Ultimate Guide to SaaS Revenue Recognition in 2025

Making SaaS Revenue Recognition Easy

Revenue recognition is a critical part of accounting for every business, especially for those that report earnings to lenders, investors, and shareholders.

It is notoriously difficult for technology companies to keep up with USGAAP and constantly evolving regulations because software and technology companies often have multiple products and services that they offer to customers. Not only that but because tech and SaaS companies offer price concessions, discounts, rebates, bundles, and even individual pricing for each customer, revenue recognition becomes increasingly complex.

There are structured rules around how businesses should calculate and report revenue. This guide is a comprehensive resource covering what every SaaS business needs to know about revenue recognition and compliance to standards like ASC 606.

What is Revenue Recognition Principle?

Revenue Recognition is the process of converting cash from ‘bookings’ into ‘revenue’.

Under the Generally Accepted Accounting Principle (GAAP), revenue recognition is the condition under which revenue is recognized and provides a way to account for it in the financial statements. It is as simple as it sounds but taking the literal value of it might not be the best way to account for revenue in SaaS businesses.

Let’s say a customer has signed an annual contract of $12,000 at $1,000 per month. Can the $12,000 be recognized as revenue immediately? Not really. From a SaaS accounting perspective, the revenue can be recognized only when the said product/service obligations are satisfied. So in this basic example, $1,000 revenue can be recognized every month in return for the product/service delivered, until the end of the contract.

Simply put, revenue recognition is about when a performance obligation is satisfied with a customer.

Revenue recognition is important for SaaS businesses because the amount of revenue that may be earned in a given period may not relate to the amount billed or cash collected.

Key Concepts and Metrics in Revenue Recognition

Before we dive into the details, here are some key concepts and metrics of SaaS revenue recognition.

Deferred Revenue

Deferred revenue is the money you’ve already billed, but you can’t recognize it as revenue because the product or service is yet to be provided. It is commonly known as unearned revenue. Deferred revenue is a liability because in theory, if you fail to perform you would forego collection or have an obligation to return funds to the customer.

Unbilled revenue

Unbilled revenue is revenue that is recognized but is not yet billable to the customer due to billing schedules or certain billing milestones noted in a contract. Unbilled Revenue is treated as an asset (a receivable) until the customer is able to be billed.

Monthly Recurring Revenue (MRR) & Annual Recurring Revenue (ARR)

Recurring revenue is what makes SaaS so appealing. Annual Recurring Revenue (ARR) indicates how much recurring revenue a SaaS business can expect based on annual subscriptions, while Monthly Recurring Revenue (MRR) is recurring revenue converted to a monthly amount. Types of MRR to be measured are:

-New MRR: The new monthly recurring revenue earned from subscriptions that were created during the corresponding period.

-Expansion MRR: The additional monthly recurring revenue generated from your existing customers.

-Contraction MRR: The MRR lost due to cancellations, downgrades to lower price plans, non-renewals, removal of recurring add-ons, or even due to customer discounts.

Calculating and understanding these metrics is a crucial part of a SaaS finance leader’s responsibility.

Further Reading

Bookings

Booking is a forward-looking metric that typically indicates the value of a contract signed with a prospective customer for a given period of time. In a nutshell, bookings signify the commitment from your customers to pay you money for the service you provide.

Various types of bookings include New Bookings, Renewal Bookings, and Upgraded Bookings. In the case of multi-year contracts, bookings that have at least one year’s committed revenue are considered as Annual Contract Value (ACV) Bookings. While ACV talks about annual amounts, Total Contract Value (TCV) Bookings are calculated taking into consideration the complete duration of the contract. Additionally, there are also non-recurring bookings that consist of one-time fees like set-up fees, training fees, and discounts.

Bookings are a primary indicator of future revenue growth. Bookings can help measure the growth of sales over time. Apart from sales, bookings help CFOs and finance teams in planning cash outflows and inflows. In effect, it helps finance teams to report bookings as committed money, without recording them as revenue and thus avoiding inaccurate calculation of MRR or ARR (Annual Recurring Revenue).

Billings

Billings are the invoice amounts billed to customers. This can be over a certain time period, for instance over a month or the whole year. Simply put, billings include money you are owed from your customer.

If a SaaS has high bookings but lower billings, it is a leading indicator of future cash flow problems. To maintain healthy cash-flows, SaaS businesses have to think of ways to get customers to pay upfront and increase billings. This can be done by offering discounts on annual payments.

Revenue

Revenue is the income earned when you actually provide your service to the customers. For every month of successful delivery of service, you can ‘recognize’ the revenue for that month. This is as per GAAP rules, which state that revenue can only be recognized once it is ‘earned’.

Relying on only booking and billings for assessing performance means that you may be looking at inflated numbers. A more accurate way is to keep tabs on recognized revenue, which is the actual amount earned by the business in exchange for the product or service.

With our detailed example here, learn how to calculate SaaS bookings, billings, and MRR.

What is Accrual Accounting?

Accrual accounting is when revenues and expenses are recorded when they are earned, regardless of when the cash actually comes in or when expenses are incurred. Accrual accounting suits subscription businesses because accrual revenue, if recognized correctly, actually tracks the MRR.

This method is more commonly used than cash-basis accounting, which recognizes revenue and expenses when cash or payment is received. Despite its complicated nature, accrual accounting is more suited for growing, inventory-heavy businesses. A business that averages more than $25 million in gross receipts each year is required to use the accrual method, as per the IRS.

The Importance of Accounting Standards

The rules and guidelines for financial accounting and reporting are enlisted by accounting standards. Revenue recognition is one of the principles of the Generally Accepted Accounting Principles in the United States (GAAP US), which is regulated by the Financial Accounting Standards Board (FASB). The alternative for most other countries is the International Financial Reporting Standards (IFRS 15), which is regulated by the International Accounting Standards Board (IASB).

Accounting standards exist to:

eliminate variations in the way businesses across industries handle accounting for similar transactions by bringing standardization and transparency in financial reporting across companies and industries.

make it easy for investors and stakeholders to comprehend and compare the financial statements across companies and industries.

The Birth of ASC 606

As per a statement released by FASB, revenue recognition requirements of IFRS lacked sufficient detail and the accounting requirements of U.S. GAAP were considered to be conflicting in certain areas.

To overcome these shortcomings, FASB and IFRS joined hands to establish a new revenue recognition standard, called the ASC 606 Revenue from Contracts with Customers.

ASC 606 defines a flexible, robust framework that encompasses the revenue recognition principles across industries. This cleared up the clouds of confusion that loomed over SaaS accounting due to inconsistent and unclear practices.

ASC 606 & Revenue Recognition in the World of SaaS

ASC 606 simplifies the preparation of financial statements through a 5 Step Model for Revenue Recognition. This model is aimed at directing businesses about how much and when to recognize revenue.

Identify the contract with a customer

This outlines the criteria to be met when establishing a contract with the customer to provide products or services. The contract is mutually agreed upon (written or oral) and defines the rights and obligations of each party.

Identify the performance obligations in the contract

This describes all the performance obligations or deliverables when the contract is being drawn up. If the services or products are distinct, they need to be accounted for separately.

Determine the transaction price

This step enlists all the considerations that have to be taken while establishing the transaction price.

Allocate the transaction price

This explains how transaction price is allocated across all performance obligations identified in the contract. This includes variable consideration as well.

Recognize revenue when (or as) the performance obligation is satisfied

Revenue can be recognized at a point in time or over time as and when the customer benefits from your product or service and is driven by the transfer of control to the customer.

There are five criteria for recognizing an arrangement fee as revenue. All these prerequisites have to be met:

Performance:

Risks and rewards have been transferred from the seller to the buyer: Risks and rewards won’t be transferred to the buyer until a month of service is delivered. This typically occurs when the benefits of the product or service have been conveyed to the customer.

The seller has no control over the goods sold: In the SaaS context, this can be fulfilled once the customer has been using the product for at least a month or more.

Collectability:

The collection of payment is reasonably assured: At least in the case of most credit card transactions, SaaS businesses can be fairly certain (within reason) about the collectability of payments.

Measurability:

The amount of revenue can be reasonably measured: The amount of revenue that a SaaS business earns is based upon fees commensurate with the services provided. This can be ratable revenue for fixed fee arrangements or unit or quantity based for volume or usage-based business models.

The costs of earning the revenue can be reasonably measured: In SaaS, the cost to service a new customer is usually negligible unless implementation services are significant and recognized as a separate performance obligation.

Key Challenges of SaaS Revenue Recognition

For annual plans, revenue recognition is straightforward. But the complexity gradually increases when there are modifications to subscription plans such as:

Cancellation of a subscription mid-stream

Upgrade from a monthly plan to an annual plan in the middle of the year

Downgrade from a higher plan ($12000) to a lower plan ($6000)

It gets more complex with these features that are often bundled in SaaS:

Set-up fees

Support fees

Consulting services

Customization

Usage-based fees

Depending on the nature of performance obligations and how they're fulfilled, SaaS companies have a number of revenue recognition methods to choose from. You can read a detailed breakdown of common revenue recognition methods and how they're implemented in SaaS businesses.

In complex revenue scenarios, revenue recognition needs to be prorated and recalibrated. We’re going to walk you through each of these scenarios in detail.

Revenue Recognition Scenarios for SaaS Companies

Let’s take an example of ‘Help!’, a SaaS company specializing in helpdesk and ticketing management. Help! offers three plans for their subscribers; Growth plan, Pro Plan, and Enterprise plan of $6000, $12000, and $24000 per annum respectively. ‘Help!’ also offers the flexibility to add additional users if required.

1. Revenue Recognition for an Annual Plan

Let’s assume that a customer has opted for the annual Pro Plan priced at $12000 per annum starting from January. The revenue recognition, in this case, is fairly straightforward.

They get billed with an invoice of $12000 upfront at the beginning of January. But like mentioned before, only $1000 gets recognized in January. What happens to the revenue that is collected but not recognized? The remaining $11000, is recorded as deferred revenue.

At the end of every subsequent month, another $1000 gets recognized for the services rendered by Help!. This goes on, till December, when Help! Has fully satisfied its obligation to the customer

The invoice raised in January will be for $12000

Revenue recognized in January: $1000

Deferred Revenue in January: $11000

Revenue recognized as of December 31: $12000

Remaining deferred revenue as of December 31: $0

2. Revenue Recognition for Plan-based Upgrades

The customer decides to upgrade from Pro to Enterprise plan i.e. from $12000 to $24000, on the 15th of April.

From a reporting perspective, the MRR report for April would show that the MRR for the Enterprise plan is $2000.

From a revenue recognition perspective, which is dependent on the billing and the services rendered, this is how the sequence of events leading to revenue recognized for April should look like:

Invoice raised in January: $12000

Revenue recognized till March 31: $3000

Revenue recognized till April 15: $500 (for 15 days of service rendered)

Total Revenue recognized from January to April 15: $3500

Credit Note raised = $8500, New Prorated Invoice raised: $17000

Total Revenue recognized in April: $1500 ($1000 for remaining days of service rendered)

Deferred Revenue at the end of April: $16000 ($24000 prorated from April 15th to December 31st)

Revenue recognized in subsequent months (May to December): $2000/mo

3. Revenue Recognition for Quantity-based Upgrades

If the customer decides to accommodate 10 additional agents to the existing Pro Plan on May 1st, at the price of $10 per agent for the subsequent months, then this qualifies as a quantity-based upgrade.

In this case, a new invoice will be generated for the additional 10 agents.

Invoice raised in January: $12000

Revenue recognized from January to April: $4000

Quantity upgraded from 100 to 110 agents on May 1st charged at $10 per agent

Prorated Invoice will be created in May for $800

Revenue recognized in May and subsequent months: $1100 ($1000 + ($10*10 agents)

Deferred Revenue in May: $7700

Deferred Revenue in June: $6600

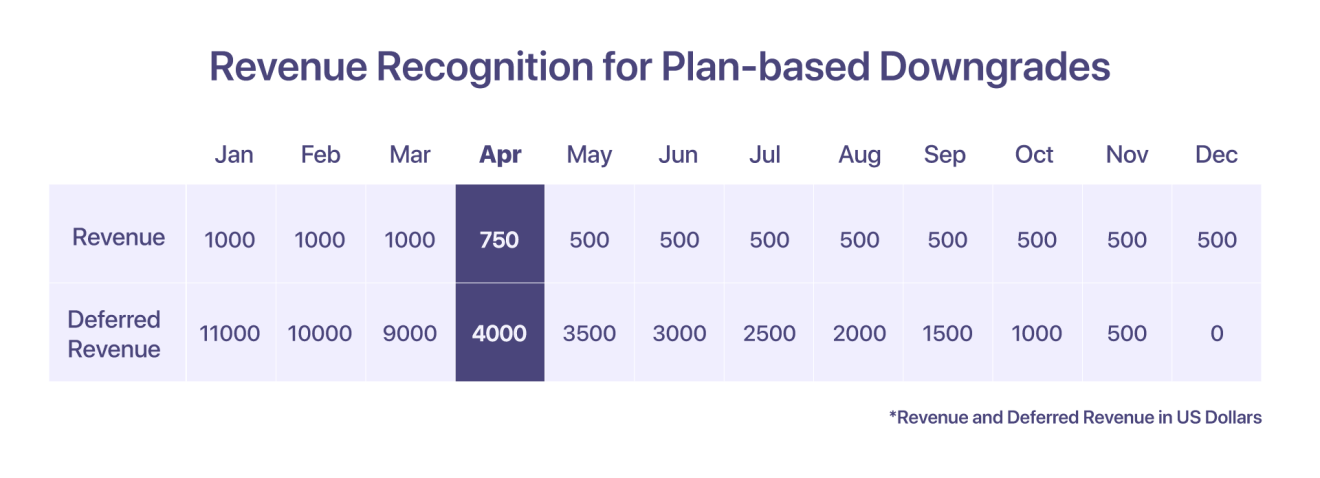

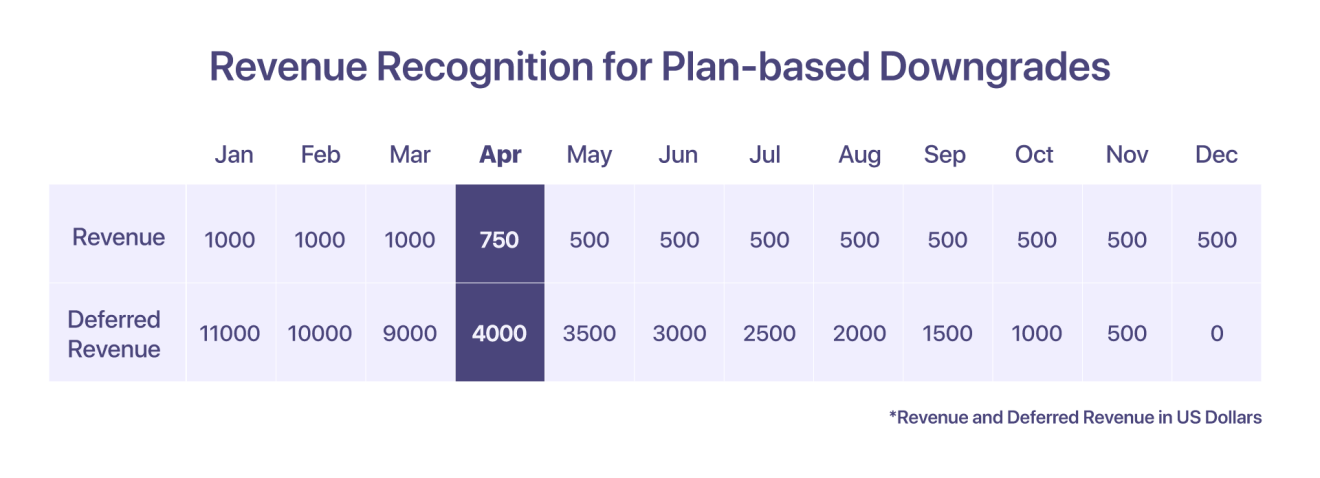

4. Revenue Recognition for Plan-based Downgrades

If the customer downgrades from the Pro Plan of $12000 to the Growth Plan of $6000, on the 15th of April, here’s how the revenue can be recognized:

Revenue recognized from April 1st to April 15th (under Pro plan) is $500. After downgrading, a credit note of $8500 will be issued and the revenue recognized from April 15th to April 30th (under Growth plan) will be $250.

Invoice raised in January: $12000

Revenue recognized from January to March: $3000

Revenue recognized from April 1st to April 15th: $500

A credit note will be issued for $8500

A new prorated invoice will be generated for $4250

Total revenue recognized in April: $750

Revenue recognized in subsequent months (May to December): $500/mo

Deferred Revenue in April: $4000

Deferred Revenue in May: $350

5. Revenue Recognition for Quantity-based Downgrades

Say the customer was using the pro plan of $12000 per annum with 10 additional agents (at $10 per agent) from January. However from April 15th onwards they decide to downgrade to 5 agents.

A credit note will be issued, to adjust for the reduced number of agents and a prorated invoice will be generated.

Invoice raised in January: $12000

Revenue recognized from January to March: $3300

Revenue recognized in April: $1000 + $50 (first 15 days) + $25 (last 15 days for 5 agents) = $1075

Credit note created: $750 (8*100 + $50 for 15 days)

Prorated invoice generated: $425 (8*50 + $25 for 15 days)

Revenue recognized in subsequent months (May to December): $1050/mo

Deferred Revenue in April: $8000 + $400 (for 5 additional agents) = $8400

Deferred Revenue in May: $7350

6. Revenue Recognition for Cancellation with Refund

The customer pays $12000 upfront to Help! following the annual contract of 12 months in January. However, they decided to request a cancellation in April.

Two possible scenarios that the customer can encounter, depending on how Help! would like to enforce its contractual rights.

In the case of cancellation with refund, the customer cancels the services from Help! at the start of April with a refund. Help! recognizes the revenue till March. Help! also creates a credit note for $9000 and refunds the amount to substantiate the cancellation.

7. Revenue Recognition for Cancellation without Refund

In the case of cancellation without refund, the customer cancels the services from Help! at the beginning of April, but contractually, is not entitled to a complete or partial refund. Help! can then recognize the balance deferred amount as revenue in April. There is no credit note created in this case.

8. Revenue Recognition for Shift in Monthly to Annual Plan Cycle

The customer has signed up with Help! on a monthly plan of $1000/month. In this scenario, the revenue from each month can be recognized in the same month.

But if the customer decides to shift the plan cycle from a monthly plan to the annual Pro Plan at $12000/year at the beginning of April, then the deferred revenue account will need to hold the prorated amount of $8000 starting from April.

Invoice raised in January = $1000

Revenue recognized from January to March = $3000

Revenue recognized in April = $1000

Prorated Invoice raised for the Pro Plan from April to December, for $9000

Deferred Revenue in April = $8000

Deferred Revenue in May = $7000

9. Revenue Recognition for Shift in Annual to Monthly Plan Cycle

The customer has signed up for the $12000 Pro Plan with Help!. The revenue recognized over the months is the same as that of an annual plan, where the revenue recognized per month is $1000.

But if they decide to shift to a monthly plan at $1000/month at the beginning of April, then Help! issues a credit note of $8000 for refund in April and thereafter, the revenue is recognized in the respective months.

Invoice is raised in January for $12000

Revenue recognized from January to March = $3000 ($1000/mo)

Deferred Revenue in March = $9000

Revenue recognized in April = $1000

Credit note of $8000 issued in April and Deferred Revenue in April is $0 after plan cycle shift

Deferred Revenue in May = $0

10. Revenue Recognition for Addons and Metered Billing

The customer includes an addon - Setup Fee, for the month of January, priced at $150, along with a metered-billing component priced at $300 per month.

There is a difference in the revenue recognition for add-ons and metered billing. The overages incurred in the metered billing will be recognized in the month in which it is accrued. As for add-ons, the amount is recognized on the basis of when it is billed.

Invoice raised in January: $12000 + addons and metered billing component

Revenue recognized in January: $1450. The metered amount of $300 will accrue from December.

Deferred Revenue in January: $11000, since revenues are recognized for Addons and metered billings in the same month, the deferred revenues for such components will be zero only.

11. Revenue Recognition for Bad Debts and Write-Offs

According to GAAP, revenue from a sale can be recognized when the services are rendered. However, if a business fails to collect the payments, the business needs to report it as a bad debt under its expense account, to offset the revenue reported during the sale. The company can decide to write-off a bad debt when the payment is deemed uncollectible.

There are two types of write-offs; partial write-off and full write-off.

Partial write-off

A partial write-off happens when a partial amount of the total invoice amount is realized and the rest is uncollectible.

Say, Help! raises an invoice of $12000 towards a customer, in the month of January. ‘Help!’ recognizes revenue of $1000 every month and the remaining is retained in the deferred revenue account. However, the customer declares that they will not be able to pay from April onwards due to insufficient funds. The amount is deemed uncollectible from April and is written off as bad debt in April.

Full write-off

A full write-off happens when the complete amount in the invoice is deemed uncollectible.

Say, Help! raises an invoice of $12000 towards a customer, in the month of January. However, the customer is unable to make the payment from January onwards. After repeated dunning requests, Help! decides in April that the amount is uncollectible and writes it off in April.

Best Practices in Revenue Recognition

Use ‘deferred revenue’ as a control account to minimize the impact on your actual revenue

Set off bad debt expense against revenue recognized every month to obtain a more realistic financial report

Set off discounts against revenues to get an accurate ‘net sales’ number on your report

Understand what the distribution of revenue and deferred revenue looks like across channels and how they can guide decision making

Understand and comply with the disclosure requirements mandated for your industry to ensure transparency and clarity in financial reporting

Related read: Best practices for SaaS revenue recognition

Making SaaS Revenue Recognition Easy

Recurring billing and revenue recognition should go hand in hand. It can be very time-consuming and tedious to have multiple sources of truth. Chargebee is a subscription management platform that not only helps manage recurring billing but also ensures globally compliant revenue recognition.

With Chargebee RevRec you can

Automate ASC 606-compliant revenue recognition

Define and implement your performance obligations into your general ledgers

Improve reporting accuracy and business valuation

Automate your revenue workflow from sales order to revenue recognition

Chargebee uncomplicates revenue recognition by using the billing platform as the single source truth, enabling seamless management of recurring billing along with revenue reporting for fast-growing startups to public companies.

Automate Revenue Recognition for your SaaS business today >