The Old Playbook No Longer Applies

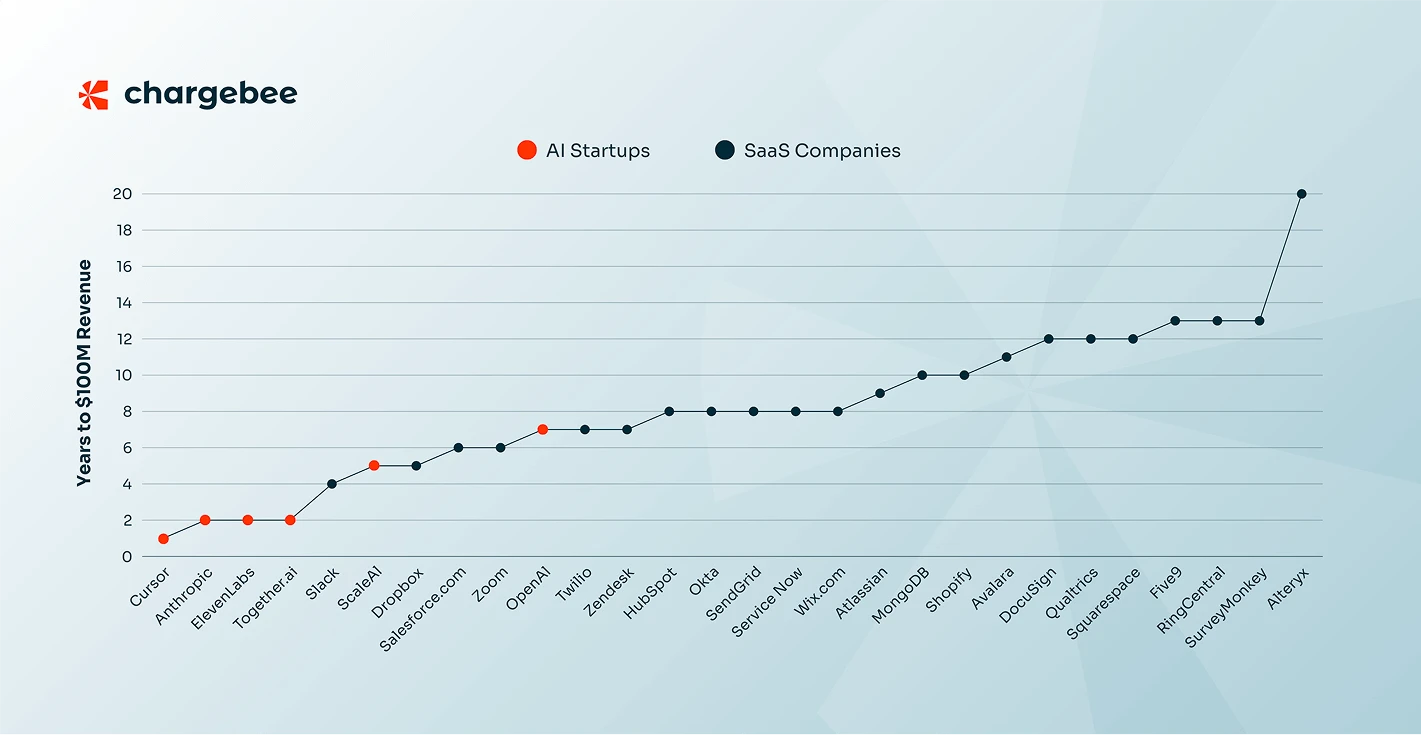

In the past, most SaaS companies followed a familiar path: start with SMBs, build traction, and eventually move upmarket. But today's growth stories don't follow that arc. AI-native startups are closing seven-figure enterprise deals from day one, while others are blending product-led growth (PLG) with traditional sales motions in a hybrid go-to-market model.

*The chart shows OpenAI at seven years, but we all know it took them far less time. ChatGPT launched in 2022, and by 2024, they were already at $3.7 billion in revenue.

Regardless of where they begin, all scaling companies face the same reality: enterprise growth brings complexity. Fast.

The Butterfly Effect of Enterprise Sales

The jump to enterprise selling means longer sales cycles, custom contracts, stricter compliance requirements, and cross-functional dependencies. Your existing playbook that is built for fast, frictionless SMB deals starts to break.

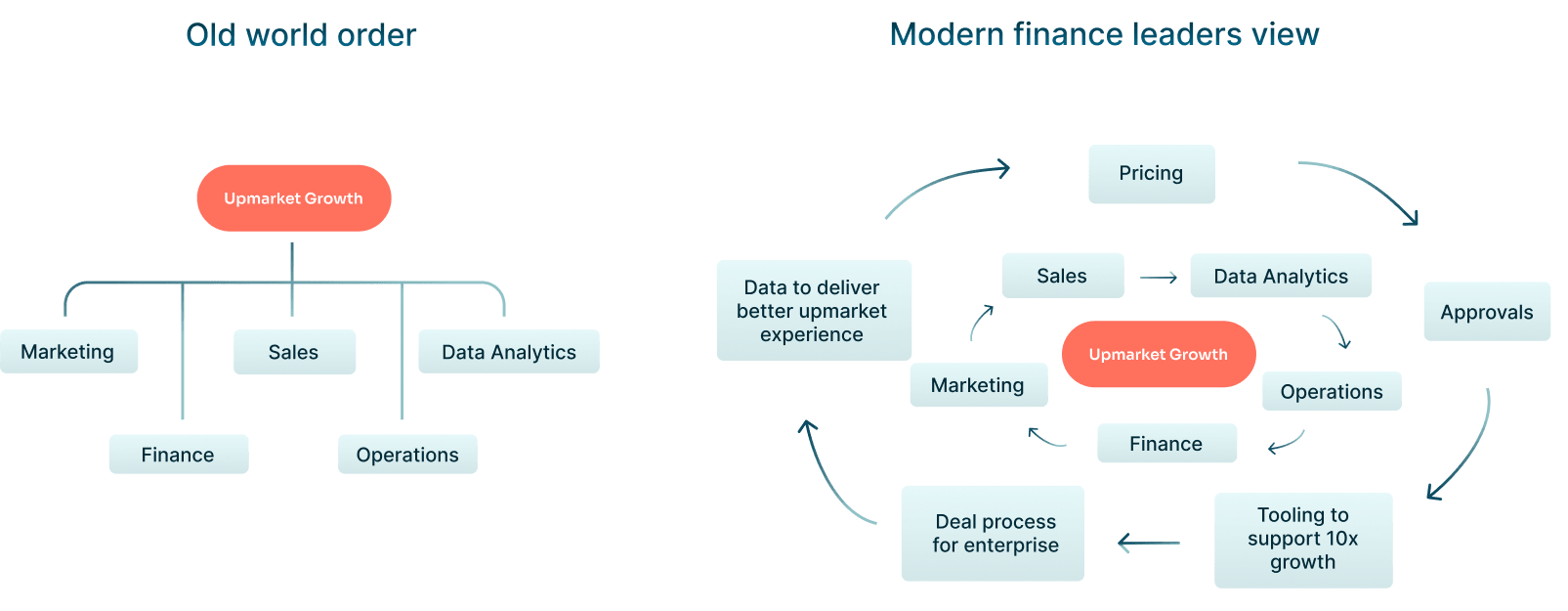

That's when companies realize: it's not just the product or the pitch that needs to change. The entire operating model has to evolve.

Why You Need a Cross-Functional "Black Box"

To serve enterprise customers, every function — Sales, Legal, Product, Security, RevOps, and Finance — must work in lockstep. These teams form a "black box": an internal system that processes complexity behind the scenes so the customer sees a seamless, professional experience.

Enterprise-grade deals demand enterprise-grade execution. Structured approvals and deal desks ensure consistency. Pricing and discounting must be tightly controlled. Handoffs between Sales and Finance need to be clearly defined. Revenue data must flow cleanly through billing and reporting systems to support audit-ready financials. Without this cross-functional backbone, complexity creates chaos, not growth.

What This Guide Covers

In this guide, Lydia Stone shares strategic guidance to help Finance leaders:

- Build financial infrastructure that supports complex enterprise contracts

- Ensure revenue recognition aligns with accounting standards

- Manage the financial implications of hybrid PLG and sales-led motions

- Establish pricing discipline through approval workflows and deal desks

- Implement systems that serve as a single source of truth for revenue and billing data

- Track new enterprise metrics like time-to-value, processing volume, and tax exposure

If your company is preparing to move upmarket, this guide will help Finance evolve from a back-office function into a key enabler of scalable, compliant enterprise growth.

Building Financial and Operational Readiness for Enterprise Sales

When a company decides to start selling to enterprises or move upmarket, the Finance function becomes essential in preparing the organization for this shift. Larger contracts bring longer terms, more stakeholders, and complex financial commitments. Finance teams are expected to establish the processes that ensure contract discipline and maintain financial accuracy. This is often when companies bring in experienced finance leaders to build the infrastructure needed for scale.

In early-stage or SMB-focused sales, contracts are usually simple monthly subscriptions with minimal custom terms. Enterprise deals, however, introduce multi-year commitments, pricing escalations, and special terms that have direct implications on revenue recognition.

For example, a three-year contract with increasing payments each year requires the total contract value to be averaged and recognized over time. Without this level of accounting rigor, companies risk misrepresenting financial performance, which can create problems during audits and investor reporting.

Aligning Finance for Hybrid GTM at Scale

The challenge deepens when companies attempt to balance Product-Led Growth (PLG) and Sales-Led Growth (SLG) simultaneously. While PLG is straightforward — customers sign up, payments are automated, and revenue recognition is simple — SLG introduces complexity due to customized deals and negotiated terms. Sales-led agreements often involve special pricing, milestone-based billing, and complex contracts, all of which require careful financial management.

As companies transition into enterprise sales, their existing sales motions often require restructuring.

Why Sales Motions Need Restructuring

Sales teams used to SMB deals may offer terms that clash with enterprise financial standards.

AEs agree to annual contracts with opt-out clauses, undermining recurring revenue (ARR).

Without structured discounting controls, pricing becomes inconsistent, leading to revenue leakage.

To address these issues:

- Approval Processes and Deal Desks: Implementing approval processes and establishing deal desks is essential to enforce pricing discipline and maintain financial accountability.

- Shift to RevOps Ownership: As deal volume and complexity grow, relying on manual processes (like AEs tracking contract details) quickly becomes unsustainable. While Finance teams may initially handle pricing approvals and contract tracking, scaling effectively requires shifting these responsibilities to a mature RevOps function.

- Alignment Across Teams: A well-structured RevOps team ensures Sales, Finance, and Operations are aligned on deal management, approvals, and compliance — providing the foundation needed to support enterprise sales effectively.

Keeping pace with this operational shift requires investing in scalable systems. Without them, Finance teams are forced to rely on manual workarounds that can't support the complexity or scale of enterprise deals.

The Cost of Delayed Investment into Systems Upgrade

The more complex enterprise sales motion demands centralized systems to manage contracts and revenue data. Relying on manual processes, such as spreadsheet tracking and ad-hoc reviews, is both time-consuming and error-prone. When companies delay investing in automated solutions, they end up pouring excessive resources into reconciliation and damage control.

Scaling into enterprise sales requires a robust data foundation to support accurate financial reporting, compliance, and revenue recognition. Without the right systems, Finance teams risk being stuck in a reactive cycle, constantly fixing errors rather than proactively managing revenue.

Why a Single Source of Truth is Critical for Scaling Finance

To operate effectively at scale, Finance needs a unified system of record for contract and billing data. When information is scattered across teams and systems, discrepancies emerge, leading to inconsistencies in revenue reporting and financial statements.

Implementing a single source of truth allows Finance to streamline revenue recognition, enhance billing accuracy, and ensure compliance with reporting standards. It also reduces operational overhead by eliminating redundant tasks and providing real-time visibility into the company's financial health. Without this foundation, companies will struggle to scale effectively and maintain financial integrity as they move upmarket.

Once the single source of truth is in place, Finance teams can move beyond basic reporting and start tracking the metrics that truly reflect enterprise growth.

New Metrics That Matter When Selling to Enterprises

Selling to enterprises doesn't just mean bigger contracts. It means tracking new metrics. One key metric is time to value — how long it takes for an enterprise customer to start realizing benefits from our product. Large customers require extensive implementation efforts, sometimes taking over a year, which affects revenue recognition and forecasting.

Additionally, processing volume becomes a key indicator. Enterprise customers grow their usage over time, leading to upgrades and additional revenue. We track whether customers are increasing their invoicing volume, which signals expansion opportunities.

New Enterprise Sales Metrics

Time to Value

Large customers often require lengthy implementations, impacting revenue recognition.

Processing Volume

Enterprise customers typically expand usage over time, driving incremental revenue.

From a compliance perspective, tax regulations become more complex as companies expand into multiple jurisdictions. When Chargebee was primarily serving startups, tax compliance was straightforward. But as we expanded globally, we had to account for VAT, GST, and country-specific tax laws, requiring us to hire tax specialists.

Preparing for Long-Term Success

Bringing in larger customers affects every part of the business, but Finance holds the responsibility for managing that complexity behind the scenes. Without strong contract controls, reliable systems, and compliance expertise, companies face a higher risk of misreporting, delayed closes, and audit failures.

Enterprise selling requires more than new sales playbooks. It demands a Finance function that is prepared, well-resourced, and equipped to scale. As your company makes this transition, financial readiness will be as important as product readiness in determining long-term success.

About Chargebee

Chargebee is the revenue growth platform purpose-built for SaaS and subscription businesses ready to scale. Whether you're balancing product-led and sales-led motions or navigating the complexities of enterprise contracts, Chargebee helps streamline quote-to-cash, automate billing operations, and stay compliant without slowing down growth.

Finance and RevOps teams at over 6,500 companies trust Chargebee to manage flexible pricing, enforce deal discipline, and unify sales and finance data—providing the control and visibility needed to support enterprise-grade scale.

Assess your enterprise readiness

Connect with us →