Revenue is probably the most crucial metric for any business. You can’t sustain a business without revenue over the long term.

That’s why revenue recognition is a critical part of accounting for every business, especially for those that report earnings to investors or other stakeholders.

However, there are some revenue recognition best practices that all subscription businesses should follow while they report their numbers. Read on to find out our top five tips for revenue recognition.

Why SaaS Revenue Recognition Matters

So, SaaS businesses have to track the money that flows in their account, and how much of it is actually recognized.

Before we dive in, let’s understand why revenue recognition is an especially important accounting method for subscription businesses.

A SaaS business charges customers upfront for services that will be delivered over a period of time. Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) dictate that businesses cannot claim revenue to be theirs until and unless they actually render the services to customers.

This basically means that SaaS businesses have to track the money that flows into their accounts and maintain an understanding of how much can be recognized.

ASC 606: What it Means for SaaS

Created jointly by the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB), ASC 606 has an overarching framework that covers all bases for SaaS revenue recognition.

The 5-step process for revenue recognition under ASC 606 is:

- Identify the contract with a customer

- Identify the performance obligations in the contract

- Determine the transaction price

- Allocate the transaction price

- Recognize revenue when (or as) the contractual performance obligations are satisfied

For a detailed explanation of each of these steps with examples, check out this guide for SaaS revenue recognition.

5 Best Practices for Revenue Recognition

It can be incredibly tempting for a business to recognize revenue from contracts all at once, without having delivered the service. This might make you look good in front of stakeholders and investors, but it can put your business in a risky position.

Subscription-based companies must be prudent and avoid showing revenue on paper as being the same as what is in hand. This will give them a truer understanding of their actual financial health, leading to more growth in the long term.

Here are some best practices that subscription-model businesses can follow for their revenue recognition processes. Feel free to jump off directly to any of the sections below:

- Use Deferred Revenue as Control Account

- Subtract Bad Debts from Revenue Monthly

- Deduct Discounts from Gross Revenue

- Prioritize Revenue Analysis

- Follow Disclosure Requirements

1. Use Deferred Revenue as the Control Acccount

A classic method to recognize revenue dictates the use of a common account called deferred revenue, which is fundamentally a routing account. Then, whenever an invoice is raised, you always route it through the deferred revenue account.

For any accounting entry we pass, we need to consider two accounts – the debit and the credit account.

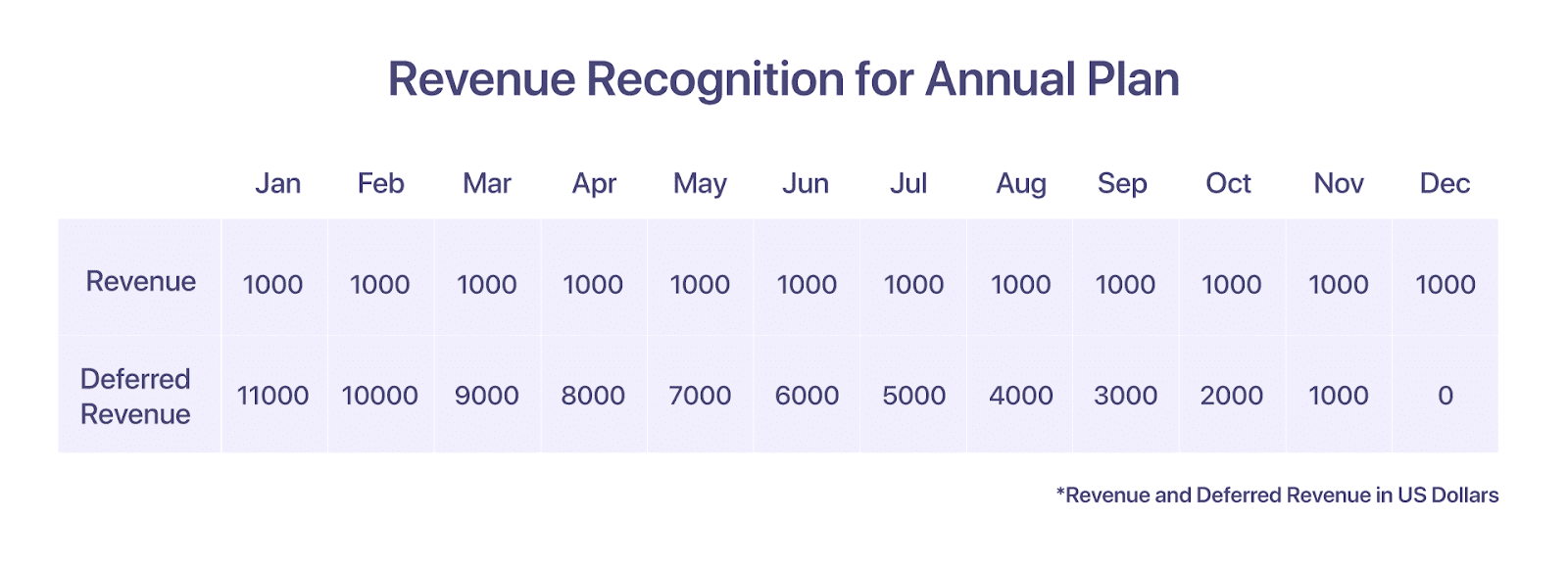

Say for example you’re billing an enterprise customer $12,000 in the month of January. In that case, you debit your account receivable of $12,000, and you credit that amount into the deferred revenue account.

This deferred revenue, thus, becomes the control account. A control account only contains summary amounts and is a general ledger account. The control account has the correct balance which can be helpful to prepare a company’s financial statements.

What businesses typically do after billing is book receivables of $12,000 and sales of $12,000, with the assumption that a sale of $12,000 has happened.

However, in the case of an annual contract, the revenue that can be recognized is not $12,000 at the end of one month, but $1,000.

In such a case, they would:

- Reverse the $11,000 from the sales account into the deferred revenue account.

- Keep only $1,000 in the sales account.

The Best Practice:

- Use ‘deferred revenue’ as a routing account.

- Whenever you raise an invoice or credit note, the impact should always be on the deferred revenue

- When you want to recognize your revenues, you move $1000 from deferred revenue into the sales account.

This is a classic methodology that should be followed for the recognition of revenue, i.e., always routing it through a control account. That way, at any given point in time you won’t overlook the control account.

Head here to see an exhaustive list of revenue recognition scenarios for SaaS with examples.

2. Subtract Bad Debts From Revenue Monthly

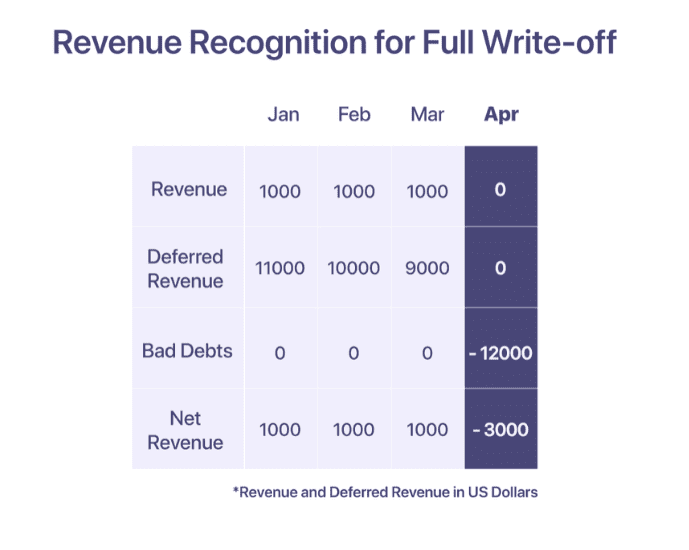

You recognize that your customer has to pay you money the minute you have invoiced them. But there could be a situation where a customer ends up not paying, even after the due date.

This can happen for multiple reasons, such as bankruptcy, trade dispute, or fraud. Once you deem the amount as irrecoverable, that receivable has to be “written off.”

If you write off a receivable, it is moved to an account called bad debts in the expense account. When it is reported, this amount is adjusted against your revenue numbers.

How?

Let’s say you bill $12,000 to a customer in the month of January. However, the customer is not able to pay the amount after repeated dunning requests. The amount is deemed uncollectible in April and is written off as bad debt.

In your financial statement, you will look like you have a revenue of $12,000, along with the other expenses, and the same $12,000 will be shown in your bad debt expense too.

But if one were to look at the revenues alone, it could look like the revenues have been overstated.

The Best Practice:

- Set off the bad debt expense with your revenue recognized every month

- This allows you to get a more realistic and less inflated view of your actual revenues.

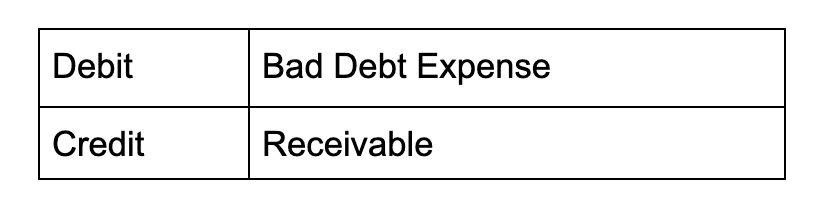

- As prudence practice, businesses must ensure that the receivables are not overstated in the financial statements. This can be done with a journal entry to write off bad debt:

- This credit entry ensures that the receivables balance is ‘nil’ as in this case, the amount is deemed irrecoverable.

- The debit entry ensures that the irrecoverable revenue is not recognized in the income statement.

3. Deduct Discounts From Gross Revenue

Discounts are used very commonly in SaaS. Discounts may be offered during promotions, for paying upfront, or for buying in large volumes. In accounting terms, this is known as “Discounts Allowed.”

Discounts Allowed are reported on the debit side of the Profit and Loss statement. According to ASC 606, discounts constitute a separate performance obligation.

Let’s see the example of a ‘prompt payment discount.”

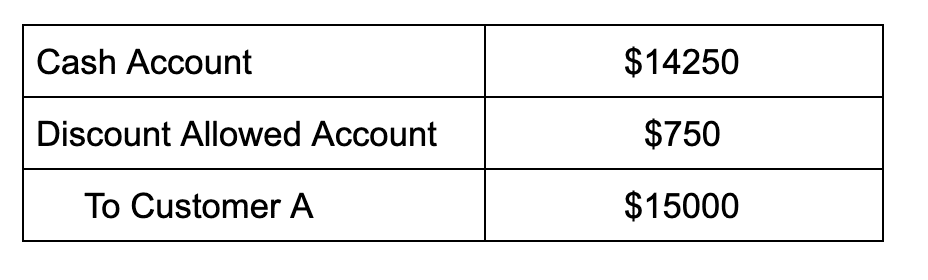

Fictitious Ltd signed on a customer ‘A’ at a price of $15,000 on credit. Fictitious Ltd has a 30-day Net-D payment period and they have offered the customer a 5% discount on prompt payment.

The Best Practice:

- If the customer pays within the stipulated period and is eligible to avail the discount, the journal entry should look like this:

- For prudent practice, it makes sense to set off discounts against revenues. This can be done by deducting the sales discounts from the gross revenue. The result is ‘net sales’ that are reported on the income statement.

- This will help you avoid skewing the revenue numbers in your financial reports.

4. Prioritize Revenue Analysis

In revenue accounting, it is useful to classify and track revenues from different channels. This will help you understand what the distribution of revenue and deferred revenue looks like across channels and how you can use it to make decisions.

The Best Practice:

It’s important to prioritize revenue analysis so that you can spot leakage as well as opportunities for growth.

Typically for a SaaS business, revenue analysis should be done for the following channels:

Typically for a SaaS business, revenue analysis can be done for the following channels:

- Subscription Revenue

- By Subscription:

- Plan-based / Fixed revenue

- Metered Revenue

- By Customer:

- Plan-based / Fixed revenue

- Metered Revenue

- By Plan:

- Plan-based / Fixed revenue

- Metered Revenue

- By Subscription:

- Revenue from other sources:

- Partnerships in the form of revenue share

- Referrals

5. Follow Disclosure Requirements

Disclosure requirements enlist certain explanatory information to be included in your financial statements.

This helps maintain transparency and clarity for anyone who is reading the statements. Some of the disclosure requirements are:

- Disclosure of the portion of the revenue that is yet to be recognized subject to the fulfillment of remaining performance obligations

- Methods and assumptions used to estimate variables and potential reversed revenue

- Any changes incurred during the accounting period.

The Best Practice:

The best practice here is to make sure you are closely following disclosure requirements and other revenue recognition guidelines. Remember, requirements differ for private and public companies.

Smart Revenue Recognition Practices Help Your Business

If you follow these five revenue recognition best practices, you’ll set your business up for success.

Interested in revenue recognition software to help you streamline your processes? For SaaS companies, recurring billing and accounting should go hand in hand.

Chargebee uncomplicates revenue recognition by using the recurring billing platform as the single source truth. From start-ups to public companies, this enables seamless subscription billing management and revenue reporting in one place.

Schedule a demo today to learn how Chargebee can automate revenue recognition.