So you’ve built a good business and made a name for yourself. You’ve created stable revenue streams, and you’re gearing up to face the looming recession. Now you’re here wondering whether adding automation to your revenue operations — like billing, collections, revenue recognition, and retention — makes that big a difference; strap in.

Yes. Yes, it does.

During economic downturns, businesses that single-mindedly streamline all their decisions and initiatives toward increasing profitability and efficiency are the ones that have successfully survived and thrived. When done strategically and holistically, adding automation is a significant bolster to your organization’s efficiency, a critical enabler for your growth, and a rite of passage to enter the big leagues.

What if you could focus on maximizing your revenue and not worry about the tech debt of your billing system? What if you could target new customer segments and not worry about the operational difficulty of accepting different currencies or complying with multiple international regulations? What if you could experiment with pricing strategies and not feel dread at the thought of executing a price change?

If you’re nodding vigorously at your screen, I’m here to tell you that your outdated systems aren’t just eating up your time. They’re stealing your growth opportunities.

Where do I start?

Today’s businesses are turning towards a mix of one-time purchases, recurring charges, and usage-based billing to tackle subscription fatigue and meet consumers’ demands for flexibility. But this mix can quickly add chaos to your systems and processes. An entanglement of various subscriptions with various billing logic only grows more complex with time and volume, which would require your team — which should be working on strategy and scenario planning — to put in critical man-hours to keep up with your billing.

Enter automation — and with it, adaptability.

A truly adaptive revenue management approach is more than just automated billing and neatly filed invoices. It’s a strategy and set of tools that manage and optimize your cash flow, reconcile your payments, and streamline collections, revenue tracking, and reporting. With an adaptive approach, you’re also automating tax management, payment processing, payment collection, and payment retries. Having the right system and strategy in place frees up your time to experiment with growth segments and pricing models.

Taking your revenue operations to the next level of automation is like switching from mortar and pestle to an actual electric blender. No one ever said they missed the mortar’s hand workout.

Growth with Automation

Here are seven ways that an automated, adaptive approach to revenue management will accelerate your growth.

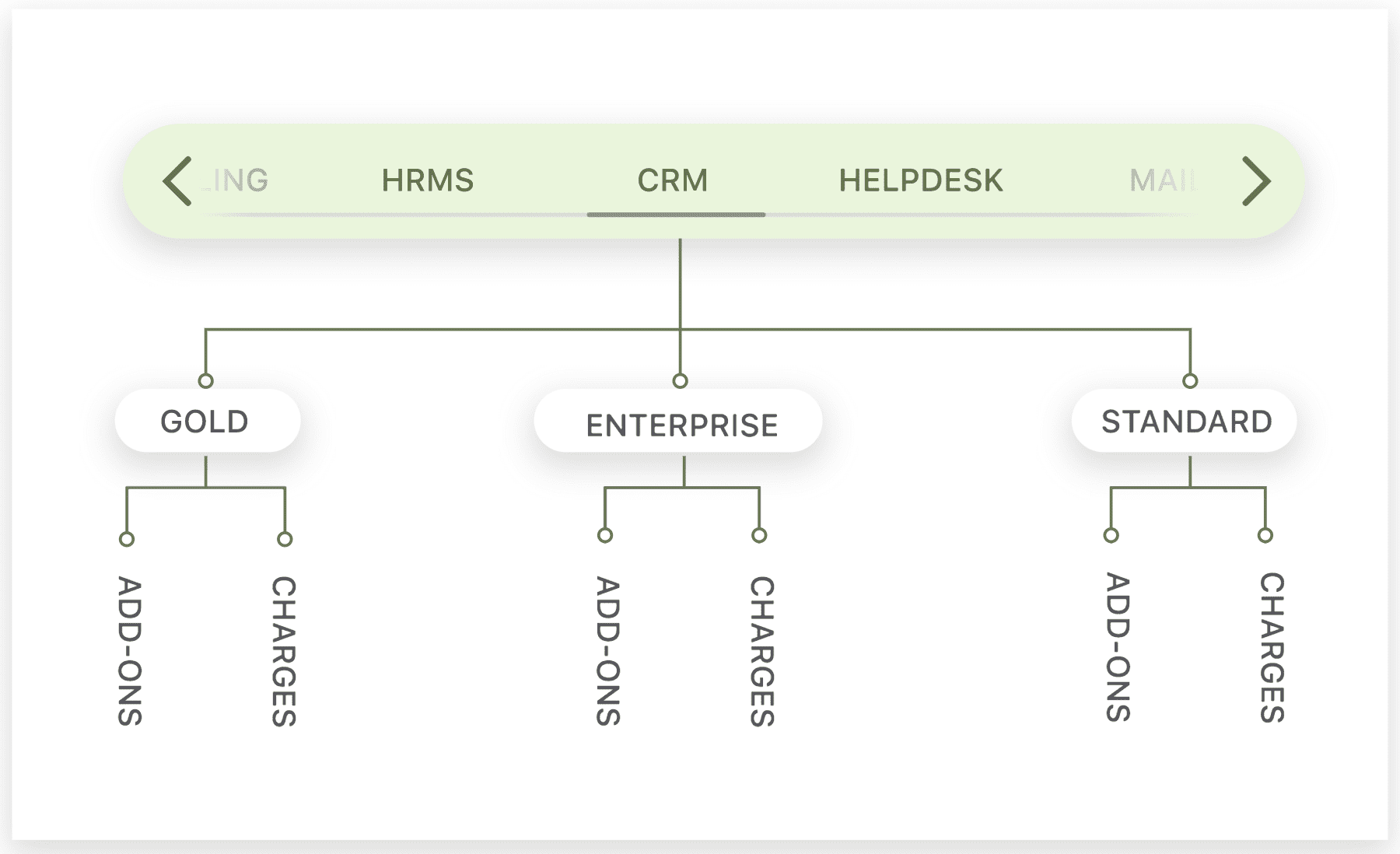

1. Unlock new revenue streams with multiple product families

Subscription products typically have multiple plans. Now throw in add-ons, coupons, different price points, different currencies, and multiple billing frequencies. Imagine managing numerous product lines with this whole cohort of operations. It’ll make anybody sweat.

Automating billing with a scalable Product Catalog makes managing your product families effortless and significantly reduces the go-to-market time for new product launches, currencies, and billing frequencies.

2. Manage multiple pricing models and execute hassle-free pricing changes

The majority of pricing used today falls into these buckets.

- Flat rate subscription – a set price charged monthly but billed annually.

- Usage-based pricing – a ‘pay-as-you-go’ approach that charges you on the volume consumed.

- Per-unit and one-time pricing – these refer to one-time transactions

- Tiered pricing – gives you different pricing slabs to choose from

When you scale this up for multiple products, each with its pricing model, it can get overwhelming quickly. With a scalable billing infrastructure, you can support multiple pricing models without wasting your precious hours poring over spreadsheets.

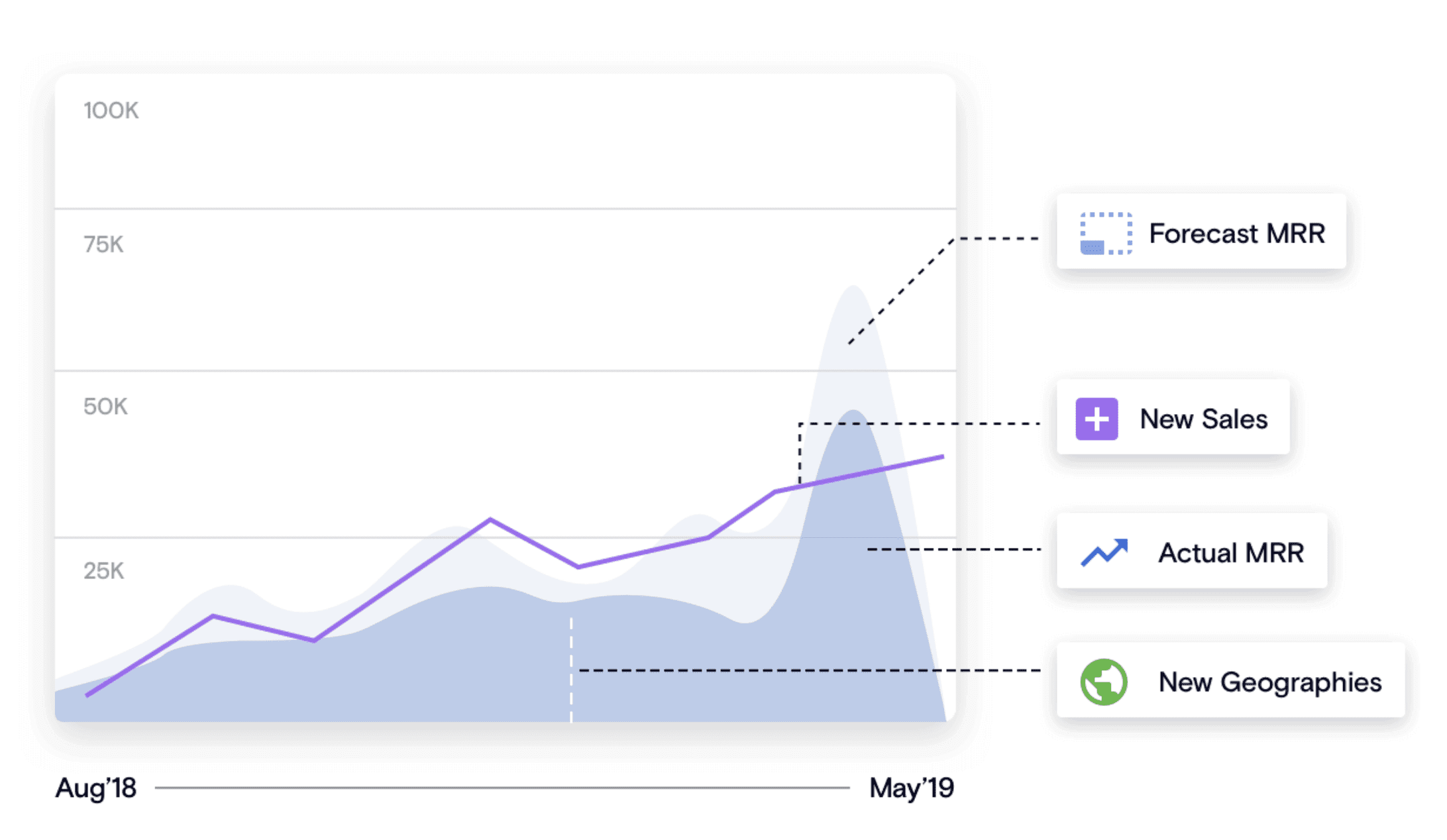

Implementing new pricing strategies or experimenting with pricing can decidedly influence your revenue generation, and you deserve to try on a few so you can find your glass slipper. A study found that continual price optimization helps shoot up your growth trajectory in a matter of months. A robust billing infrastructure makes running pricing experiments as easy as trying on a shoe. You can change your pricing model overnight, offer flexible billing periods, and grandfather your existing customers seamlessly.

3. Reach a wider audience by accepting payments globally

Targeting a broader audience means supporting preferred payment methods and payment gateways of the places you cater to. Your billing system needs to process larger transactions in multiple currencies and languages and calculate taxes based on your geographical location. It also needs to take into account compliance requirements.

Global tax regulations are evolving on a regular basis — but with the right strategy in place, you don’t have to worry about manually making changes every time a regulation changes. You can simplify tax management with automated and precise tax rate updates, ensuring effortless tax filing and reporting. You can also ensure you have custom tax rules for your subscriptions and give your customers tailored attention.

An automated, adaptive revenue management strategy also allows you to control the access levels of different people working with your recurring revenue systems and helps you adhere to compliance more easily.

4. Stay on top of revenue leakage with dunning management

Did you know that 20-40% of your churn comes from credit card failures, and it’s not even voluntary?

Now imagine having to spot, cross-check, follow up, and somehow revive this lost revenue manually, without losing your customer in the process — especially when they may not even know that their card was declined. Hassle, isn’t it?

Maximizing cash flow will be a critical factor for the survival of all businesses. If someone is trying to pay you, it should be your top priority to reduce all possible friction to ensure that this cash hits your coffers.

Chargebee Receivables automates your entire AR workflow, reducing collection costs, and improving the end-user experience. Actionable insights ensure you proactively manage your receivables, and a self-help portal provides your customers with a transparent experience, strengthening their trust in your organization.

5. Simplify your revenue recognition

Tracking the inflow of funds and recognizing revenue accurately is crucial for any subscription-based business. However, revenue recognition can be a complicated process, especially when subscribers have the flexibility to modify their subscriptions. Managing revenue recognition manually can be a nightmare for finance teams.

Furthermore, maintaining accuracy in revenue recognition is vital as incorrect revenue numbers can’t be reported in financial statements and reports. Additionally, staying compliant with ever-evolving global standards is a necessity.

Automated revenue recognition helps you eliminate complexities, automatically recognize revenue upon fulfillment, accurately forecast revenue, and comply with global standards like ASC 606 and IFRS.

6. Streamline data collection for efficient decision-making

Your recurring revenue lifecycle involves a vast amount of data, including confidential customer information and preferred payment methods. Managing and processing this sensitive data can be challenging if you’re handling it all on your own. Fortunately, there are tools available that can help streamline the process.

Some accounting systems may not fully understand subscription logic, which could lead to miscalculations in your monthly recurring revenue (MRR). To ensure accurate financial reporting, it’s important to choose accounting systems that are capable of handling subscription-based businesses.

By optimizing data collection and utilizing appropriate tools, you can make informed decisions and drive efficiency in your business operations.

Chargebee offers a comprehensive perspective by consolidating all the data that drives your recurring revenue lifecycle. It also establishes connections between various data points like customer lifetime value, churn rate, average revenue per customer, and more. Valuable insights that guide your company’s immediate direction are silently tucked away in these data sheets.

7. Boost Customer Lifetime Value with personalized retention strategies

Focusing on customer acquisition without a solid retention strategy can be costly in today’s competitive landscape. By prioritizing retention, you can strengthen your relationship with existing customers, prevent churn, and maximize their lifetime value.

With Chargebee Retention, you have the power to test and personalize content, reducing cancellations and improving customer loyalty. Utilize a churn deflection funnel to gain valuable insights into why customers leave, allowing you to make real-time, persuasive offers to encourage them to stay.

An automated, adaptive revenue management strategy offers a seamless, error-free experience for your customers while unlocking growth opportunities for your business – a win-win situation.

When striving to thrive in a dynamic business landscape, it’s crucial to go beyond billing automation and adopt a comprehensive solution that powers your entire recurring revenue lifecycle.

That’s why Chargebee was built – to provide multiple, modular solutions under one umbrella: recurring billing, receivables, revenue recognition, and retention. Chargebee enables efficient and sustainable growth, enhances customer acquisition, and boosts customer LTV, all while ensuring compliance and operational excellence.

How can Chargebee elevate your recurring revenue lifecycle?

An automated, adaptive revenue management strategy offers a smooth, error-free experience for your customers while helping you unlock growth opportunities for your business – it’s a win-win.

When trying to survive and thrive in a challenging climate, it’s crucial to look beyond billing automation to a holistic solution that powers your full recurring revenue lifecycle.

That’s why we built Chargebee to offer multiple, modular solutions under one umbrella: recurring billing, receivables, revenue recognition, and retention. Chargebee enables efficient, sustainable growth, better customer acquisition, and increased customer LTV without compromising compliance and operational excellence.

We’ve helped over 4500+ businesses scale their recurring revenue operations across different industries. If you’d like to automate your recurring revenue lifecycle and get started on the journey to adaptive revenue management, get in touch with us, and we’ll take it forward from there.