearing account in Xero.

- Use Chargebee's Chrome plugin to perform Reconciliation.

Mapping payments between the Gateway statement, Invoices/transactions, and your Bank statement becomes easy.

Note:

Currently, Chargebee only supports downloading and pushing account statements from Stripe Gateway.

| Invoices/ Transactions | Gateway Statement | Bank Transaction |

|---|---|---|

| Customer 1 - Invoice 001 - $99 (Paid on 2nd Jan) | Transaction processed, for $99 | |

| Customer 2 - Invoice 002 - $99 (Paid on 2nd Jan) | Transaction processed, for $99 | |

| Customer 3 - Invoice 003 - $99 (Paid on 2nd Jan) | Transaction processed, for $99 | |

| Customer 4 - Invoice 004 - $99 (Paid on 2nd Jan) | Transaction processed, for $99 | |

| Customer 5 - Invoice 005 - $99 (Paid on 2nd Jan) | Transaction processed, for $99 | |

| Processing Fee - $5.00 | ||

| Transfer $490 to Bank account on 4th Jan | Sum of $490 credited to the Bank Account on 4th Jan |

Note:

The gateway processing fees may be aggregated in case the fees were applied multiple times.

Steps to Reconcile Payments between Chargebee and Xero

1. Download Gateway Statement from Chargebee

-

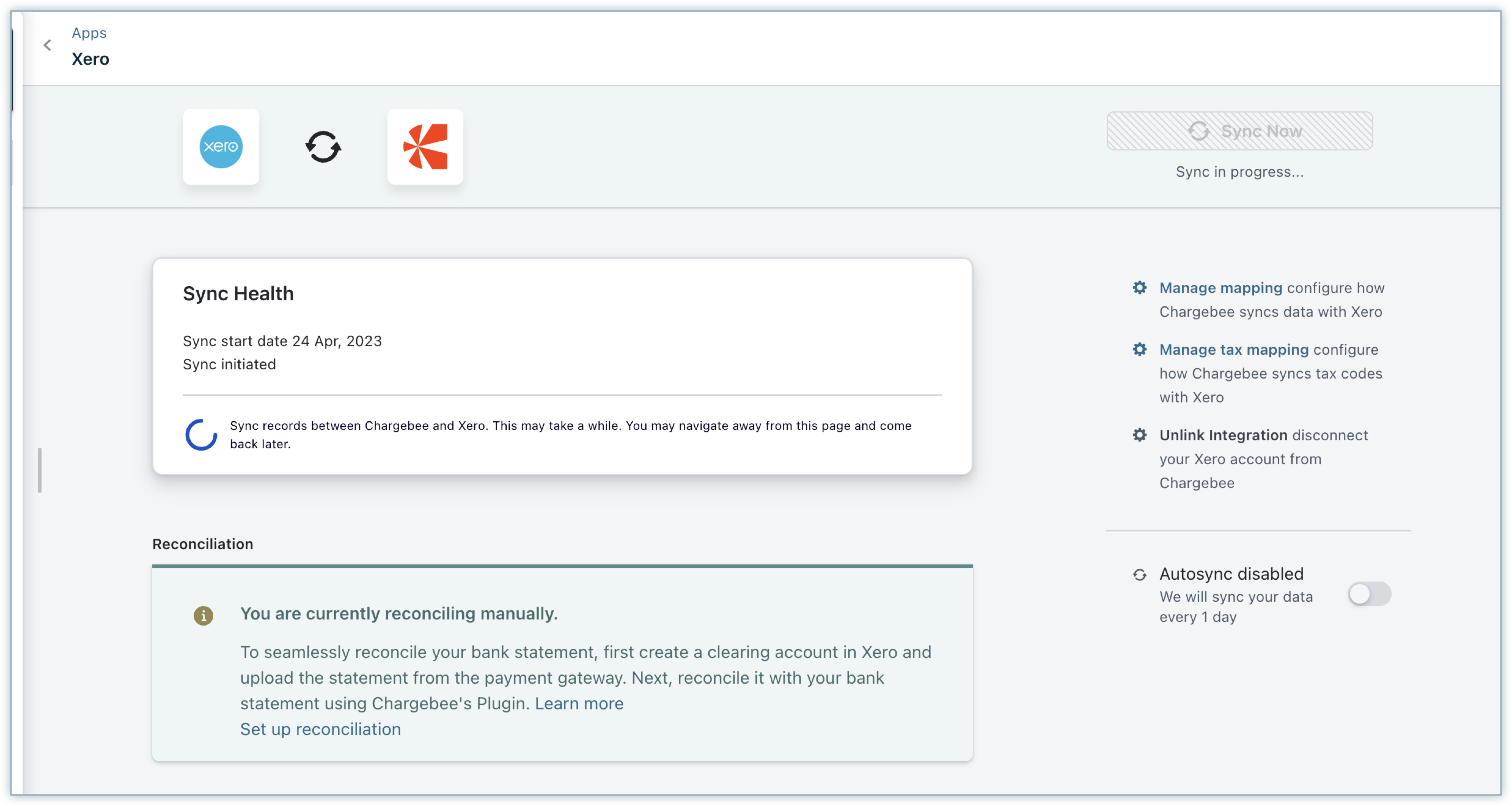

Connect your Chargebee and Xero accounts. Click Apps > Go to Marketplace > Accounting > Xero > Reconciliation to navigate to the Xero integration sync settings page.

-

Click Generate New Statement under the Reconciliation tab. The Reconciliation tab displays up to five recently generated gateway statements. You can also view the generated time and the date range of these statements. Note that the date and time range for Xero should not exceed two months.

-

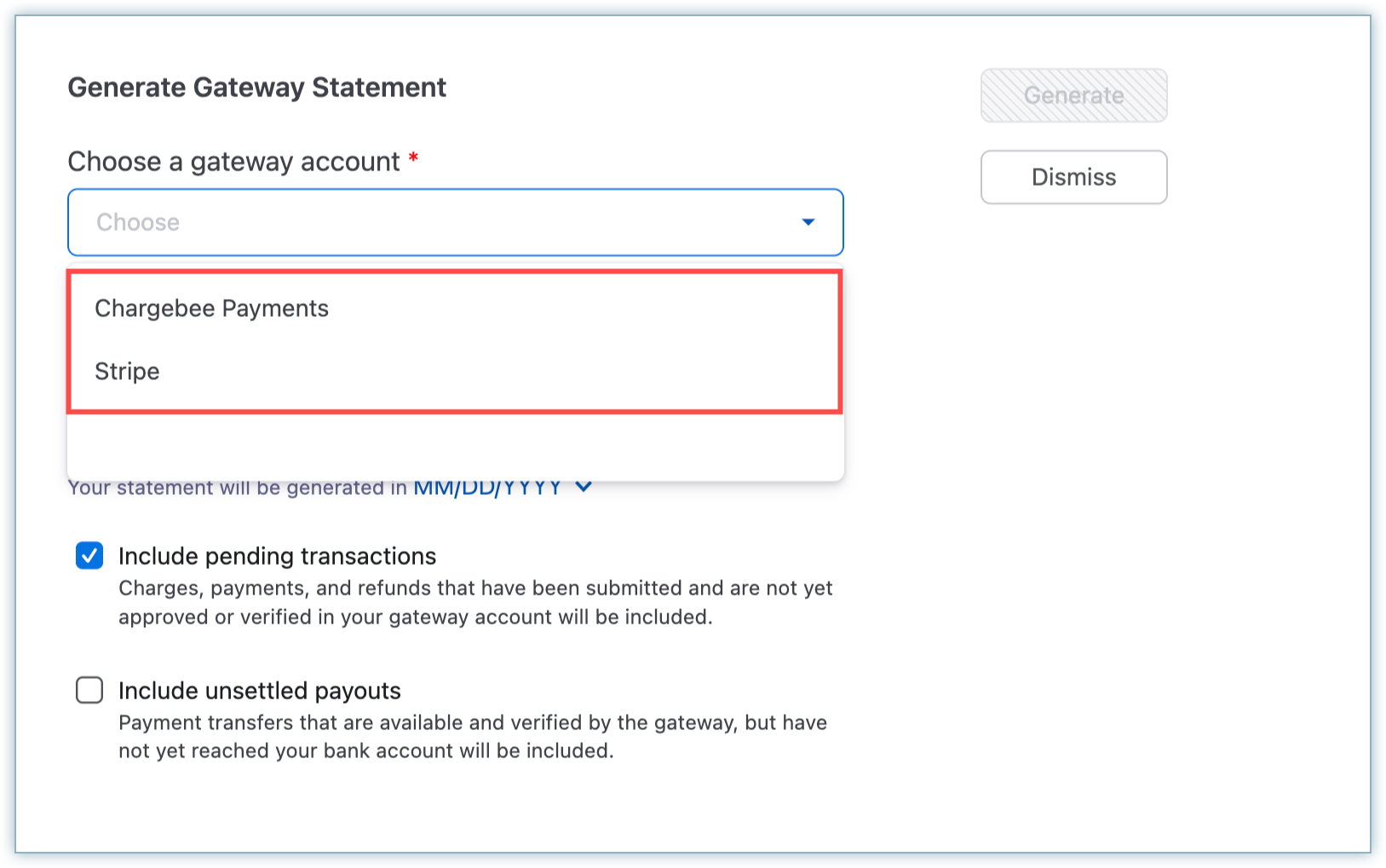

In the Generate Gateway Statement pop-up, select a gateway account for which you want to download the statement.

-

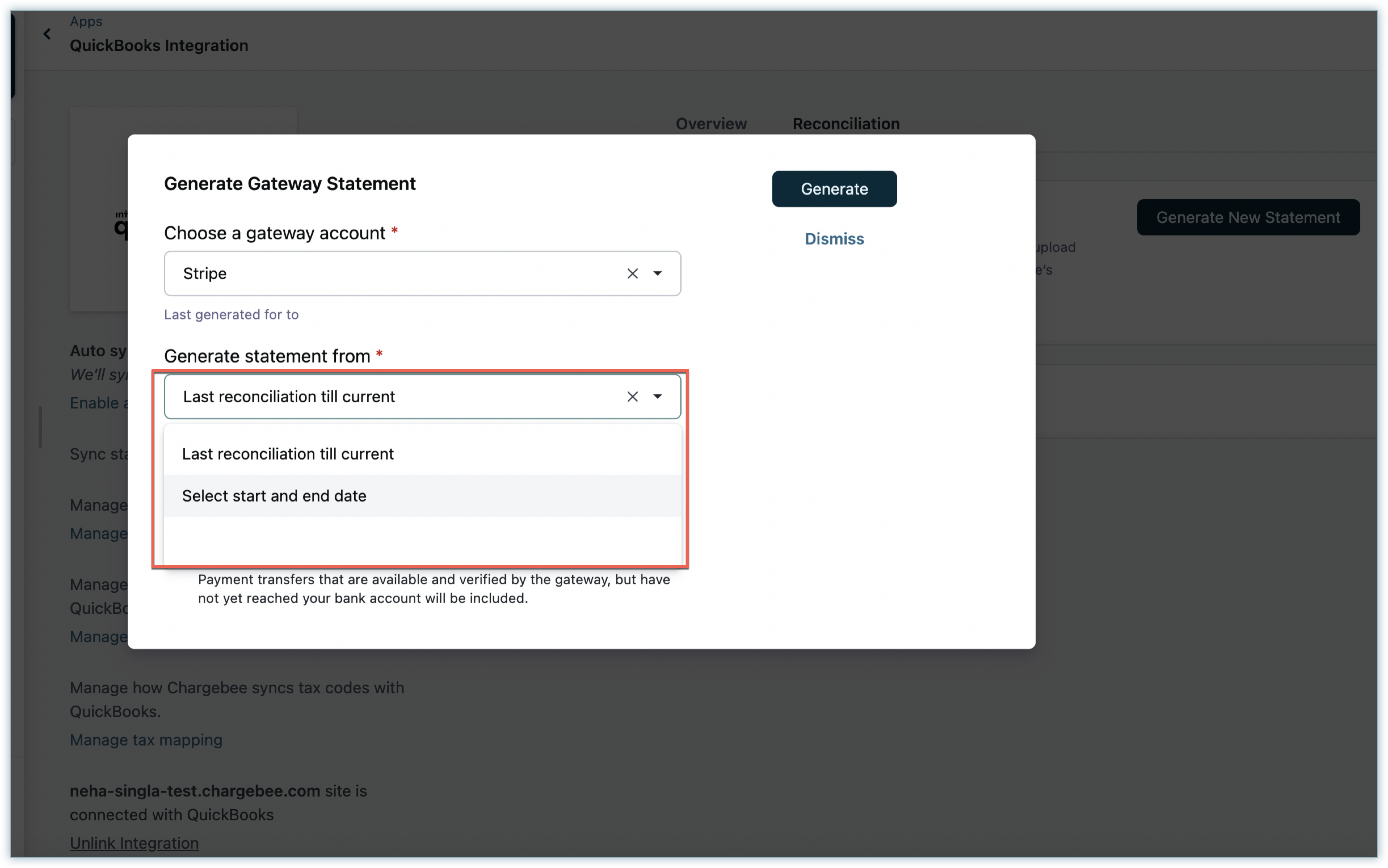

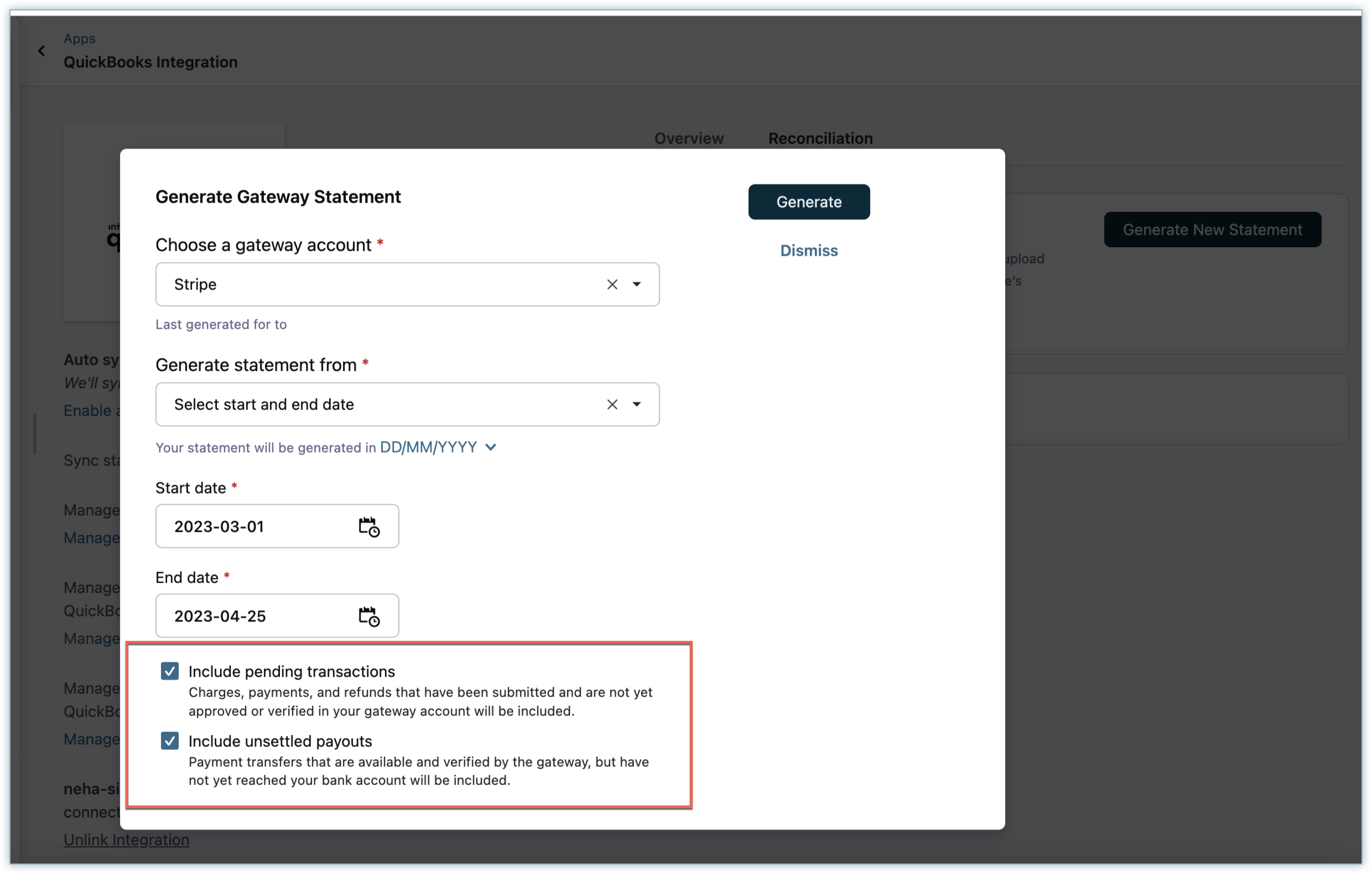

Select the date range for which the statement should be downloaded. You can choose to download from Last reconciliation till current date or select start and end date, as required.

-

You can optionally select Include pending transactions for charges, payments, and refunds that are in in-progress status to be included in the reconciliation statement.

-

Similarly, select Include unsettled payouts to include settlements and bank transfers that are in in-progress status to be included in the reconciliation statement.

-

Click Generate to generate a new gateway statement for the selected date range. Once the statement is generated, you can download the statement and upload it to your Xero account.

2. Upload Gateway Statement in Xero

If you have an existing gateway account in Xero with Type as Bank to manage gateway statement, you can use that; otherwise, create a new gateway Account with Type as Bank to import the Gateway statement.

Note:

All Paid Invoices shall be integrated from Chargebee to Xero into the Gateway account in Xero with type as Bank.

3. Start Reconciliation Process

- Download and install the browser extension for Chrome.

Note

- Download this file from the link provided.

- Go to Manage Extensions.

- Enable the Developer mode button.

- Select the Load unpacked tab.

- Select this file from downloads.

- Run the Reconciliation plugin.

- The plugin will start searching for transactions and find matches automatically.

Chargebee's plugin is compatible with the current reconciliation logic and User Interface (UI) of Xero. Any further updates on the Xero reconciliation logic or UI will not be supported automatically by the plugin and might disrupt the reconciliation process.

Note:

- If a match is not found, the extension will skip the entry and proceed to the next transaction

- The extension will not match Gateway Fees and Settlements to Bank Accounts, these should be matched automatically (as explained in the following steps).

4. Map the Gateway Processing Fees Manually

Map the Gateway Processing fees to a specific expense account in Xero.

Note:

You can also create a Reconciliation rule so Xero can match the conditions next time and automatically display as a match. Read more about Xero Reconciliation rules.

5. Transfer Settlement Amount to a Bank Account

After the payments and refunds are reconciled between the Gateway Statement and Gateway Bank account, the lump sum amount pending to be transferred in the Gateway Statement shall be transferred from the Gateway Bank Account to your actual Bank Account.

6. Reconcile Bank Statement

The gateway transfer should be reconciled against the bank statement entry to complete the Reconciliation process.

Reconciling Multi-currency Invoices

- If you have multiple bank accounts linked to Stripe and in Xero, you can generate separate statements per currency and upload them in currency-specific clearing accounts in Xero. Contact support to generate multi-currency statements.

- If you have multiple currencies in Chargebee and a single bank account in Stripe, Stripe applies the exchange rate while processing payments. Chargebee syncs the exchange rate used in Stripe to Xero. You should manually reconcile such transactions. For example, if the base currency in Xero is CAD, the reconciliation account has CAD currency, and exchange rate is applied on the payment.

- Chargebee's plugin works only when the reconciliation account currency and the payment currency are the same.

FAQ

1. How will the gateway statement be converted into Xero understandable format?

When you download the statement from Chargebee, Chargebee will understand the type of gateway and convert it to a format accepted by Xero.

2. How are multi-currency invoices managed?

For multi-currency users, the exchange rate will be derived from the Gateway (by calculating the exchange rate from the original and converted amount).

3. Why should I enable Include pending transactions and Include unsettled payouts?

Payment transactions and payment gateway payouts between your bank and gateway accounts do not happen in real-time. Let's say you are using the Stripe payment gateway for payment processing and you have a few transactions initiated via Stripe for the last week of May. You might actually see these amounts credited in your bank account only in the first week of June, until when they are marked "in progress" in your gateway statement. Similarly, Stripe payouts towards your bank account that include settlements might take a while to be processed and do not happen in real-time with every transaction.

Some businesses may find this sort of time lag difficult because it could come in the way of the reconciliation process. To address this time lag and to help you with successful reconciliation during any given period of time, you can enable Include pending transactions and Include unsettled payouts. This will help reconcile all amounts successfully, even those that are in pending status.

Was this article helpful?