What are Recurring Payments?

These payments can be set up via recurring billing for any frequency that’s agreed upon between the customer and the business. It could be weekly, biweekly, monthly, quarterly, or on an annual basis.

What Types of Businesses Use Recurring Payments?

Most businesses using recurring payments follow a subscription business model where customers have the flexibility to choose the duration and frequency of their subscription and can renew or cancel it at any point.

Subscription businesses are becoming increasingly popular across a wide range of industries as they provide businesses with a predictable revenue stream and offer convenience for customers.

The global SaaS industry has grown 500% in the last seven years. Especially during times of economic uncertainties, when businesses need to focus on maximizing their cash flow, subscription businesses are a good bet for business owners and investors alike.

A variety of businesses offer recurring payments for their products or services, such as:

Streaming Services: Hulu, Amazon Prime, Netflix

eCommerce & DTC: Blume, Feastables

Fitness: Gym Memberships, Practo

SaaS: Chargebee, Slack

Education: Udemy, Study.com

Magazines & Publications: Bloomberg, The New York Times

How Do Recurring Payments Work?

Simply put, recurring payments work as an agreement between the customer and the business, where the customer agrees to make payments on regular intervals, and the business agrees to provide the product or service for as long as the payments are being made. Once the contract ends, the customer can choose to continue or terminate the subscription.

Here’s a detailed step-by-step process to understand the recurring payments workflow:

Once the customer has subscribed to your product or service, they can choose the payment method (Credit Card, Direct debit, ACH or SEPA).

The customer can then enter their payment details for the first payment. These details are saved in a payment gateway for processing the subsequent payments securely.

Then the payment intermediaries, the acquiring bank, credit card network and the issuing bank approve the transaction and the payment is transferred to the merchant account.

The payment is debited according to a predetermined billing schedule until an active subscription. This removes the need to manually type in the payment details for every payment cycle.

Types of Recurring Payments

Recurring payments can be categorized based on the payment modes used and based on how the payment to be charged is calculated.

Based on Payment Modes:

1. Recurring Card Payments:

This refers to a recurring payment that’s done by providing credit card or debit card details to the merchant.

2. Recurring Direct Debit Payments:

This is a payment method that allows the merchant to automatically charge the customer's bank account on a regular basis.

3. Recurring ACH Payments:

This is an electronic bank-to-bank payment in the United States. ACH is an effective way for subscription businesses to accept recurring payments from customers without incurring large fees.

4. Recurring SEPA Payments:

Similar to ACH, SEPA (Single Euro Payments Area) is a payment system in the European Union that enables electronic money transfers between banks within the EU.

All of the above payments involve the payment intermediaries that can decline the transaction resulting in a payment failure. Hence, it’s advisable to provide your customers with multiple recurring payment options for your subscription business.

Based on Usage:

1. Fixed Recurring Payments:

When a specific amount of money is charged at regular intervals, such as a monthly or annual subscription fee, it’s termed as a fixed recurring payment. For example, a gym membership that charges a fixed fee of $50 per month for access to the gym facilities.

2. Variable Recurring Payments:

These payments vary based on usage or consumption. For example, a mobile phone plan where the customer is charged based on the number of minutes or data used.

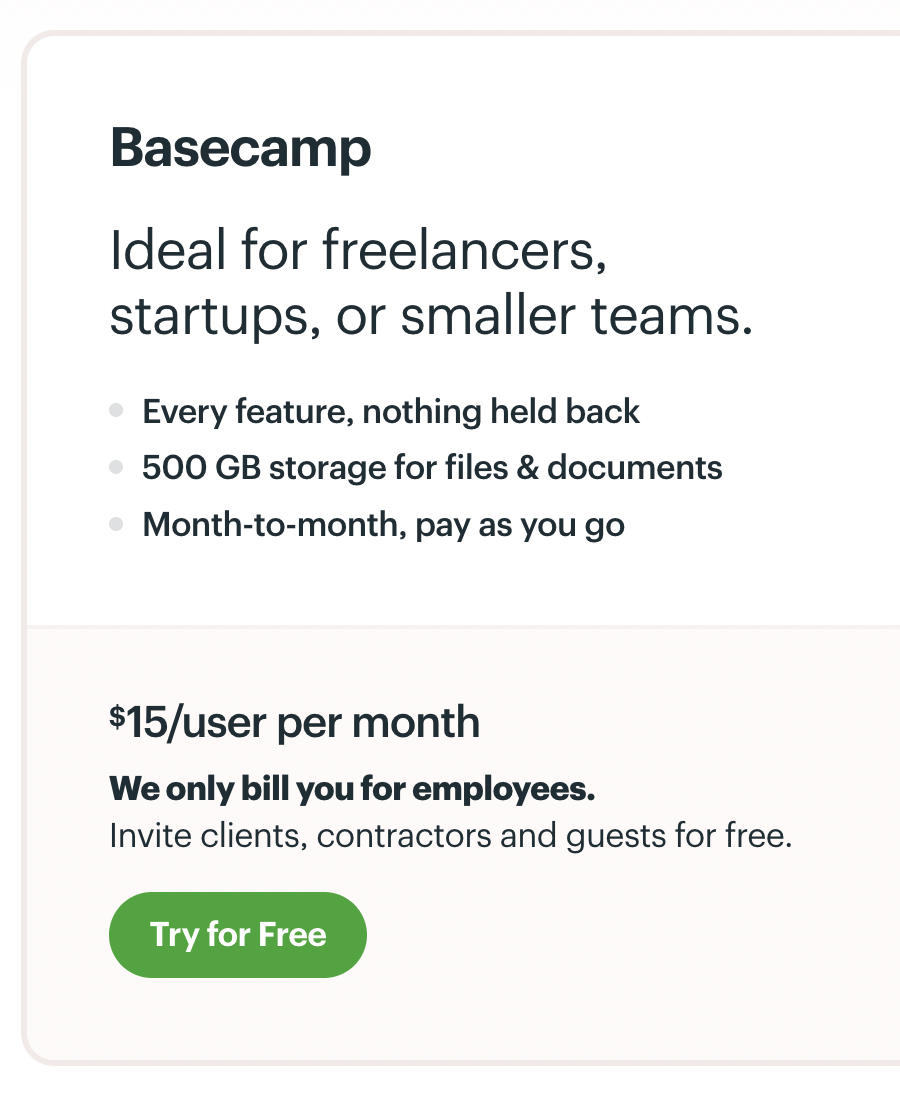

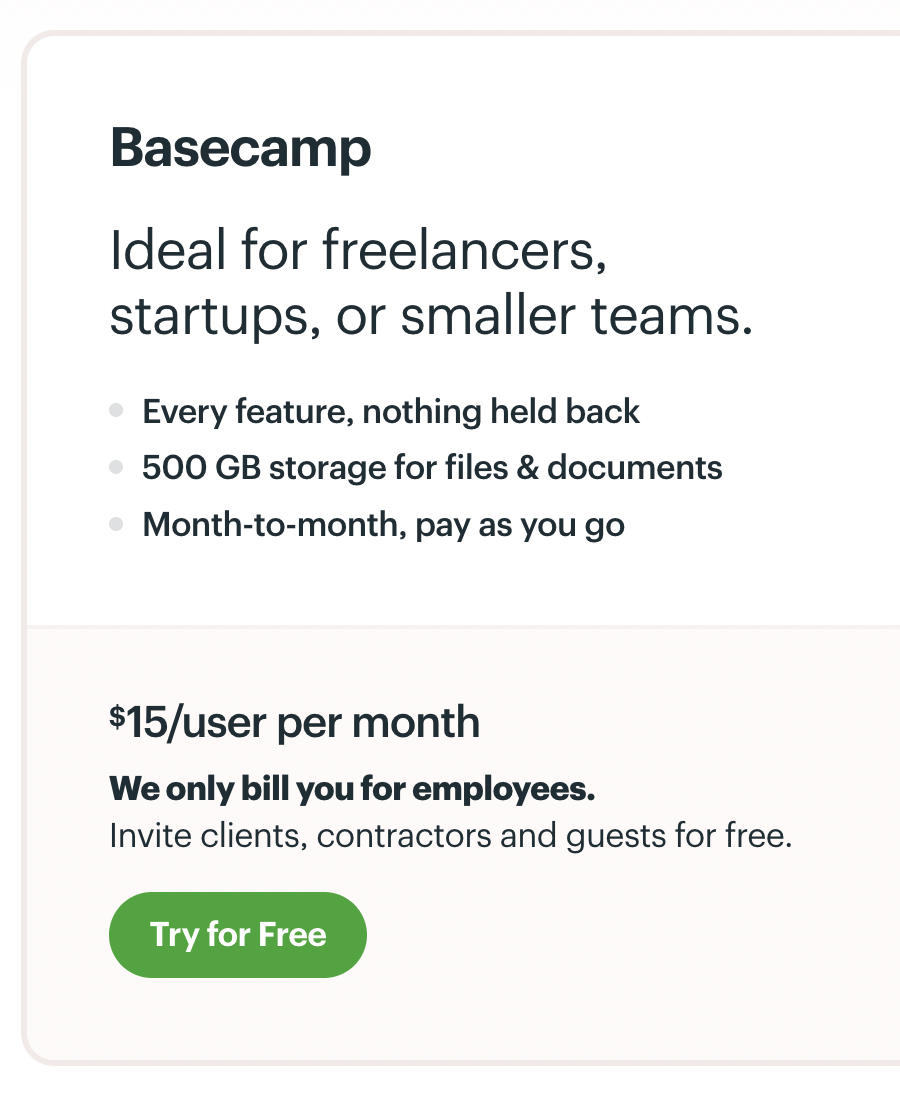

Most SaaS and other subscription businesses offer both fixed and variable recurring payment options in their plans. For example, Basecamp, a real-time communication tool for businesses offers two plans depending on business size.

A fixed payment plan for large businesses with a monthly fee of $299/ month, billed annually with all-inclusive features and no per-user charges.

They also offer a pay as you go plan for smaller teams with all-inclusive features and a $15/ user per month fee. As the number of users increases, the monthly recurring fees increases as well.

Benefits of Recurring Payments

Business leaders across the globe agree that a subscription-based model can foster sustainable growth for their businesses. According to a research by Gartner, all new software entrants and 80% of historical vendors now offer recurring payments.

From a customer’s standpoint, they are automated making it one less thing to worry about on their to-do list. Additionally, they can make budgeting easier for customers since they know the exact amount they will be charged on a recurring basis. For businesses, subscription payments have a lot of advantages, including:

1. Predictable Cash Flow: With subscription payments, businesses can more easily predict how much revenue they will be generating each month, which can help with budgeting and revenue forecasting.

2. Customer Retention: Subscription models offer deeper customer insights as opposed to one-off purchases. A continued customer relationship provides the opportunity to develop a strong understanding of consumer behaviors and preferences. Businesses can alter their products or services according to their needs and nail the customer experience. In addition to personalized offering, the “set and forget” nature of subscription payments increases customer convenience and helps in customer retention.

3. Minimal Manual Effort: Once you’ve set up recurring billing for your customers, you can put collections on autopilot. A strong billing software eliminates manual collection and errors, thus saving business time and money.

4. Easy to Upsell or Cross-sell: If a customer is already committed to your product/ service and is paying via recurring payments, they may be more likely to consider additional products or services you offer. This can increase revenue and customer lifetime value for the business.

Pricing Models for Recurring Payments

As a growing SaaS business, if you’re not pricing your product or service right, you’re leaving money on the table.

“#1 tip for pricing strategy is to treat it as an experiment.,” says Yoav Shapira, Director Of Engineering at Meta.

Building a successful product that ensures recurring revenue hits your coffers boils down to an essential factor - pricing. The right pricing strategy will help you monetize your product or service better and keep your business in good health.

Various pricing models can work for recurring payments based on the business model. Some of the most common recurring revenue pricing models are:

Flat-rate Pricing: Flat-rate pricing charges a customer at a pre-determined price offering a fixed set of features with no options or variations to choose from. It is based on the idea that one price fits all customers, regardless of the number of users or the usage level. Customers are charged the same amount on a regular basis, whether it be monthly or annually. Example, Basecamp’s pricing model for smaller teams.

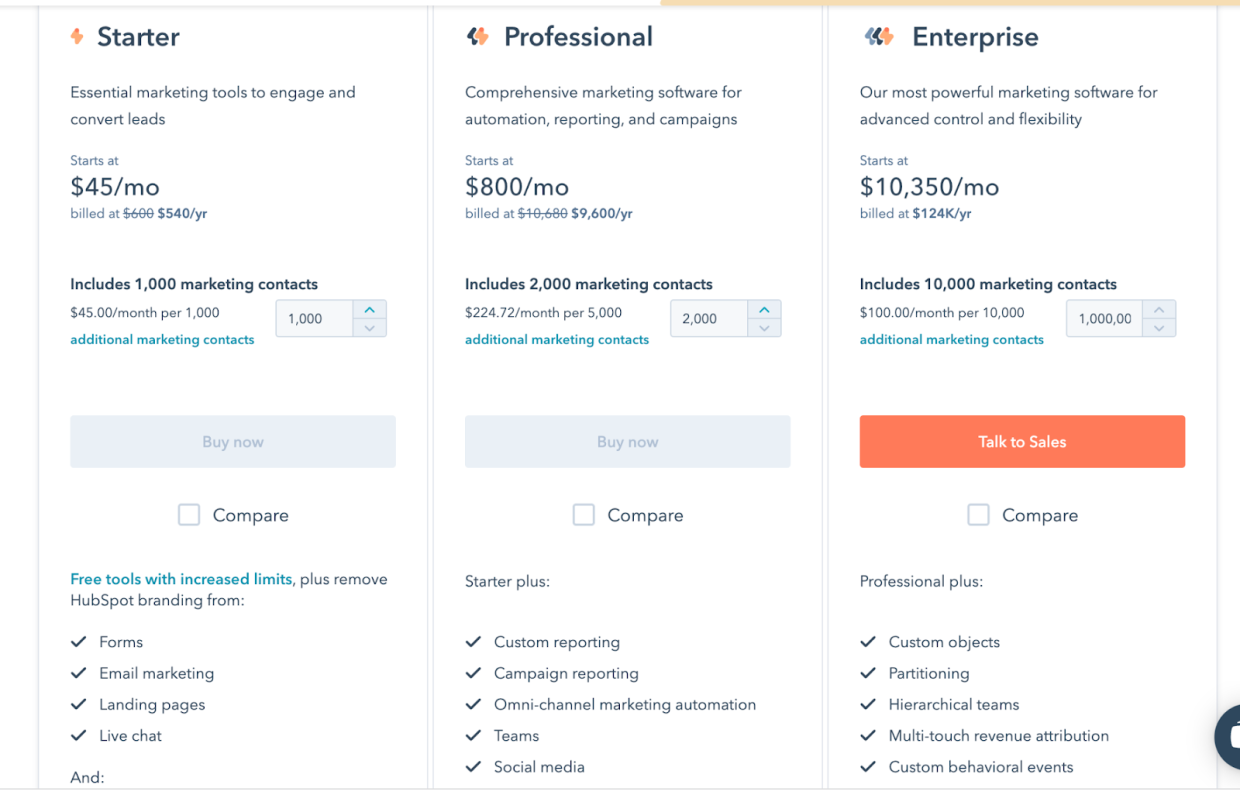

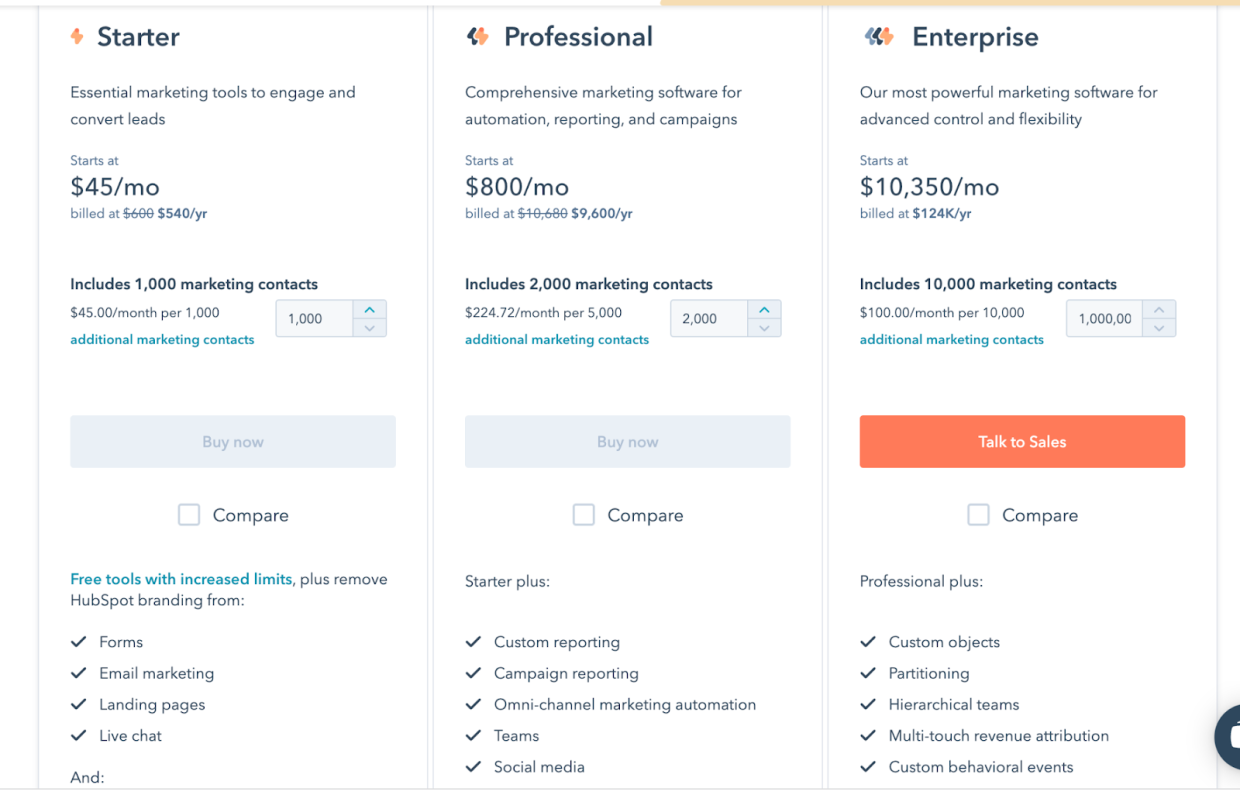

Tiered Pricing: In this case, a customer can choose a bundle of features that have different pricing points. When a customer upgrades or downgrades, their pricing varies accordingly. Additionally, this model can be used to upsell customers incrementally by offering additional features as they scale up. Example: Hubspot

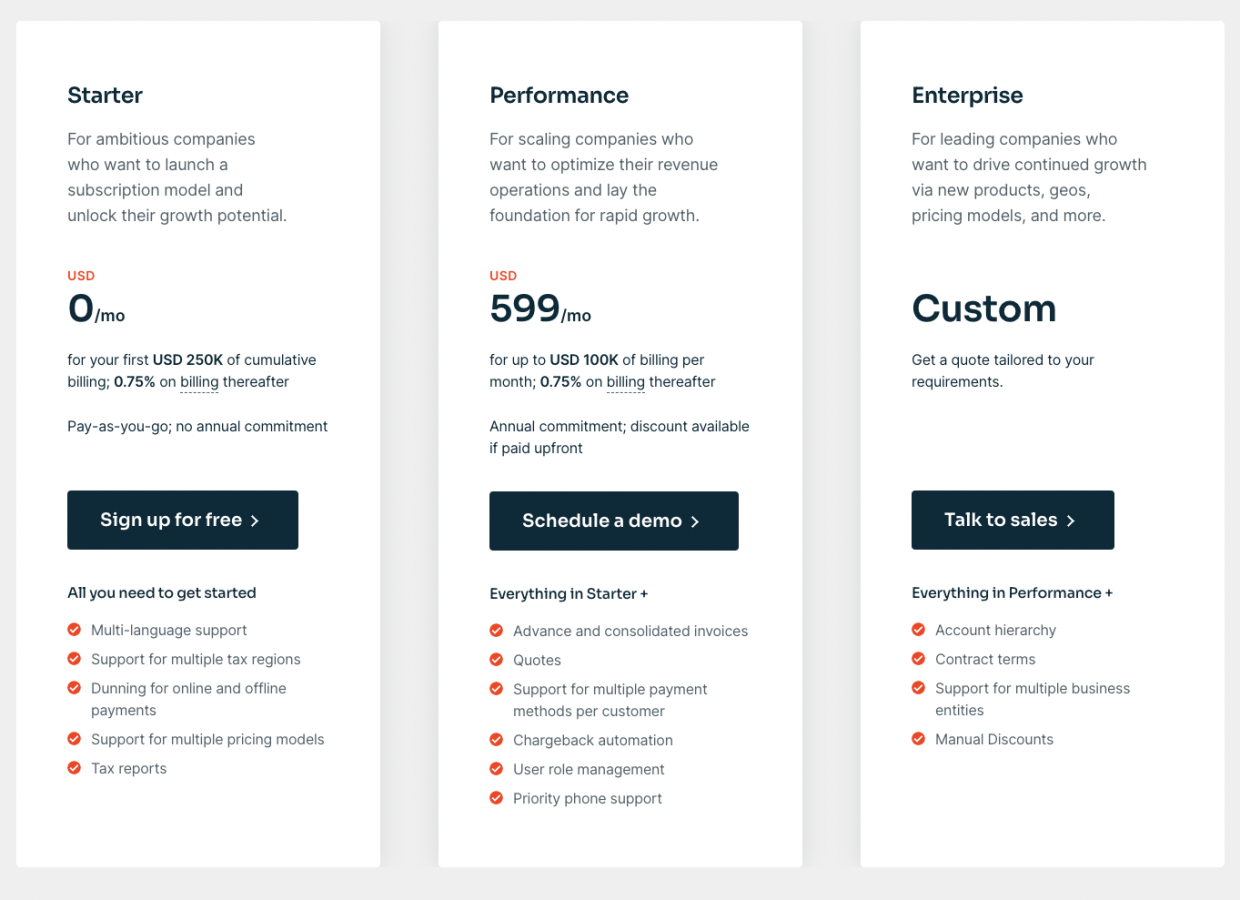

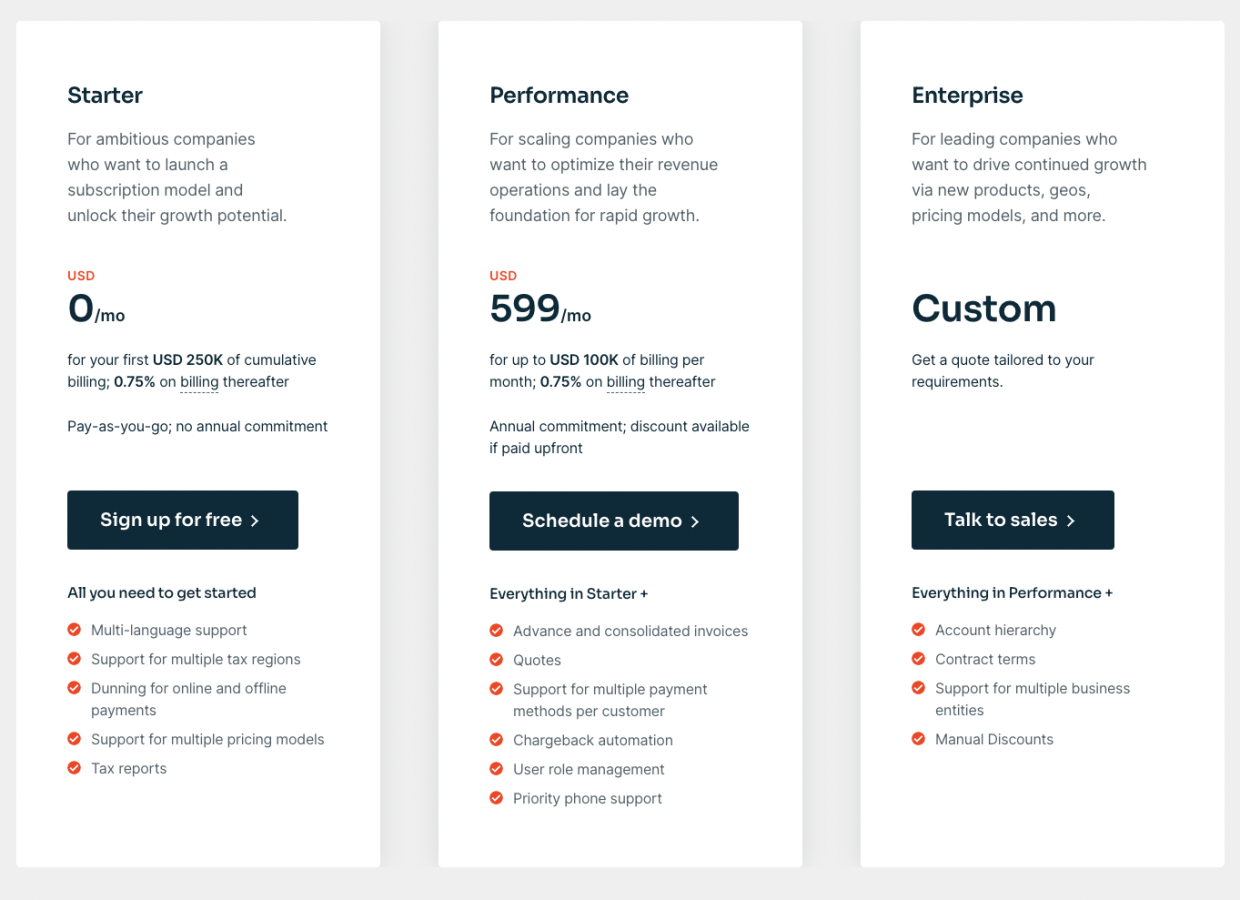

Usage-based Pricing: When customers are charged based on their usage, it’s termed as usage-based billing. Post a pre-determined schedule, an invoice is generated based on the customer’s usage. Customers often consider this pricing model as fairest as it directly proportionates to their usage. If they use more, they’re charged more. It’s considered more transparent with no hidden fees whatsoever. Example: Chargebee

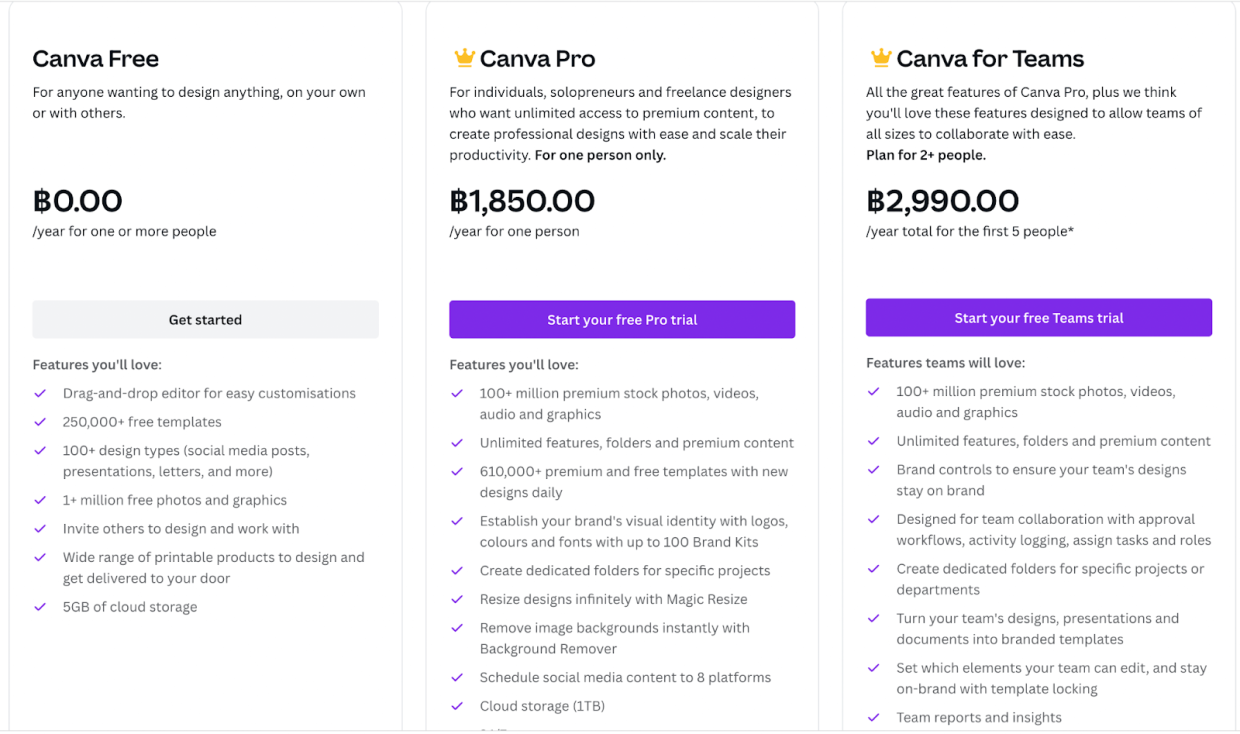

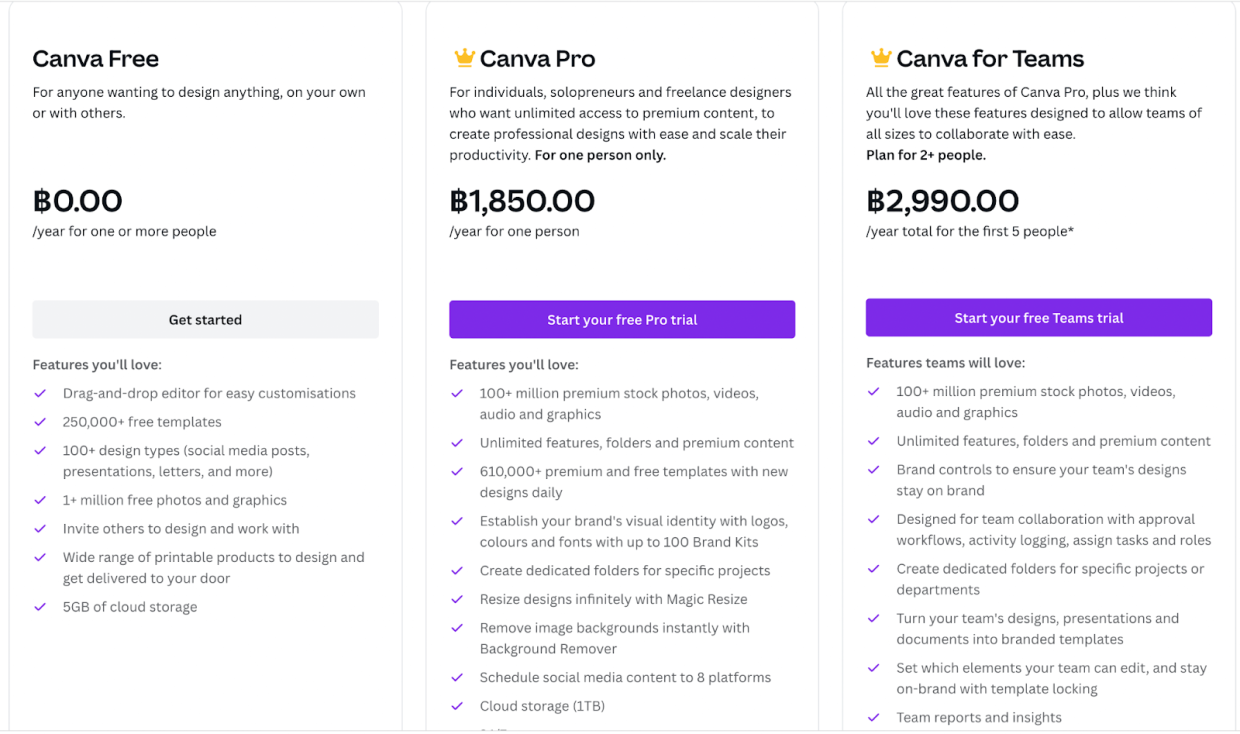

User-based Pricing: Here, customers are billed according to the number of ‘users’ that use the product or service. Example: Canva

How to Accept Recurring Payments?

To start accepting recurring payments, one of the most critical things you must solve is the pricing strategy or the billing logic. Once you have sorted your price calculations, grandfathering, invoice proration, etc., you can request a recurring payment. The actual payment from a customer’s account to your merchant account is done via a payment gateway.

So, in essence, accepting recurring payments requires two blocks, a billing engine and a payment processor.

But, it’s not so simple.

Finding a payment gateway and a billing system that scales with your business can get overwhelming.

Let’s talk about payment gateway first. There’s no dearth of payment gateways out there, Stripe, Paypal, checkout.com..the list is endless, but it’s a mammoth task to compare, evaluate, and pick out the best solution to process your recurring payments.

You need to look for these factors while choosing a payment gateway:

What billing logic do they support?

What’s the time gap to transfer funds from your customer’s bank account to yours?

Do they support multiple currencies and payment types?

Can you build a custom checkout process on your website or they’ll redirect customers to a different platform?

We know that no two payment gateways are the same. That’s why we built a comprehensive tool to help you compare and choose the best payment processor for your subscription business, specific to your country. Give our free tool a try here.

Next, let’s talk about a billing system. As a rapidly growing SaaS or Subscription business, your billing needs will constantly evolve. Global expansion, pricing experiments, add-ons, discounts…the list keeps on growing. A homegrown billing system can indeed generate invoices automatically but cannot handle complex billing logic.

To future-proof your business, you need to ask yourself, is your billing engine scalable enough?

Set up Recurring Payments with Chargebee

Chargebee enables you to accept recurring payments in minutes, from anywhere in the world. All you have to do is:

Sign up for a free trial and configure your billing rules and payment methods in our sandbox.

Choose your preferred integrations with 30+ payment gateways and 100+ currencies. You can also process payments offline through bank transfers and checks.

Customize invoicing and checkout experience for your customers.

Setup payment retry settings, and dunning logic to combat payment failures.

Once everything is set according to your needs, just flip a switch and go live!

As growth partners to 6500+ subscription businesses, we understand the importance of robust recurring billing software. That’s why we built Chargebee, an adaptive revenue management software to enable businesses across the globe to not just accept recurring payments, but

Recover failed payments automatically and collect both online and offline invoices with end-to-end accounts Receivable software.

Increase with personalized cancel experiences.

Automate compliant revenue recognition.

Weave an accurate and insightful revenue story with an exhaustive dashboard for subscription analytics.

And a lot more!

If you want to onboard a reliable recurring payment solution, get in touch with our experts and we’ll take it from there.