eInvoicing Compliance for Global Subscription Businesses

Support eInvoicing across 20+ countries: Ensure eInvoicing compliance in countries like Germany, Denmark, India, Australia and more.

Avoid costly penalties: Steer clear of hefty fines by ensuring your business adheres to local eInvoicing mandates.

Eliminate manual intervention: Generate compliant, accurate eInvoices with zero manual effort, minimizing errors and saving time.

Be future-ready: Stay ahead of tomorrow's evolving eInvoicing regulations with a platform designed to evolve with changing compliance landscapes.

Get centralized eInvoicing

and tax compliance with Chargebee

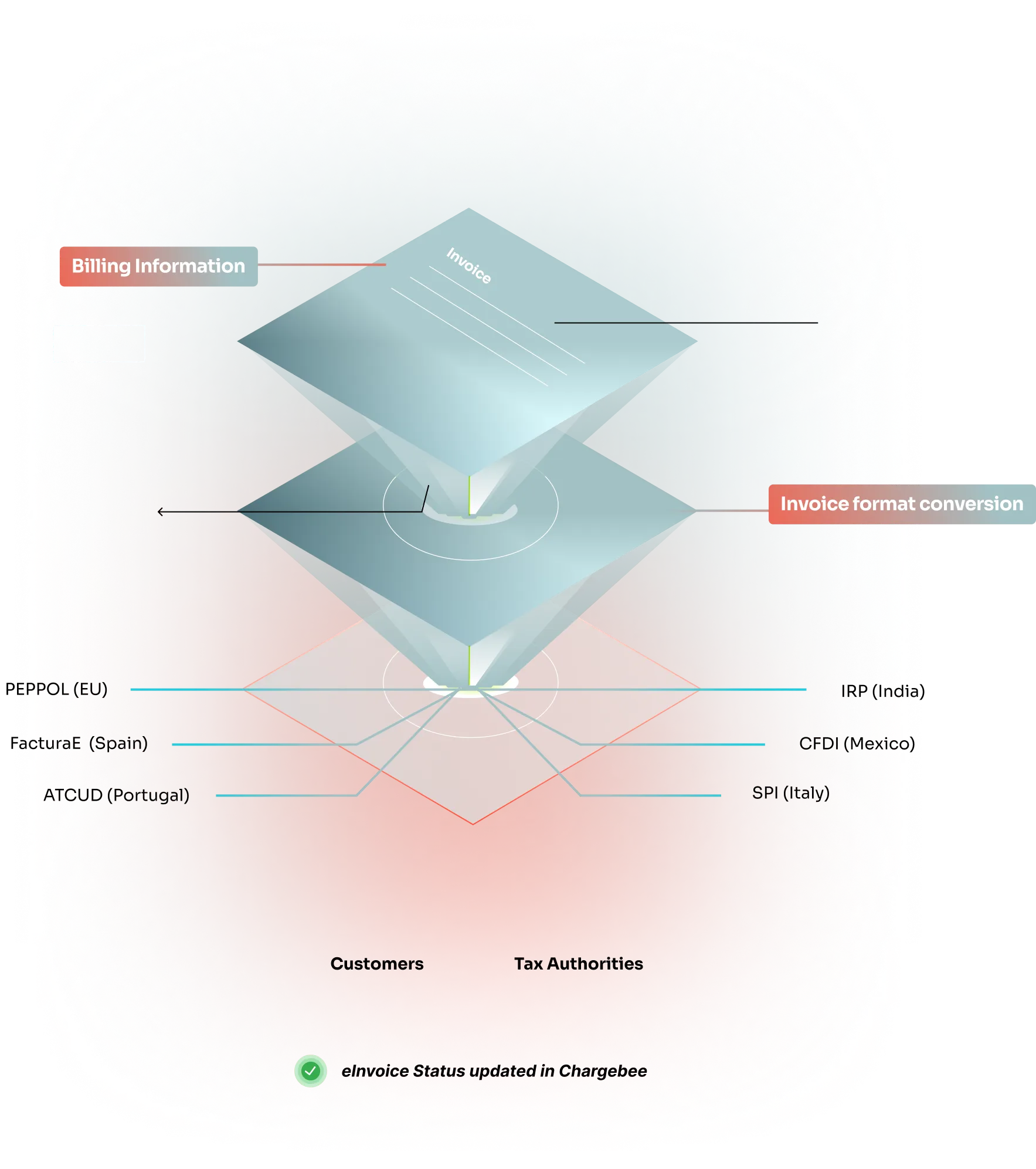

Global eInvoicing Compliance in 20+ Countries

Stay ahead of evolving compliance requirements with Chargebee. As invoicing regulations become increasingly complex - spanning B2B, B2C, and B2G transactions across more countries - Chargebee keeps your business compliant and audit-ready, wherever your expansion takes you.

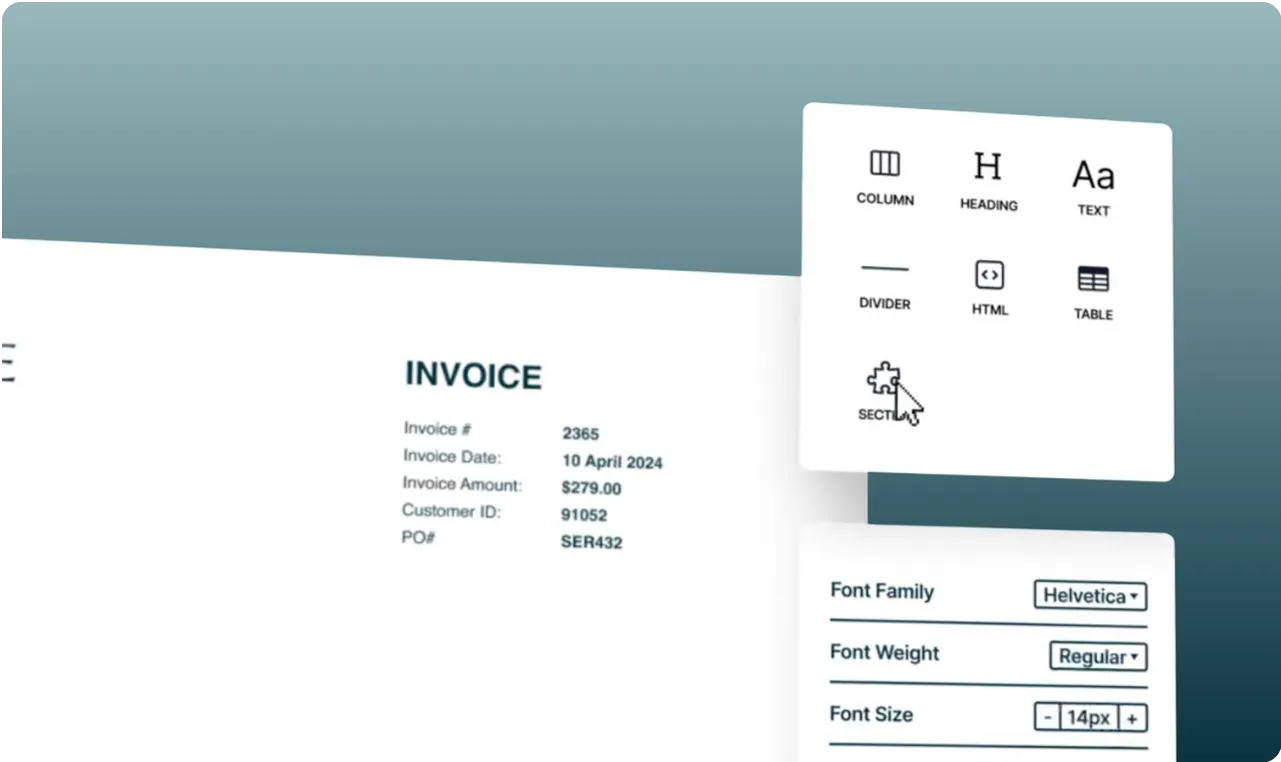

Automated and Compliant Invoicing

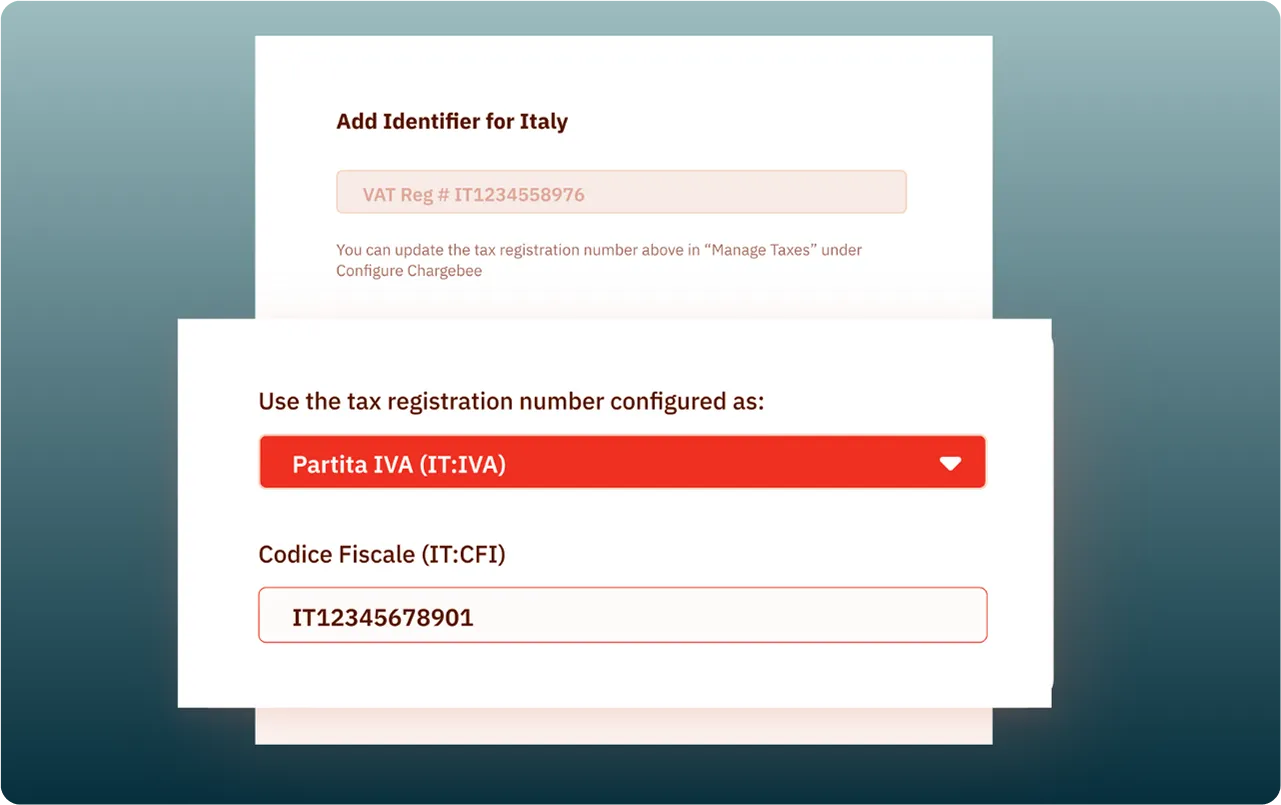

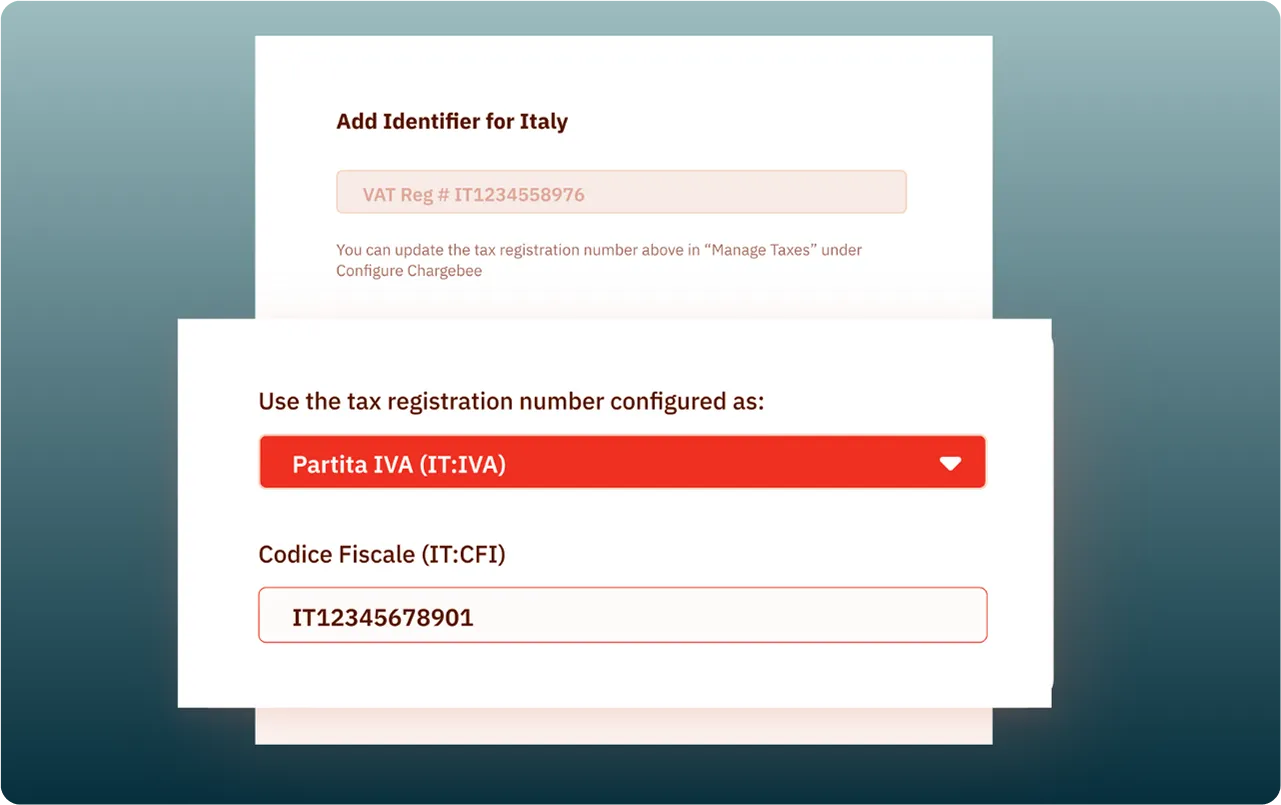

Build compliant invoices effortlessly with our no-code template builder, and customize formats for any regional requirement. Chargebee automatically applies real-time tax rates and subscription changes, then delivers accurate invoices directly to customers and tax authorities through major eInvoicing networks including PPEPOL, SDI, and IRP.

Recurring eInvoicing Tailored to Billing Cycles

Automatically generate eInvoices based on the billing frequency set in your subscriptions, even when subscriptions undergo changes. Track the real-time status of all your eInvoices within Chargebee to ensure compliance in every billing cycle. Enable auto-sync with accounting and ERP systems to reconcile all invoices without manual intervention.

Frequently Asked Questions

Frequently asked questions

Is eInvoicing available on all Chargebee plans?

Yes, eInvoicing is available as an add-on on all Chargebee billing plans for an additional monthly price:

Starter

Performance

Enterprise

Number of invoices allowed under the base add-on (monthly)

100

5,000

15,000

Base price

$49

$149

$249

Charges per document

*

once the monthly quota is exhausted

C

$0.19

$0.02

$0.02

Monthly price per additional network

$49

$149

$249

* An invoice or a credit note is considered a document

| Starter | Performance | Enterprise | |

|---|---|---|---|

| Number of invoices allowed under the base add-on (monthly) | 100 | 5,000 | 15,000 |

| Base price | $49 | $149 | $249 |

|

Charges per document

*

once the monthly quota is exhausted

C

|

$0.19 | $0.02 | $0.02 |

| Monthly price per additional network | $49 | $149 | $249 |

* An invoice or a credit note is considered a document